# itr

12 posts in `itr` tag

Got TCS on Your Tax Statement? Here's What It Means for You!

This blog demystifies Tax Collected at Source (TCS) for taxpayers, especially for Financial Year 2024-25 (Assessment Year 2025-26). It explains what TCS is, lists common transactions where it applies (like motor vehicle sales, overseas tour packages, and foreign remittances under LRS), and details how TCS affects one's tax liability. The post guides readers on how to reconcile TCS entries using their AIS/TIS and claim the correct credit when filing their Income Tax Return, helping them ensure accurate tax compliance and avoid discrepancies.

Big Changes in Your Tax Report: All You Need to Know About the New Form 26AS (AIS)

This detailed blog explores the significant evolution of Form 26AS into the more comprehensive Annual Information Statement (AIS) and Taxpayer Information Summary (TIS). It breaks down the expanded scope of information, including various high-value financial transactions (SFT/AIR data) like property deals, mutual fund transactions, and cash movements, far beyond traditional TDS/TCS. The post emphasizes why these updates are crucial for enhanced transparency, simplified ITR pre-filling, proactive discrepancy identification, and reduced chances of scrutiny. It also provides clear instructions on how to access the new statements and actionable steps for taxpayers to ensure accurate reporting and compliance.

CBDT's Compulsory Scrutiny: A Quick Guide for FY 2025-26

This concise guide explains CBDT's compulsory scrutiny guidelines for FY 2025-26. It outlines the specific high-risk scenarios that can lead to a detailed income tax examination, such as search operations, credible information of tax evasion, or large refund claims. The synopsis highlights that selected taxpayers will receive a Section 143(2) notice for complete, often faceless, scrutiny and advises preparedness and seeking professional help.

New Income Tax Refund Rules 2024: A Detailed Guide for NRIs to Secure Timely Refunds

This comprehensive blog post details the crucial updates to India's income tax refund rules for Non-Resident Indians (NRIs for Assessment Year 2025-26). It highlights the new "No Dues, No Refund" policy, emphasizing the necessity of clearing all outstanding tax demands and compliance issues for refund processing. The guide also covers revisited residential status rules, the default new tax regime, streamlined refund processing, and the vital role of Form 26AS and AIS/TIS. Special attention is given to capital gains and TDS on property sales, a common source of NRI refunds, outlining critical compliance steps. Finally, it provides actionable advice for NRIs to ensure their tax refunds are processed smoothly and without delays.

Old Tax Regime Benefits: Essential Deductions (80E, 80G, 80TTA, 80TTB) Beyond 80C

This blog post delves into crucial tax-saving sections beyond the popular 80C, specifically detailing Sections 80E (education loan interest), 80G (donations), 80TTA (savings interest for non-seniors), and 80TTB (interest on deposits for senior citizens). It explains who can claim these, their limits, and, most importantly, their non-applicability under the New Tax Regime for FY 2024-25. The post encourages taxpayers to compare regimes carefully and highlights myitronline's services for expert assistance.

ITR Filing 2024-25: All Important Deadlines You Need to Know

This blog post provides a comprehensive overview of all crucial Income Tax deadlines for Financial Year 2024-25 (Assessment Year 2025-26). It details specific dates for Form 16 issuance, ITR filing for non-audit and audit cases (including the extended September 15, 2025 deadline for individuals), advance tax installments, and updated returns. The post emphasizes the importance of meeting these deadlines to avoid penalties and promotes myitronline for reliable tax filing assistance.

Form 16 for FY 2024-25: Your Complete Guide to What's New & How to Verify

This blog post provides a detailed guide to Form 16 for Financial Year 2024-25 (Assessment Year 2025-26), highlighting the crucial changes under the new tax regime, including the increased standard deduction and NPS benefits. It offers a step-by-step process for taxpayers to verify their Form 16 against Form 26AS and other documents, ensuring accurate ITR filing and avoiding discrepancies. The post also emphasizes the extended ITR filing deadline and promotes myitronline's services for expert assistance.

ITR Alert: ITR-1 & ITR-4 Offline Utilities for AY 2025-26 Now Available!

