Understanding the Key Differences: Old vs New Tax Regime

As the financial year 2025-26 begins, taxpayers face a crucial decision: Old Tax Regime or New Tax Regime? This blog simplifies the choice with real-life examples of Mr. Arun Sharma and Mr. Rahul Mehta, breaking down their income, deductions, and tax liabilities under both regimes. Discover which regime is better for you, whether you have significant deductions or prefer simplicity. Learn how to save more on taxes and make an informed decision for FY 2025-26.

.jpg )

Old vs New Tax Regime: Which is Better for You in 2025-26?

As the new financial year 2025-26 begins, many taxpayers like Mr. Arun Sharma face a crucial decision: should he opt for the Old Tax Regime or the New Tax Regime? With two tax structures to choose from, it can be a bit tricky. In this article, we’ll break it down in the most relatable way possible by using Mr. Arun Sharma’s situation as an example. We’ll help him (and you) make an informed decision about which regime suits him best.

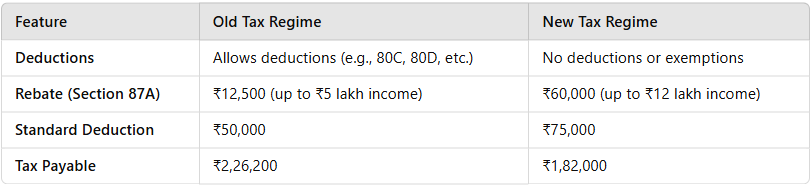

The Old Tax Regime vs. The New Tax Regime – Understanding the Key Differences

Old Tax Regime

In the Old Tax Regime, you can avail various exemptions and deductions that can help reduce your taxable income. It's a great choice for those who have investments like PPF, NPS, or HRA (House Rent Allowance).

Key Features:

- You can claim deductions like 80C (up to ₹1.5 lakh), 80D (health insurance), HRA, NPS (₹50,000), and standard deduction (₹50,000).

- Tax slabs are higher, and deductions reduce taxable income, lowering the overall tax payable.

New Tax Regime

The New Tax Regime was introduced for simplicity. It comes with lower tax rates but removes deductions like 80C, HRA, or NPS. However, the standard deduction of ₹75,000 applies.

Key Features:

- Lower tax rates across various income slabs.

- No deductions or exemptions, except for the standard deduction.

Example 1

Let’s Break It Down with Mr. Arun Sharma's Example

Mr. Arun Sharma has a gross income of ₹20,00,000. He is debating whether he should stick with the Old Tax Regime or switch to the New Tax Regime. Let’s walk through his situation in both scenarios.

Old Tax Regime for Mr. Arun Sharma:

1. Income Details:

- Basic Salary: ₹8,00,000

- HRA: ₹3,60,000

- Bonus: ₹2,00,000

- LTA: ₹1,20,000

- Conveyance Allowance: ₹96,000

- Other Allowance: ₹4,24,000

- Rent paid: ₹4,80,000

- Total Income: ₹20,00,000

2. Deductions (Tax-saving Investments):

- Section 80C: ₹1,50,000 (e.g., PPF, ELSS)

- NPS Contribution: ₹50,000

- Section 80D: ₹40,000 (Health Insurance)

- Standard Deduction: ₹50,000

- HRA Exemption: ₹3,60,000

New Tax Regime for Mr. Arun Sharma:

1. Income Details:

- Gross income remains the same: ₹20,00,000

2. Deductions:

- Standard Deduction: ₹75,000

- NPS Contribution: ₹50,000

Comparison of Old and New Tax Regime

Which Tax Regime Should Mr. Arun Sharma Choose?

IF IN THIS CASE HRA EXEMPTION EXCEEDS WITH 141667 TAX IS EQUAL IN BOTH REGIME

- Old Tax Regime is better for Mr. Arun if:

- He has significant deductions (e.g., HRA, 80C, NPS).

- He wants to maximize his tax-saving potential.

- New Tax Regime is better for Mr. Arun if:

- He prefers simplicity and doesn’t have many deductions or exemptions.

- He wants lower tax rates and finds the ₹60,000 rebate under Section 87A appealing.

- He earns under ₹12 lakh and is looking for the easiest way to file taxes.

Summary:

In Mr. Arun Sharma's case, after comparing both regimes, the New Tax Regime works out to be the better choice. The tax payable in the new regime is significantly lower at ₹1,75,000, compared to ₹2,17,500 under the Old Regime. This is because the New Tax Regime offers lower tax rates and a higher rebate of ₹60,000 for income up to ₹12 lakh.

If you, like Mr. Arun, don’t have substantial exemptions or deductions, the New Tax Regime might be the best way forward for a simplified and lower-tax option. However, if you have considerable tax-saving investments, the Old Tax Regime could provide better savings.

Conclusion:

Ultimately, the choice between the Old Tax Regime and the New Tax Regime depends on your individual financial situation. For someone like Mr. Arun Sharma, who doesn’t have significant tax-saving investments, the New Tax Regime is the more tax-efficient and simpler option. However, for individuals who have a substantial amount of deductions to claim, the Old Tax Regime might still offer better tax benefits.

The key takeaway? Evaluate your deductions and rebates before making your choice, and choose the tax regime that fits your financial habits and lifestyle best.

Example 2

Old vs New Tax Regime: Which is Better for You in 2025-26?

As the new financial year begins, many taxpayers, including Mr. Rahul Mehta, face the dilemma of choosing between the Old Tax Regime and the New Tax Regime. In this article, we’ll help Mr. Rahul understand which regime will suit him best by breaking it down with a relatable example and providing a side-by-side tax calculation comparison.

Old Tax Regime vs. New Tax Regime: A Quick Overview

Old Tax Regime:

- The Old Tax Regime allows you to claim various exemptions and deductions, making it ideal for taxpayers with investments and expenses they can use to reduce taxable income.

- Key Features:

- Deductions like 80C (up to ₹1.5 lakh), 80D (health insurance), NPS, HRA, etc.

- Tax Slabs are higher, but deductions reduce taxable income, lowering the overall tax payable.

New Tax Regime:

- The New Tax Regime provides lower tax rates but removes deductions like 80C, HRA, NPS, etc. It is perfect for those who prefer a simpler tax structure with fewer exemptions.

- Key Features:

- Lower Tax Rates across all income slabs.

- No deductions except for the standard deduction of ₹75,000.

Let’s Walk Through Mr. Rahul Mehta’s Example

Mr. Rahul Mehta has an annual income derived from two sources:

- Salary Income: ₹18,00,000

- Basic – 7,20,000

- HRA – 2,50,000

- Bonus – 1,00,000

- Other allowance – 7,30,000

- Business Income: ₹6,00,000

- Total Gross Income: ₹24,00,000

Deductions and Exemptions Mr. Rahul Claims:

- Section 80C (e.g., PPF, ELSS, etc.): ₹1,50,000

- NPS Contribution: ₹50,000

- Standard Deduction - ₹50,000

- Section 80D (Health Insurance Premium): ₹40,000

- HRA exemption: ₹2,50,000

- Total Deductions: ₹2,90,000

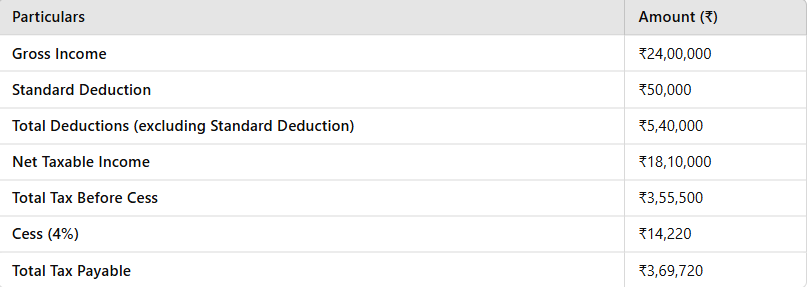

Old Tax Regime Calculation

- Gross Income: ₹24,00,000

- Total Deductions: ₹5,90,000 (80C, NPS, 80D)

Tax Slabs for the Old Regime (2025-26):

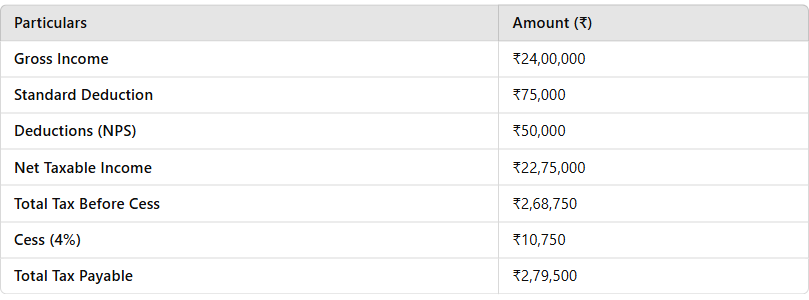

New Tax Regime Calculation

- Gross Income: ₹24,00,000

- Deductions:

- Standard Deduction: ₹75,000

- NPS Deduction: ₹50,000

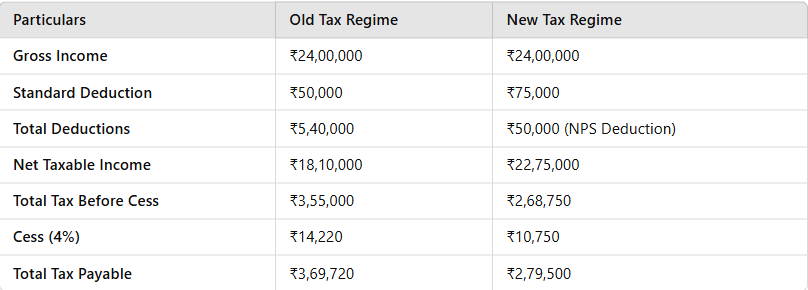

Comparision old and new

Which Tax Regime Should Mr. Rahul Mehta Choose?

Old Tax Regime is better for Mr. Rahul if:

- He has significant deductions, such as NPS, 80C, Office Expenses, and Depreciation.

- He wants to reduce taxable income through his investments and expenses.

- He doesn’t mind the higher tax rates in exchange for potential savings.

New Tax Regime is better for Mr. Rahul if:

- He prefers simplicity and doesn’t have many deductions to claim.

- He wants lower tax rates without worrying about tracking deductions.

- He’s willing to trade-off tax-saving opportunities for an easier, streamlined filing process.

Summary:

- Old Tax Regime:

- Deductions: With total deductions of ₹5,90,000 (₹50,000 standard deduction and ₹5,40,000 other deductions), the Net Taxable Income comes down to ₹18,10,000.

- Total Tax Payable: After applying the tax slabs and cess, the total tax payable is ₹3,69,720.

- New Tax Regime:

- Deductions: With only the standard deduction of ₹75,000 and an NPS deduction of ₹50,000, the Net Taxable Income is ₹22,75,000.

- Total Tax Payable: After applying the tax slabs and cess, the total tax payable is ₹2,79,500.

Conclusion:

- New Tax Regime results in a lower tax liability (₹2,79,500) as compared to the Old Tax Regime (₹3,69,720).

- The Old Tax Regime offers a wider range of deductions but requires more detailed calculations. It reduces taxable income significantly, but the overall tax liability might be higher.

- The New Tax Regime provides a simpler approach with fewer deductions, resulting in a lower tax liability for individuals with fewer deductions.

- For individuals like Mr. Rahul Mehta, who may not have extensive deductions, the New Tax Regime could be a better choice, offering a simpler and more favorable outcome.

Written by Sumit Rawat, Accountant

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles