# itr

12 posts in `itr` tag

CBDT Refund Delay: What Taxpayers Should Know

There is no halt on refund processing by CBDT. Only high-risk refund claims are being held for verification, while smaller refunds are being processed normally. Most legitimate refunds are expected to be released by December.

Late Filing of Form 10IC Will Not Deny Lower Tax Rate: ITAT Ruling

Mumbai ITAT has ruled that late filing of Form 10IC should not prevent eligible taxpayers from availing the concessional corporate tax rate under Section 115BAA. The order states that filing Form 10IC is a procedural requirement and the intent to opt for the new tax regime is more important.

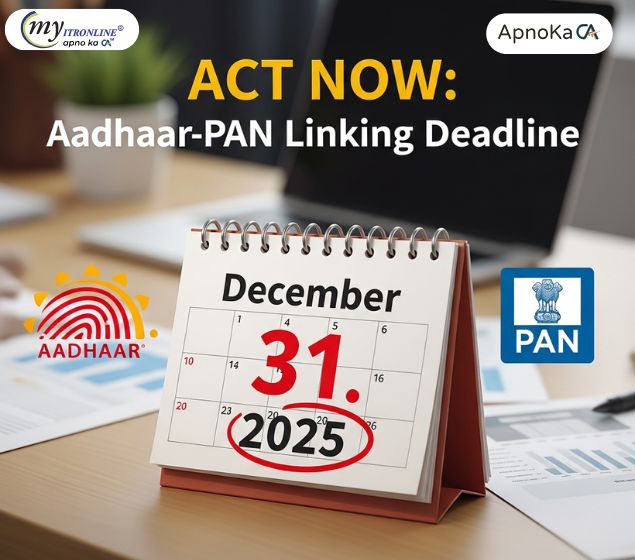

Act Now: Aadhaar-PAN Linking Deadline is December 31, 2025

Link your PAN with Aadhaar by December 31, 2025. If you miss the date, PAN goes inoperative from January 1, 2026, stopping ITR filing and blocking refunds. Pay 1,000 on the e-Filing portal and link now. Some groups are exempt.

New Income Tax Rules Effective December 2025: Key Updates

The Income Tax Department has introduced key updates effective December 1, 2025, focusing on real-time TDS error alerts, significantly faster ITR refund processing (7 days), strict AIS/26AS income matching rules, and an increased late filing penalty of ₹7,500 for high-income taxpayers.

Tax Alert: Foreign Assets Under Scanner Fix Your ITR Before 31 December

The Income Tax Department is sending alerts to people who may have foreign bank accounts, investments or property that are not shown in their Income Tax Return. If you get this message, you must check and revise your ITR before 31 December 2025 to avoid big tax and penalties under the Black Money Act.

Why Your Income Tax Refund Is Delayed and How to Check Status

Many taxpayers are still waiting for their refund. This guide explains how to check your income tax refund status, why refunds get delayed, and simple steps you can take to fix the issue and receive your money soon.

Income Tax Refund Hold: New Rules for Big Refunds

Many taxpayers in India are seeing a delay in income tax refunds, especially when the refund amount is high. The Income Tax Department is checking big refunds more carefully to stop wrong or fake claims. In this blog, you will understand in simple words why your refund is delayed and what you should do next.

Finally! The 2025 Capital Gains Relief Scheme is Making Life Easier

The 2025 Amendment Scheme has modernised the Capital Gains Account Scheme (CGAS) by making it digital-first and easier to use. Taxpayers can now deposit capital gains online through Net Banking, UPI, RTGS, or NEFT, with the deposit date clearly defined. Electronic statements replace passbooks, more banks are authorised to manage CGAS accounts, and simpler ITR forms are on the way. With broader exemptions like Section 54GA included, the scheme reduces stress and makes compliance smoother for property sellers, NRIs, and businesses.

Why Your Tax Refund Is Delayed and What CBDT Wants You to Know

Many taxpayers are waiting for refunds, especially where the refund is large. The Central Board of Direct Taxes (CBDT) is closely checking high-value and flagged returns to stop fake claims and tax cheating. This guide explains the main reasons for delays, which cases get compulsory scrutiny, and simple steps you can take now to clear your refund faster.

CBDT’s New Rules: Faster Tax Refunds and Easier ITR Corrections

The CBDT has empowered the CPC Bengaluru with concurrent jurisdiction under Section 154 to rectify obvious errors in ITRs like missed TDS/TCS credits, relief miscalculations, and interest under Section 244A—leading to faster refunds, reduced compliance burden, and greater transparency. Effective from October 27, 2025 (Notification No. 155/2025), this centralized approach streamlines rectifications and allows demand notices under Section 156 where needed.

Reels, Revenue, and Returns: Tax Rules for Creators Earning from Facebook & Instagram Reels

The creator economy is booming, but taxes are unavoidable. This blog explains how income from Facebook and Instagram Reels is treated under Indian tax laws, covering ITR filing, deductions, TDS rules, and GST registration.

Intimation U/S 143(1): Your ITR is Processed Here's How to Respond

The Intimation under Section 143(1) is a routine message from the Income Tax Department after processing your ITR. It may confirm your return, show a refund, or raise a tax demand. This blog explains how to read the notice, respond correctly, and avoid penalties.