# compliance

12 posts in `compliance` tag

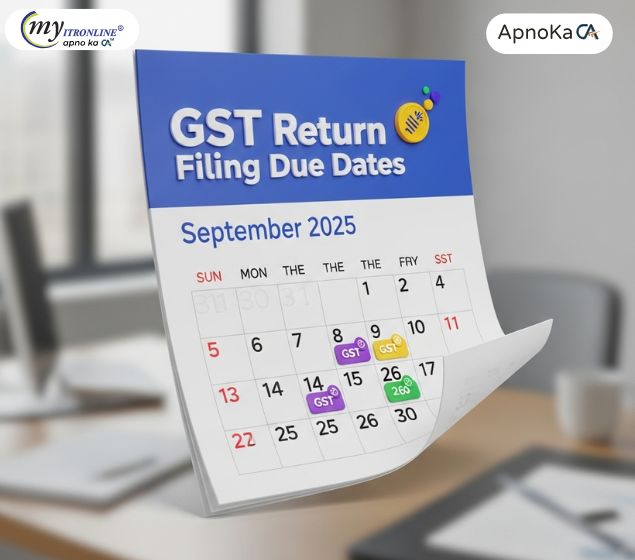

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

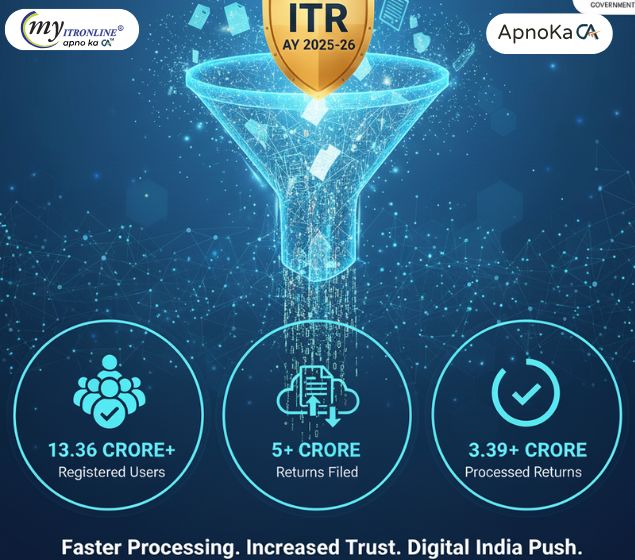

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

GST Rate Changes: Your Essential Guide to Stock ITC Recovery & Reversal

This blog post provides a comprehensive guide to the upcoming GST rate changes in India, effective 22 September 2025, focusing specifically on the implications for Input Tax Credit (ITC) on stock. It explains the new simplified tax slab structure (5%, 18%, 40% for luxury goods) and details how businesses should handle ITC for stock purchased before the changes, supplies made after the changes, and unsold old inventory. The post offers practical advice on identifying stock, claiming eligible ITC, reversing ITC where necessary, seeking manufacturer support, and maintaining audit-ready records to navigate this significant tax transition effectively.

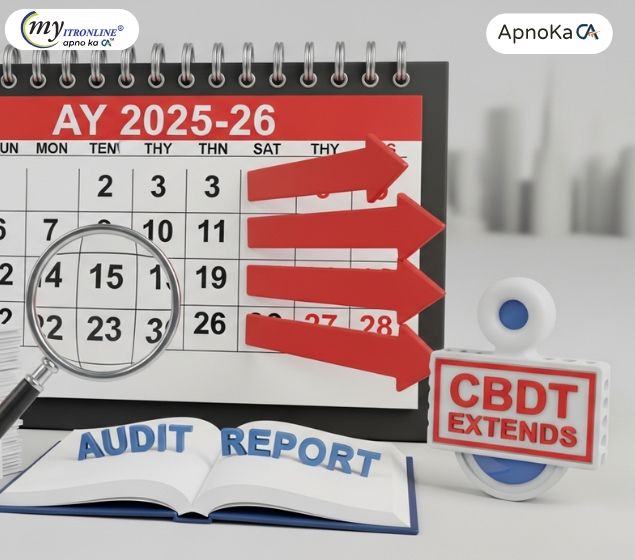

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

CBDT Circular 9/2025: No More 20% TDS Trouble in Property Deals

This blog post explains CBDT Circular No. 9/2025, which clarifies that the higher 20% TDS rate under Section 206AB will not apply to property transactions covered by Section 194-IA. This brings significant relief to buyers and sellers by ensuring a consistent 1% TDS deduction on property sales over ₹50 Lakhs, simplifying compliance and streamlining real estate dealings.

Taxpayers Alert: Major Updates in GST Refund Rules

The Goods and Services Tax Network (GSTN) has significantly revamped its refund system, introducing a unified application form (RFD-01), enhanced document uploads, real-time tracking, and integration with PFMS for faster disbursements. This blog details these crucial updates, explaining how they streamline the refund process for taxpayers, promote transparency, and minimize delays, ensuring timely receipt of their legitimate refunds.

CBDT Overhauls Income Tax: Simpler Forms & Stronger Data Protection by 2025

The Central Board of Direct Taxes (CBDT) is implementing significant changes to income tax forms and rules, effective April 2025, following the new Income Tax Act of 2025. The initiative focuses on simplifying tax filing through smart, pre-filled forms, drastically reducing the number of forms from 200 to under 100, and ensuring robust protection for digital data collected during tax procedures. While new ITR forms are slated for 2027, immediate efforts are on TDS, TCS, advance tax, and exemption forms. These reforms aim to enhance transparency, ease compliance, and create a smarter, safer tax environment for Indian taxpayers.

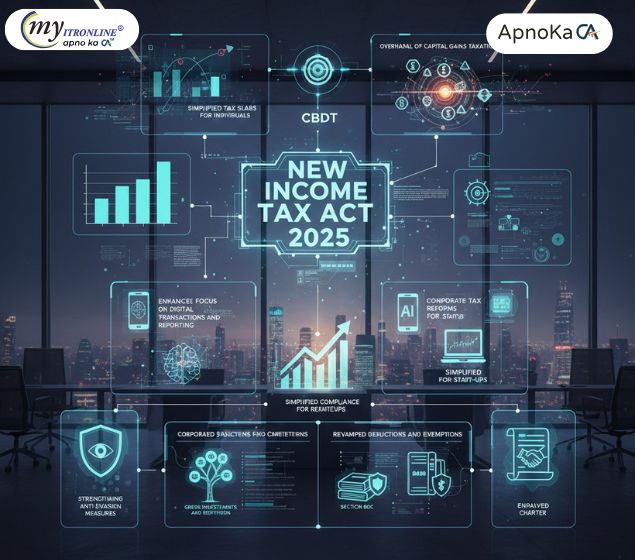

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.