ITR-7 Utility, Schema & Validations Released on 21st August 2025

The Income Tax Department has released the ITR-7 Form for AY 2025-26, applicable to persons and institutions required to file returns under sections 139(4A), 139(4B), 139(4C), and 139(4D). This blog covers the newly released Excel-based utility, JSON schema, and validation guidelines to simplify your tax filing process.

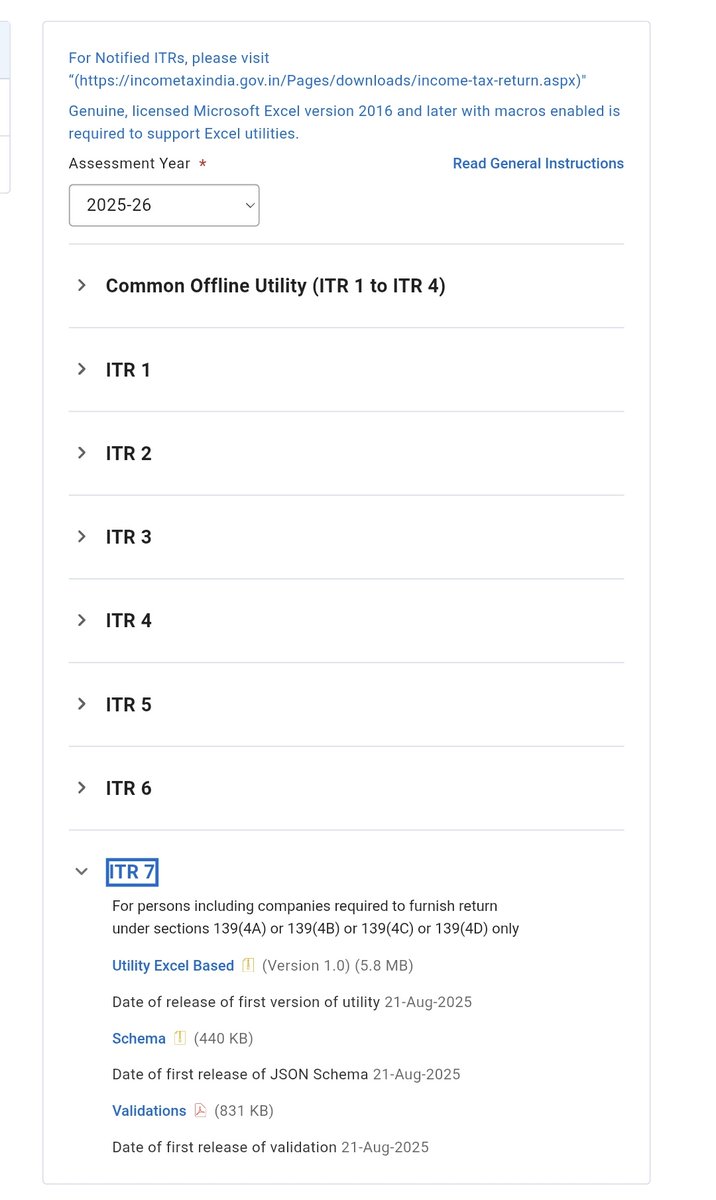

The Income Tax Department of India has officially released the ITR-7 filing utilities and related documents for the Assessment Year 2025-26. This update is essential for entities like charitable trusts, political parties, research associations, universities, colleges, and other institutions that need to file their returns under specific sections of the Income Tax Act.

In this blog, we will cover everything you need to know about the ITR-7 Form, its Excel-based utility, JSON schema, and validation details.

What is ITR-7?

The ITR-7 Form is intended for individuals (including companies) required to file returns under the following sections of the Income Tax Act:

- Section 139(4A): For income generated from property held under trust or legal obligation for charitable or religious purposes.

- Section 139(4B): For political parties whose income exceeds the maximum amount not subject to income tax.

- Section 139(4C): For scientific research associations, news agencies, institutions, and similar entities.

- Section 139(4D): For universities, colleges, and institutions that are not required to file returns of income or loss under other provisions.

In simple terms, ITR-7 is mandatory for entities operating in charitable, political, scientific, or educational fields and claiming exemptions.

Latest Release (21st August 2025)

The Income Tax Department released the first version of the utilities and documents for ITR-7 filing on 21-Aug-2025. Below are the details:

This PDF provides a detailed list of validation rules that must be followed when filing ITR-7. It ensures accurate filing and helps taxpayers avoid rejection of returns.

Why is this Important?

- Ensures accurate return filing for trusts, NGOs, and political parties.

- Helps software developers add ITR-7 filing features into tax solutions.

- Provides clarity on compliance requirements for institutions under Sections 139(4A) to 139(4D).

- Supports smooth filing on the Income Tax e-filing portal.

How to Use These Utilities?

- Download the ITR-7 Excel Utility from the official Income Tax website.

- Fill out the form offline with required details such as income, exemptions, donations, and more.

- Validate the form using built-in checks.

- Generate a JSON file for upload.

- Upload the JSON on the Income Tax e-Filing Portal.

Final Thoughts

The release of ITR-7 Utility, JSON Schema, and Validations on 21st August 2025 is a significant update for charitable trusts, political parties, and institutions filing under the Income Tax Act.

If you belong to any of these categories, be sure to download the latest utility and schema to ensure smooth and accurate return filing for AY 2025-26.

Stay compliant, stay updated, and file your returns before the due date!

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles