TR-U vs. Condonation of Delay: Which Option is Right for Your Late Tax Return?

This blog discusses the distinctions between ITR-U and Condonation of Delay for late tax filing in India. Learn about eligibility, methods, and how to select the best solution for your needs.

.jpg )

Introduction

Filing your Income Tax Return (ITR) on time is critical for ensuring compliance with Indian tax regulations. However, if you miss the deadline, the Income Tax Department provides two important options to help you fix the issue:

- ITR-U (Section 139(8A)): For amending previously filed returns.

- Delay Concession (Section 119(2)(b)): For those seeking assistance owing to actual hardship.

Understanding these possibilities can assist taxpayers in determining the best method for their specific situation.

ITR-U (Section 139(8A)): Updated Return for Missed Income

Introduction:

ITR-U, introduced in 2022, permits taxpayers to file an amended return within 24 months from the end of the relevant assessment year if they have omitted or under-reported income in earlier years.

Key Features of the ITR-U:

- Purpose: To repair mistakes or omissions in previously submitted ITRs.

- Eligibility: Taxpayers who either did not file their ITR or need to update their income information.

- Time Limit: File within 24 months of the end of the relevant evaluation year.

- Additional Tax Liability: Taxpayers must pay an extra tax of:

- If submitted within 12 months, you will be charged 25% of the tax and interest.

- If submitted after 12 months but before 24 months, you will be charged 50% of the tax and interest.

Cases in Which ITR-U Cannot Be Filed:

- If it results in a refund or reduced tax burden.

- If there be further losses.

- In circumstances requiring search, survey, or assessment procedures.

Section 119(2)(b): Relief for Late Filing

Section 119(2)(b) permits taxpayers to request CBDT clearance for ITR filing delays owing to genuine causes such as sickness, natural disasters, or technological challenges.

Key Characteristics of Delay Condonation:

- Purpose: To get relief from the penalty of missing the ITR filing deadline.

- Eligibility: Taxpayers who were unable to file their ITR for a legitimate cause and are now requesting a refund or loss carry-forward.

- Proof of Actual Hardship: Required as a ground for condonation.

- Time Limit: Generally, applications must be submitted within 5 years of the conclusion of the relevant evaluation year.

- Process:

- File an application with the Jurisdictional Principal Chief Commissioner or Chief Commissioner.

- Please provide genuine reasons for the delay, together with supporting papers.

- Financial Impact: There is no additional tax, however interest under Sections 234A/B/C may apply.

- Discretionary Power: The CBDT has the ability to grant or deny the condonation request.

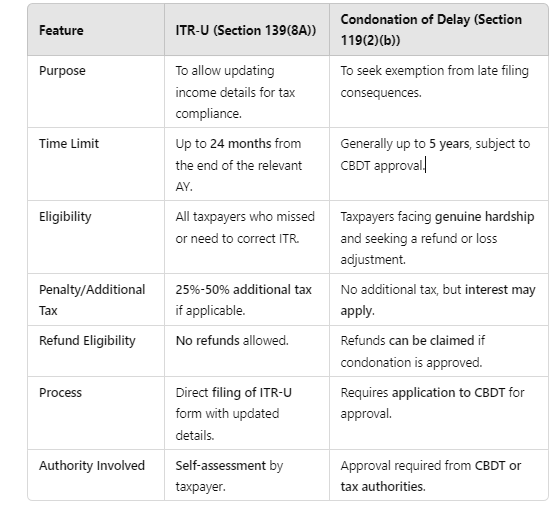

Comparison Table: ITR-U vs. Condonation of Delay

When To Choose ITR-U:

- You've already submitted your ITR but realized you didn't record certain income.

- Correct mistakes in your return within the specified timeframe.

- You are ready to pay extra taxes.

When Should I Apply for Delay Condonation?

- You missed submitting your ITR for a valid cause, such as a medical emergency or natural calamity.

- You seek refunds or loss carry-forward benefits.

- You wish to avoid fines (if condonation granted).

Important Considerations:

- Maintain accurate records of income and expenses.

- File your ITR on time to avoid penalties and interest.

- If you miss the deadline, examine your position and take the appropriate action.

- If you are confused about which choice is best for your situation, get expert help.

Conclusion

Both ITR-U and Condonation of Delay provide relief for taxpayers who have missed their tax reporting deadlines, although they serve distinct purposes:

- ITR-U: Used to remedy under-reported income and requires an extra tax payment.

- Delay Condonation: For real hardships and may result in reimbursements or loss adjustments.

Taxpayers should assess their unique position to identify the best course of action. Consulting with a tax specialist can assist assure compliance while minimizing financial effect.

Disclaimer

This blog is just for informative purposes. Before taking any action, please review the official tax legislation or speak with an expert.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles