Understanding the Trends in India's Direct Tax Collections FY 2025-26

This blog analyzes India's direct tax collections for FY 2025-26 (as of June 19, 2025). While net collections show a slight dip, the detailed breakdown reveals robust gross collection growth and a significant increase in tax refunds, reflecting enhanced taxpayer services. Positive advance tax figures further signal underlying economic strength and optimistic future expectations, painting a picture of resilience rather than slowdown

The latest figures on direct tax collections, released by the Central Board of Direct Taxes (CBDT) as of June 19, 2025, offer important insights into India's economic performance and revenue generation for the current fiscal year (FY 2025-26). While the initial headline number might give pause, a closer look reveals a more complex and largely positive story, especially regarding efficiency and future growth prospects.

Let’s break down the data to understand the trends.

The Overall Picture: Net Collections vs. Gross Collections

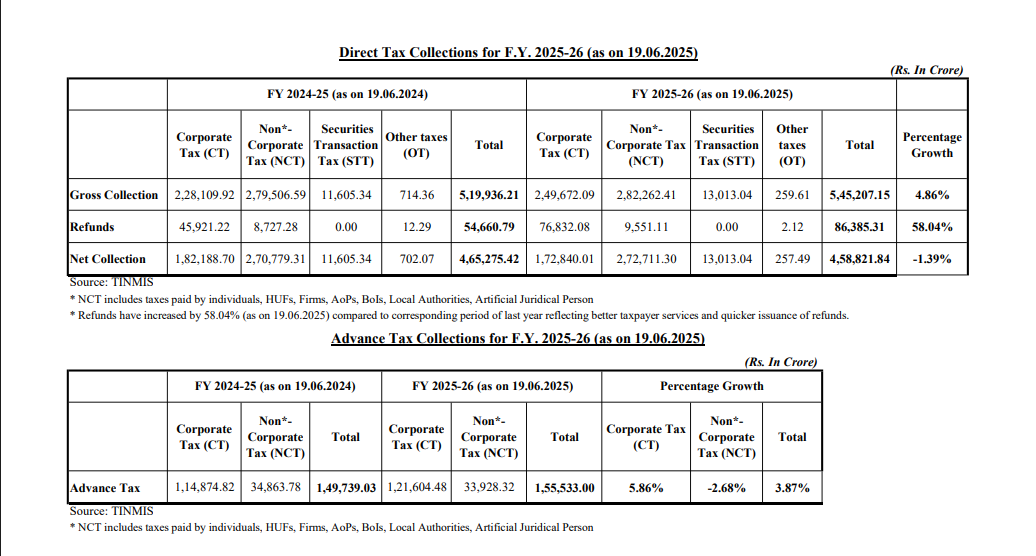

Initially, the Net Direct Tax Collection for FY 2025-26 (as of June 19, 2025) is Rs. 4,58,821.84 crore. This shows a slight decline of 1.39% compared to the same period last year (FY 2024-25, as of June 19, 2024).

However, this negative growth in net collection doesn’t reflect the full story. Looking at Gross Direct Tax Collections, we see a different trend. Gross collections have actually grown by 4.86%, reaching Rs. 5,45,207.15 crore for FY 2025-26.

Figure: Direct Tax Collections for F.Y. 2025-26 (as on 19.06.2025)

The Refund Story: Efficiency in Action

The key to understanding the difference between gross growth and net decline is Refunds. Refunds have increased significantly by 58.04% this year compared to last year, totaling Rs. 86,385.31 crore.

The explanatory note states: "Refunds have increased by 58.04% (as of 19.06.2025) compared to the corresponding period last year, reflecting better taxpayer services and quicker issuance of refunds."

This is an important insight. The rise in refunds does not point to an economic slowdown but highlights the government’s improved efficiency in processing tax refunds. Though it temporarily lowers the net collection figure, it puts money back into the hands of taxpayers and businesses faster. This can boost spending and investment. It also shows a commitment to a transparent and responsive tax system.

Component-wise Analysis: Corporate vs. Non-Corporate Tax

Corporate Tax (CT):

- Gross CT collection for FY 2025-26 is Rs. 2,49,672.09 crore.

- Net CT collection is Rs. 1,72,840.01 crore.

While gross corporate tax collection shows a positive trend, the net collection may be affected by corporate refunds.

Non-Corporate Tax (NCT):

NCT includes taxes paid by individuals, Hindu Undivided Families (HUFs), firms, Associations of Persons (AOPs), Bodies of Individuals (BoIs), local authorities, and artificial juridical persons.

- Gross NCT collection totals Rs. 2,82,262.41 crore.

- Net NCT collection is Rs. 2,72,711.30 crore, indicating a strong performance in this area with relatively lower refunds compared to CT in percentage terms.

Securities Transaction Tax (STT) & Other Taxes (OT):

STT collections reached Rs. 13,013.04 crore, slightly higher than last year, showing continued activity and confidence in the capital markets. Other taxes are relatively smaller components.

Looking Ahead: The Optimistic Signal from Advance Tax Collections

Perhaps the most reassuring part of this data is from the Advance Tax Collections. Advance tax is paid by taxpayers throughout the year, anticipating their annual tax liability. It often serves as a forward-looking indicator of business profitability and individual income growth.

For FY 2025-26 (as of June 19, 2025), overall advance tax collections have grown by 3.87%, reaching Rs. 1,55,533.00 crore.

- Corporate Tax (CT) Advance Tax: There is strong growth of 5.86%, reaching Rs. 1,21,604.48 crore. This indicates corporate confidence and expected higher profits.

- Non-Corporate Tax (NCT) Advance Tax: There is a slight decline of -2.68%, amounting to Rs. 33,928.32 crore. This small drop could stem from various factors, but given the overall positive gross collection for NCT, it may be a temporary fluctuation.

The overall positive growth in advance tax suggests that businesses and high-income individuals expect higher earnings for the rest of the fiscal year, signaling underlying economic strength.

Conclusion:

While the initial 1.39% decline in net direct tax collections may seem troubling, a detailed analysis shows it's largely due to an efficient and faster refund process. The robust 4.86% growth in gross collections and the positive 3.87% growth in advance tax collections reflect underlying economic resilience and hopeful future expectations.

The government’s focus on improving taxpayer services, as seen in the quick refund disbursements, is a positive development. It helps ensure liquidity in the economy and builds trust in the tax system. This data should be viewed not as a sign of slowdown but as an indicator of a dynamic economy along with a more responsive tax administration.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles