# compliance

12 posts in `compliance` tag

Difference Between Original, Revised, and Updated ITR A Complete Guide

This blog explains the differences between Original, Revised, and Updated Income Tax Returns (ITR) in India. It covers filing timelines, applicable sections, fees, and practical examples to help taxpayers choose the right return type and avoid penalties.

MCA Extends CRA-4 Filing Deadline No Extra Fee Till 31st December 2025

The Ministry of Corporate Affairs (MCA) has extended the deadline for CRA-4 filing without extra fees till 31st December 2025. This move helps companies and cost auditors adjust to the new form rollout on the MCA V3 portal and avoid penalties.

Tax Refunds Can’t Be Denied for Form 26AS Mismatch: High Court Ruling

The Allahabad High Court has ruled that tax refunds cannot be denied just because TDS is missing from Form 26AS. If a taxpayer provides valid Form 16A certificates, the Income Tax Department must verify the claim with the deductor instead of rejecting it outright. This protects honest taxpayers from delays caused by clerical errors.

Great News for Entrepreneurs! Get Your GST Number in Just 3 Days

GST 2.0 is a game-changer for small businesses in India. Starting November 1, 2025, new applicants can opt for a simplified GST registration process with automatic approval in just 3 working days. Designed for low-risk businesses, this reform reduces hassle and speeds up business launch.

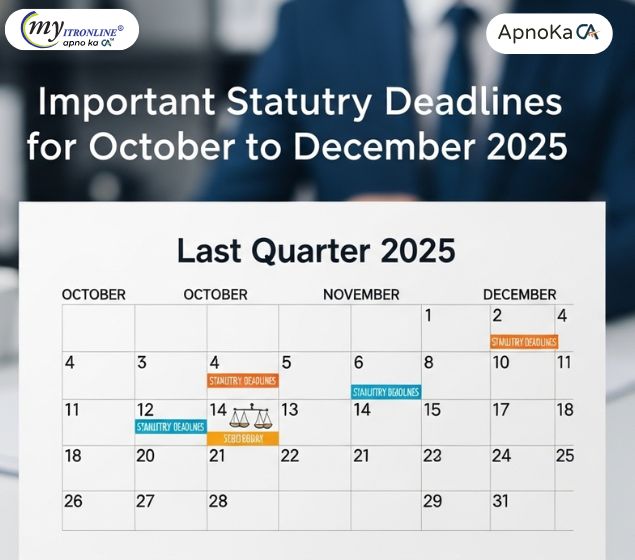

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

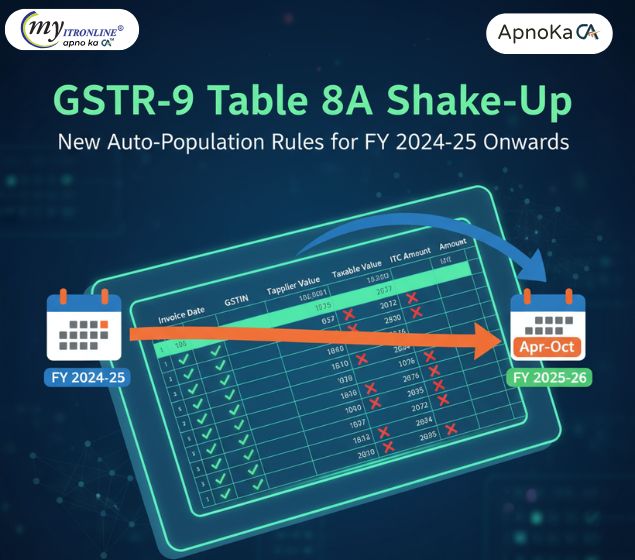

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

GSTR-9 and GSTR-9C Filing for FY 2024-25 is Now Open

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

DIR-3 KYC Deadline Extended to October 31, 2025 – No Late Fees

The Ministry of Corporate Affairs (MCA) has extended the DIR-3 KYC deadline to October 31, 2025. This allows directors to file without incurring the ₹5,000 late fee and avoid DIN deactivation. Learn who needs to file, which form to use, and why early action is crucial.

GSTN Clarifies: No Change in ITC Auto-Population from GSTR-2B to GSTR-3B

GSTN has issued a clarification confirming that the auto-population of Input Tax Credit (ITC) from GSTR-2B to GSTR-3B remains unchanged, even after the implementation of the Invoice Management System (IMS). GSTR-2B will continue to be generated automatically on the 14th of every month. This update helps clear confusion and reassures taxpayers that their filing process remains stable.

GST Appeals Made Easier: Lower Pre Deposit Rules Under Finance Act 2025

The Finance Act 2025 brings relief to businesses by reducing the pre-deposit requirement for penalty only GST appeals from 25% to 10%. Tax appeals remain unchanged at 10%. Businesses can now use Input Tax Credit (ITC) for deposits, improving cash flow and easing compliance. These changes will be effective after CBIC notification.

GST Changes from October 2025: What You Need to Know

Starting October 2025, the GST system will undergo major changes affecting how businesses file returns and claim input tax credit. Key updates include manual ITC acceptance, locked GSTR-3B liabilities, new credit note rules, and invoice-level TDS reporting. Businesses must adapt to stay compliant and avoid filing issues.

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.