# itr

12 posts in `itr` tag

Rectify Your ITR: Claim Forgotten Section 80C Deductions and Avoid Penalties

This blog post provides a comprehensive guide for taxpayers who have missed claiming eligible deductions under Section 80C of the Income Tax Act, 1961, in their original Income Tax Return (ITR). It explains the importance of Section 80C, the concept of a Revised ITR, and offers a detailed step-by-step process for filing a revised return online. The article also emphasizes the significance of adhering to deadlines to avoid penalties and provides essential tips for a smooth filing experience, ensuring taxpayers can reclaim their rightful tax benefits

Double Your Benefits: Utilize Sections 80C & 80D Simultaneously to Enhance Your Tax Savings

This blog explores how Indian taxpayers can maximise their income tax savings by leveraging both Section 80C and Section 80D of the Income Tax Act. While Section 80C focuses on investments and expenses like PPF, ELSS, and home loan principal repayment, Section 80D offers deductions on health insurance premiums and preventive health check-ups. By using these sections together, taxpayers can claim deductions up to ₹2,00,000 annually. The blog explains eligibility, deduction limits, strategic planning tips, and helps readers choose between the old and new tax regimes for optimal tax benefits.

Section 44ADA Explained: Presumptive Taxation Benefits for Self-Employed

This comprehensive guide delves into Section 44ADA of the Income Tax Act, 1961, offering a simplified "presumptive taxation" scheme for eligible self-employed professionals. Discover who qualifies, how to calculate your taxable income at a minimum of 50% of gross receipts, and the significant benefits like exemption from detailed bookkeeping and tax audits. Learn about crucial compliance aspects, including advance tax and the increased ₹75 Lakhs gross receipts limit, to make informed decisions for smarter tax planning and effortless compliance.

.jpg)

Don't Miss Out! Maximize Section 87A & Claim Every Deduction in Your FY 2024-25 ITR

Maximize your savings and simplify your ITR filing for FY 2024-25! Discover how to effectively utilize the Section 87A rebate and navigate the complexities of deductions under both the old and new tax regimes. This essential guide empowers you to make informed choices, accurately claim every eligible deduction, and confidently file your ITR to prevent any unwelcome tax notices.

.jpg)

Got an Income Tax Notice? A Salaried Professional's Definitive Guide

Receiving an income tax notification can be intimidating, especially for salaried professionals. This comprehensive guide demystifies the reasons behind income tax notices in India, detailing common types (like 143(1), 139(9), 143(2), 148, and 156) and providing a step-by-step approach on how to respond effectively. Learn about discrepancies in income/TDS, defective returns, high-value transactions, and best practices to prevent such communications.

Major Update: You Can Now File ITR-U for the Past Four Years!

The Income Tax Department has announced a monumental extension for ITR-U (Updated Income Tax Return) filing, allowing taxpayers to rectify errors or omissions for up to four previous years instead of the prior two. This blog delves into what ITR-U is, the new extended deadlines, who is eligible to file, situations where it cannot be filed, the associated additional tax liability, and the myriad benefits this flexibility offers for enhanced tax compliance and reduced legal complications.

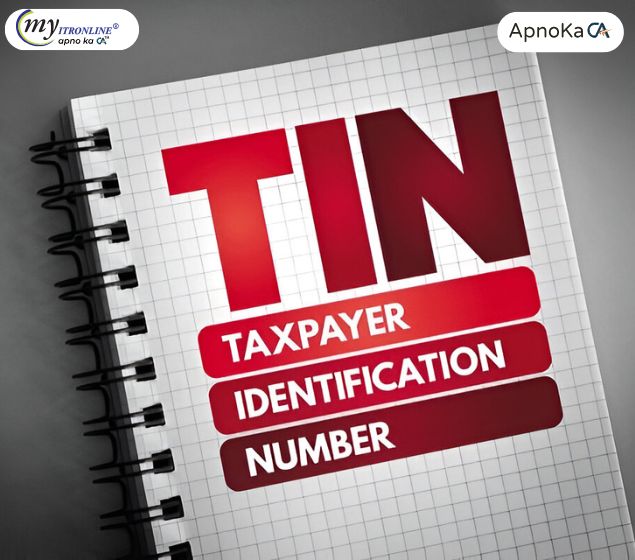

Understanding TIN: Importance, Application, and Verification Explained

This blog explores the crucial role of Tax Identification Numbers (TINs) in global tax systems. It explains what a TIN is, its significance, where and how it is used, how to apply for one, and the ways to verify its authenticity. Designed for individuals and businesses alike, it highlights why accurate TIN usage is vital for efficient tax compliance and administration.

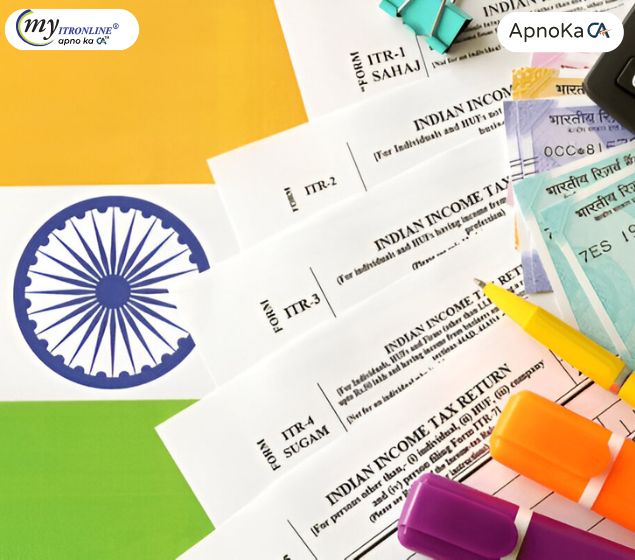

Tax Alerts: 9 Essential Updates to ITR-1, ITR-2, ITR-3, ITR-4 for FY 2024-25

The Income Tax Department has notified updated ITR forms (ITR-1, ITR-2, ITR-3, ITR-4) for FY 2024-25 (AY 2025-26) incorporating several crucial changes. This blog details 9 important adjustments, including relaxed eligibility for ITR-1/ITR-4, mandatory TDS section reporting, removal of Aadhaar Enrolment ID acceptance, detailed disclosures for tax regime options, bifurcated capital gains reporting, new treatment for buyback proceeds, raised asset reporting threshold, additional requirement for disability deductions, and streamlined capital gains sections, all aimed at ensuring accurate and compliant tax filing.

AY 2025-26: Top 28+ Income Tax Return Errors and How to Avoid Them

Filing your Income Tax Return (ITR) for AY 2025-26? Avoid the 28+ most common mistakes that can lead to notices, penalties, or delayed refunds. This comprehensive guide covers identity, income reporting, deduction, procedural, and verification errors, plus new regime selection tips. Stay updated, file accurately, and ensure a smooth tax season!

AY 2025-26 Tax Guide: Important Updates for Senior Citizen Filers

This blog post provides an essential guide for senior citizens regarding their tax filing for Assessment Year 2025-26 (FY 2024-25). It explains the choice between Old and New tax regimes, highlights key tax benefits like higher exemption limits and specific deductions (80TTB, 80D), details the ITR filing exemption under Section 194P for those aged 75+, clarifies applicable ITR forms, and touches upon important upcoming changes for AY 2026-27, empowering seniors with crucial tax information.

How to Save Tax on Capital Gains: Key Exemptions and Step-by-Step Claim Guide

This blog explains the key exemptions available under India’s capital gains tax laws for FY 2025-26, including the latest updates from Budget 2025. It covers who can claim each exemption, how to utilize the Capital Gain Account Scheme, and the correct process for claiming exemptions in your income tax return.

Income Tax Filing 2025-26: CBDT Rolls Out Revised ITR-V and Acknowledgement Forms

The Central Board of Direct Taxes (CBDT) has introduced significant updates to the Income Tax Return Verification Form (ITR-V) and the ITR-Acknowledgement form for Assessment Year 2025-26, effective retroactively from April 1, 2025. These changes, announced under Notification No. 45/2025, are part of the Income-tax (Seventeenth Amendment) Rules, 2025, and are designed to streamline e-filing and verification, enhance security, and promote paperless tax administration. Key features include detailed verification options, improved security, comprehensive return summaries, and a strong emphasis on electronic verification, ensuring a faster, more convenient, and compliant tax filing process for millions of taxpayers.