The Income Tax Department has released offline utilities for ITR-1 and ITR-4 for Assessment Year 2025-26. This blog post explains what these utilities are, how to download and use them, and highlights the important changes in this year's ITR filing. Start your ITR filing preparation now! Contact MyITROnline for expert assistance.

No DIN, No Problem! Your GST Notices Remain Valid.

The CBIC has clarified that GST notices from the official portal are now valid with a Reference Number (RFN), even without a separate Document Identification Number (DIN). The RFN serves as a unique identifier, making the DIN redundant for these digital communications. This move aims to reduce confusion, simplify verification, and emphasize digital communication. Taxpayers can use the RFN on the GST website to authenticate notices. Caution is advised for notices received without a DIN via other channels.

Important Announcement for Taxpayers: CBDT Extends Deadline for Processing AY 2023-24 Income Tax Returns

The Central Board of Direct Taxes (CBDT) has issued an order extending the processing deadline for electronically filed Income Tax Returns (ITR) for Assessment Year (AY) 2023-24 to November 30, 2025. This relaxation applies to returns where the intimation under Section 143(1) had previously lapsed. The blog post explains who benefits, important exceptions (like scrutiny cases and assessee-attributable delays), and reiterates the necessity of PAN-Aadhaar linking for refund eligibility. It highlights this as a significant relief for taxpayers.

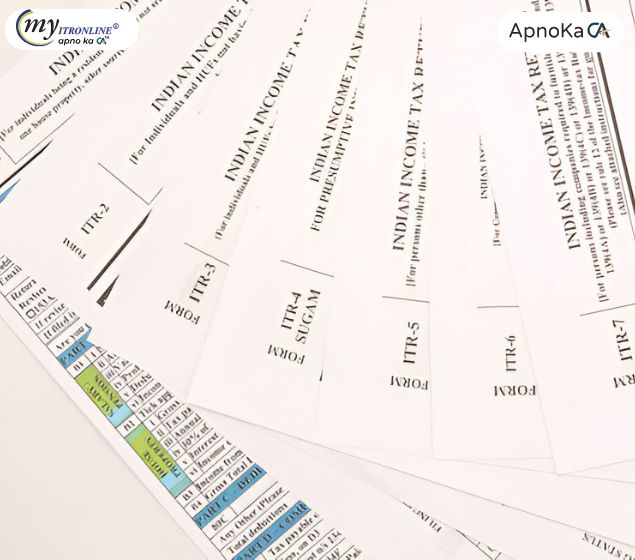

Understanding ITR Forms (ITR-1 to ITR-7) for AY 2025-26: Selecting the Appropriate Form for Your Earnings

This blog post serves as a comprehensive guide to selecting the correct Income Tax Return (ITR) form (ITR-1 to ITR-7) for Assessment Year 2025-26 (Financial Year 2024-25). It begins by emphasizing the importance of choosing the right form to avoid penalties and highlights the extended filing deadline for individuals and HUFs. The post then details important updates for AY 2025-26, including changes to LTCG reporting in ITR-1/4, compulsory detailed disclosures for old regime deductions, new TDS section requirements, revised asset reporting thresholds, and the default new tax regime. A simplified overview of applicability and exclusions for each ITR form (ITR-1 to ITR-7) is provided. Finally, it uses seven practical case studies to illustrate how different taxpayer profiles (salaried, freelancers, businesses, firms, companies, trusts) can correctly identify their applicable ITR form. The synopsis concludes by advising readers to consult official guidelines and tax professionals for accurate filing.

Disability Deductions (80DD & 80U) AY 2025-26: Your Certificate Acknowledgement Number is Now a Must-Have!

This blog post details a critical update for Indian taxpayers claiming deductions under Sections 80DD and 80U for disability for Assessment Year (AY) 2025-26. It highlights the new mandatory requirement to furnish the disability certificate's acknowledgement number in the Income Tax Return (ITR). The post explains the significance of this change for verification and compliance, provides a clear checklist for taxpayers, and outlines essential documentation beyond the acknowledgement number, ensuring a smoother tax filing process under the Old Tax Regime.