# compliance

12 posts in `compliance` tag

Compliance Calendar October 2025 – Key Tax and Regulatory Deadlines

October 2025 is packed with critical tax and regulatory deadlines. This blog highlights key dates for income tax, GST, MCA filings, EPF/ESI contributions, and audit-related submissions to help you stay compliant and avoid penalties.

ITAT Ahmedabad: No Penalty for Late TDS Remittance under Section 271C

In a landmark ruling, ITAT Ahmedabad has held that penalty under Section 271C of the Income Tax Act is not applicable for delayed remittance of TDS, provided the tax was deducted and paid with interest. This decision, based on Supreme Court precedent, offers relief to taxpayers facing procedural delays.

MCA Extends DIR-3 KYC Deadline to October 15, 2025 - File Without Fees

The Ministry of Corporate Affairs has extended the DIR-3 KYC filing deadline from September 30, 2025 to October 15, 2025, without any filing fees. This compliance requirement applies to all directors holding a DIN. Directors can file either DIR-3 KYC (with DSC) or DIR-3 KYC-WEB (OTP-based) forms. Non-compliance will result in DIN deactivation, penalties up to ₹5,000, and disqualification from director appointments. The extension follows stakeholder representations requesting additional time for compliance.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

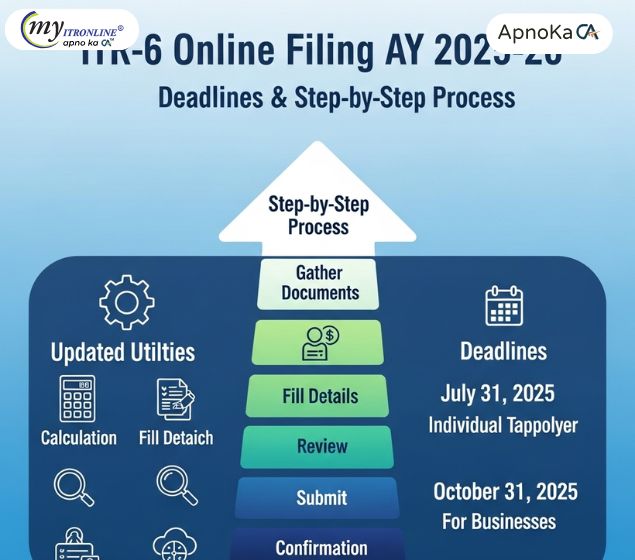

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

ICAI Membership Fee Alert: 1.20 Lakh CAs Risk Cancellation Pay Before September 30, 2025

Nearly 1.20 lakh out of 5 lakh ICAI members are at risk of losing their Membership and Certificate of Practice (COP) due to non-payment of annual fees for 2025-26. The Institute has set a firm deadline of September 30, 2025, after which memberships will be automatically cancelled. This will result in immediate loss of practice rights, audit signing authority, and professional standing. Members can pay securely through the ICAI eServices portal using multiple payment options including UPI, net banking, and cards. With just days remaining, immediate action is essential to avoid cancellation and the hassle of reactivation procedures.

March 31, 2026: The TDS/TCS Correction Deadline You Cannot Miss

The Income Tax Act, 2025 has introduced a crucial change in TDS/TCS compliance: the timeline for filing correction statements has been reduced from 6 years to 2 years. Businesses must file all pending TDS/TCS corrections for FY 2018-19 Q4 through FY 2023-24 Q3 by March 31, 2026. Failure to meet this deadline will lead to automatic recovery proceedings, penalties, and compliance complications. Learn about the key changes, understand the implications for your organization, and discover the immediate steps you need to take to ensure full compliance before the deadline expires.

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

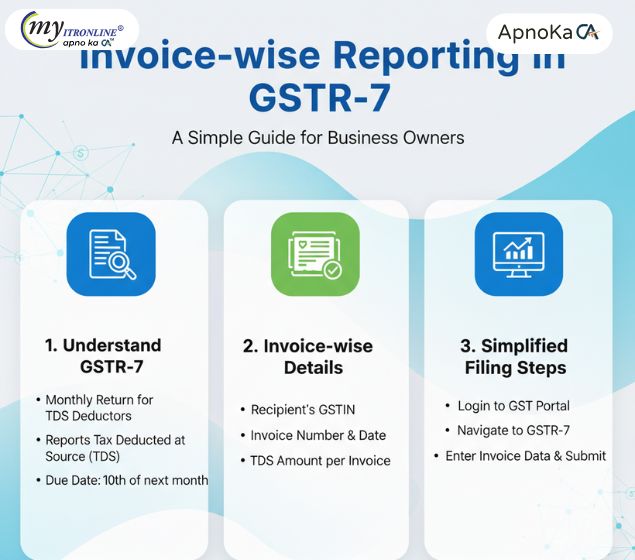

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.