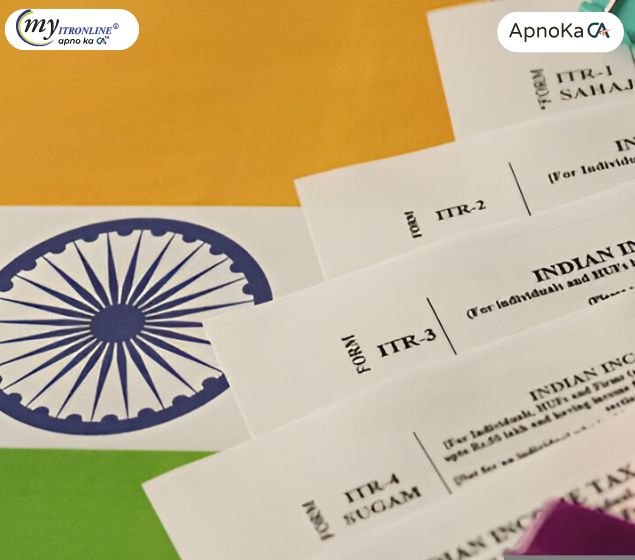

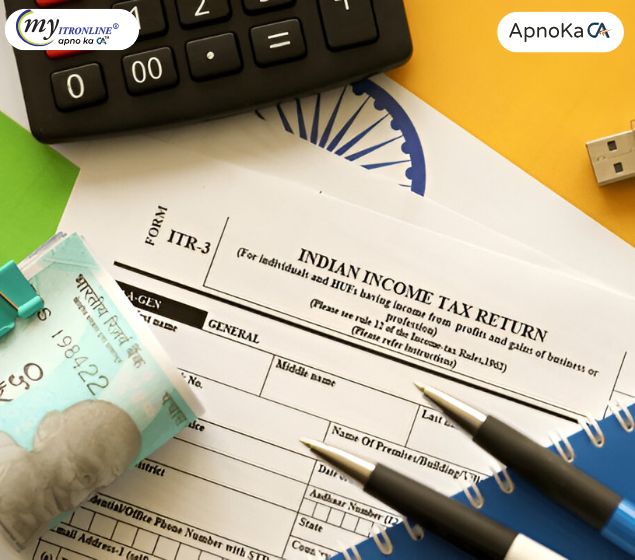

Income tax

Understanding income tax is crucial for managing your finances. Discover how income tax works, learn about tax brackets, deductions, and credits. Stay informed about changes in tax laws and filing requirements. Navigate the world of taxation with confidence and ensure you make the most of your financial opportunities.