How Marginal Relief Ensures Fair Taxation for Income Just Above 12 Lakh

This blog explores the Indian income tax system's marginal relief idea and explains how it helps taxpayers with earnings over 12 lakh. The blog illustrates how marginal relief lowers the tax due, guaranteeing equity and avoiding excessive tax increases, using the example of a 12,10,000 income. In order to demonstrate how this clause upholds a just and equitable tax system, the blog also provides instances of other income categories that are impacted by marginal relief.

.jpg )

Introduction: A Concept Known as Marginal Relief

A concept known as marginal relief was created by the Indian tax system, and it is especially advantageous for those whose salaries just barely beyond the 12 lakh barrier. This blog discusses the tax ramifications for an individual earning 12,10,000 as well as how marginal relief operates. Let's examine the tax computations and see how taxpayer fairness is ensured via marginal relief.

Marginal Relief: What Is It?

A feature of the income tax system known as marginal relief makes sure that those who make slightly more than 12 lakh don't pay an excessive amount in taxes. Taxpayers who earn only a little more than 12 lakh under this system only pay the marginal tax, which is equivalent to the income above 12 lakh. This guarantees that the tax rise will not significantly impact the taxpayer's net income.

Tax Calculation for a 12,10,000 Income

Let's look at a person who makes 12,10,000 in taxable income. The tax payable without any marginal relief is 61,500, as per the tax slabs. The marginal assistance provision, however, lowers this sum.

Without Marginal Relief, Income Tax:

Income subject to taxes: 12,10,000

Payable tax: 61,500

Let's Now Examine the Use of Marginal Relief in This Situation:

Marginal Relief on Tax Payable:

Over 12 lakh in income: 10,000 (12,10,000 - 12,00,000)

The tax due is lowered to 10,000 with marginal relief, keeping the taxpayer's net income as near to 12 lakh as feasible.

How Other Income Ranges Are Affected by Marginal Relief

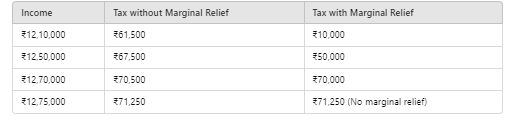

To further understand how marginal relief applies to salaries slightly above 12 lakh, let's examine a few additional examples:

Marginal relief, as shown in the table, makes ensuring that the tax due does not rise disproportionately for people making just over 12 lakh. The taxpayer's income stays as close to 12 lakh as feasible while the amount of tax paid is reduced.

In Conclusion

One important step in making income tax more equitable for people with incomes slightly above 12 lakh is the implementation of marginal relief in the tax code. By lowering their tax liability, this clause improves their financial security by enabling them to keep a larger portion of their income. Marginal relief can assist lessen the burden of taxes and preserve a more equal income distribution, regardless of your income level (12,10,000 or 12,70,000).

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles