AY 2025-26: Your Simple Guide to ITR-1 & ITR-4 Changes)

This comprehensive blog post outlines the significant changes introduced by the Income Tax Department for Assessment Year 2025-26 (FY 2024-25) concerning ITR-1 (Sahaj) and ITR-4 (Sugam) under the Old Tax Regime. It details the newly mandated annexures for claiming various deductions, including HRA, Section 80C, 80D, 80DD, 80DDB, 80E, 80EE, and 80EEB. Readers will find crucial information on the new required fields for each section, key points to remember for seamless e-filing, common validation errors to avoid, and important deadlines. The post emphasizes the importance of accurate data submission and retaining supporting documents to ensure tax compliance.

AY 2025-26: Understanding New Required Annexures for ITR-1 & ITR-4 (Old Regime)

Are you an individual taxpayer intending to file your Income Tax Return (ITR-1 Sahaj) or ITR-4 Sugam for the Assessment Year 2025-26 (Financial Year 2024-25) under the Old Tax Regime? If so, it's important to pay close attention! The Income Tax Department has rolled out several new obligatory annexures that demand detailed information for claiming different deductions.

These updates are essential to ensure precise tax filing and to prevent last-minute validation issues. Missing or incorrect information can hinder your e-filing process. Let’s take a look at the new annexures and the information you’ll need to provide for each.

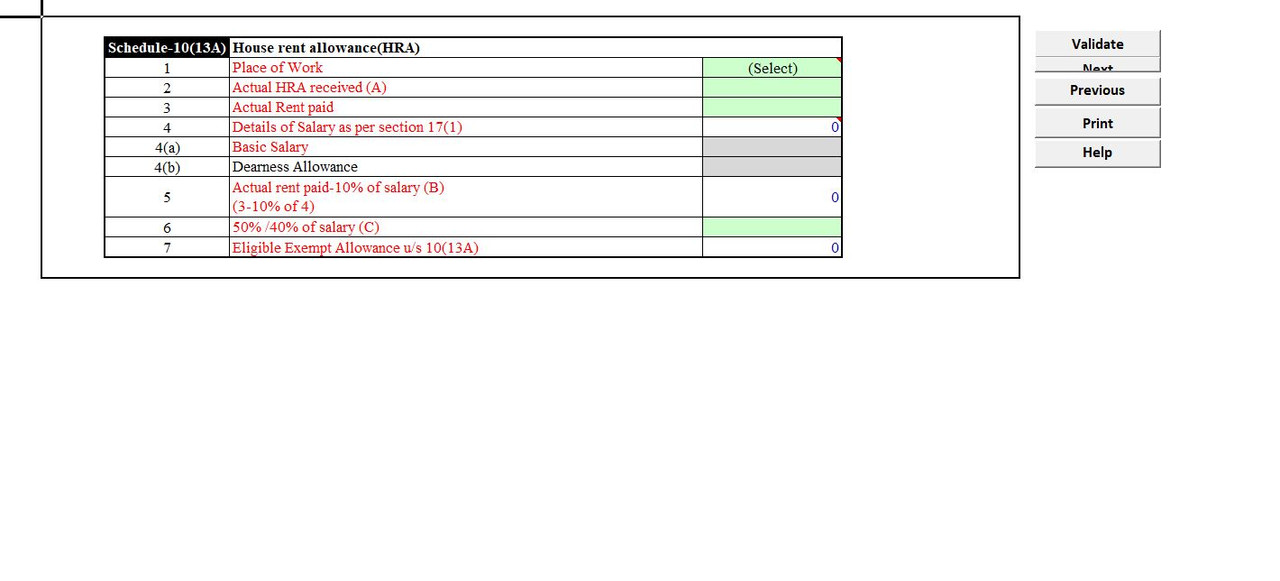

1. HRA (House Rent Allowance) – Schedule 10(13A)

Claiming a House Rent Allowance (HRA) deduction has become more intricate. This section now asks for specific information to support your claim.

Required Fields:

- Location of Employment

- Basic Salary

- Actual HRA Received

- Rent Paid

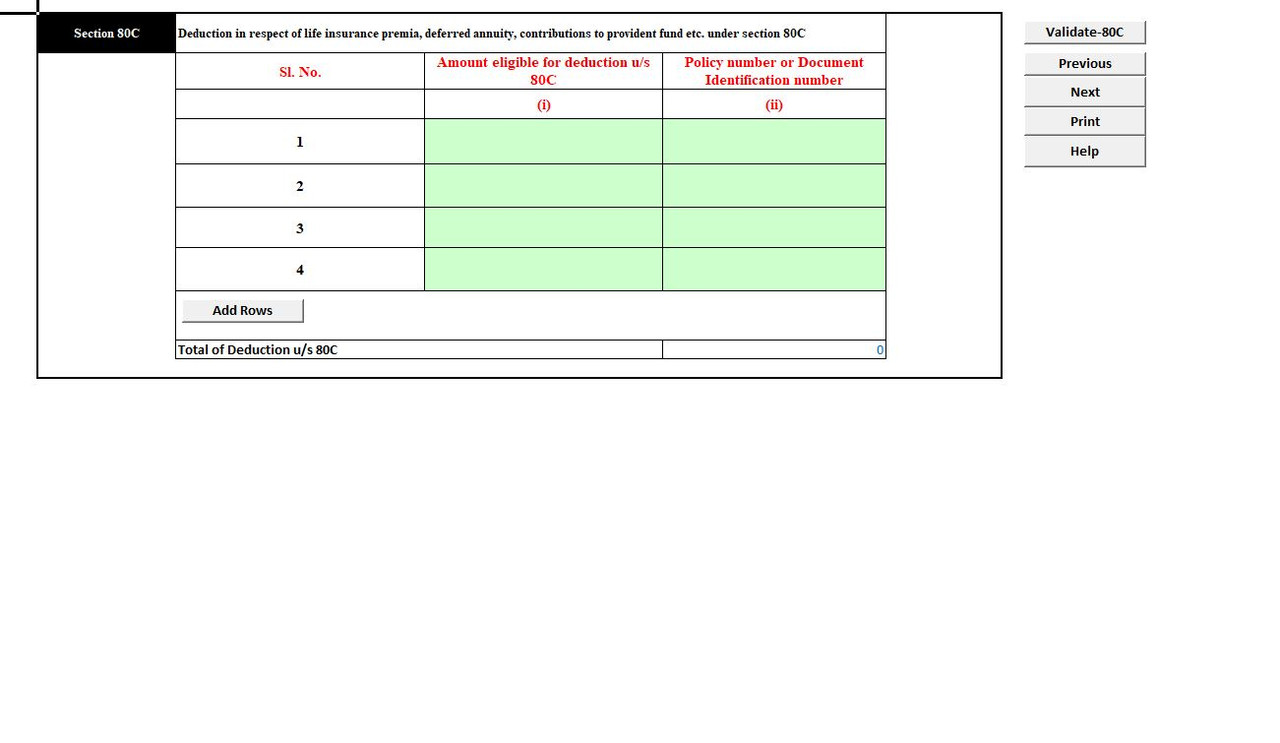

2. Section 80C (Eligible Investments)

Section 80C remains a favored section for claiming deductions on various investments and expenses. For AY 2025-26, more detailed information is needed for each qualifying investment.

Required Fields:

- Date of Investment

- Description of Instrument (e.g., PPF, ELSS, Life Insurance, Home-Loan Principal Repayment)

- Amount Eligible for Deduction

- Policy/Document Identification Number (This is now required for each investment)

3. Section 80D (Health Insurance Premium)

The deductions for health insurance premiums under Section 80D come with stricter reporting requirements, which facilitate accurate claim verification.

Essential Fields:

- Insurance Company Name

- Policy Number

- Amount Paid (separately for self & family, and for parents)

4. Section 80DD (Care for Specially-Abled Dependent)

If you're requesting a deduction for the care or medical treatment of a dependent with a disability, comprehensive details are required.

Essential Fields:

- Nature of Disability (dependent) – you'll have to choose between "Disability" or "Severe Disability"

- Type of Dependent (self / spouse / children / parents)

- PAN & Aadhaar of Dependent

- Date & Acknowledgement No. of Form 10-IA (mandatory)

- Acknowledgement No. per Rule 11A(2)(c) (if applicable)

- UDID No. (Unique Disability ID Number - if available)

- Amount Claimed (under Section 80DD)

5. Section 80DDB (Medical Treatment of Specific Diseases)

For costs related to the medical treatment of specific diseases, the ITR now requires specification of the condition.

Essential Field:

- Specified Disease (e.g., Cancer, Parkinson’s, Thalassemia, HIV/AIDS, Chronic Renal Failure) – you'll select from a dropdown menu.

- Expenses Incurred (medical costs)

6. Section 80E (Interest on Education Loan)

The process for claiming deductions on interest paid for education loans is now more extensive, as it demands specific loan details.

Essential Fields:

- Source of Loan ("Bank" or "Other than Bank")

- Name of Bank/Institution

- Loan Account Number

- Date of Approval

- Total Amount of Loan

- Outstanding Amount (as of 31 March 2025)

- Interest Claimed (under Section 80E)

7. Section 80EE (Interest on First-Home Loan)

For interest paid on loans taken out for your first home, similarly detailed loan specific information is now necessary.

Essential Fields:

- Source of Loan ("Bank" or "Other than Bank")

- Name of Bank/Institution

- Loan Account Number

- Date of Approval

- Total Amount of Loan

- Outstanding Amount (as of 31 March 2025)

- Interest Claimed (under Section 80EE)

8. Section 80EEB (Interest on EV Loan)

This relatively new deduction for interest on loans taken for electric vehicles comes with specific reporting prerequisites.

Essential Fields:

- Name of Bank/Financial Institution

- Loan Account Number

- Date of Approval

- Total Amount of Loan

- Outstanding Amount (as of 31 March 2025)

- Vehicle Registration Number (This is a must for EV loan claims)

Important Points to Consider for Smooth Filing:

- Essential Fields: All the fields listed above are obligatory in the ITR-1/ITR-4 Excel utility. Make sure you fill them out correctly.

- Validation Errors: Missing or inaccurate information will result in validation errors, preventing your e-filing. Review all entries carefully.

- Documentation is Crucial: Always keep all supporting documents, including loan sanction letters, policy documents, Form 10-IA acknowledgements, medical certificates, and PRAN (for NPS contributions, though not explicitly a change here, it's advisable).

- Understand Your ITR Form: If you have specific income types such as ESOP, lottery winnings, crypto income (TDS under Sections 194B/194BB/194S), capital gains exceeding a certain threshold, or foreign assets, DO NOT opt for ITR-1. You will require ITR-2 or ITR-3 instead.

- Deadlines: The original ITR filing deadline for individuals is 31st July 2025. The extended deadline, if provided, is usually 15th September 2025. It’s best to file early to avoid last-minute rushes and technical issues.

Conclusion

While navigating the new annexures may appear challenging at first, with adequate preparation and understanding, you can facilitate a smooth tax filing experience. Begin gathering your documents early and diligently provide all required details. Correct annexure submissions will help you bypass validation problems and ensure adherence to the latest regulations regarding income tax.

For expert help with your tax filing and to guarantee accurate annexure submissions, consider reaching out to the professionals at MyITROnline. Call us at 9971055886 or visit our website: www.myitronline.com

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles