# taxpayer

12 posts in `taxpayer` tag

Supreme Court’s Big GST Decision Huge Relief for Taxpayers

The Supreme Court of India has ruled that once a taxpayer pays the 10% pre-deposit required to file a GST appeal, the government cannot freeze bank accounts or recover additional funds. This landmark decision protects honest taxpayers and ensures fair enforcement under GST law.

Tax Refunds Can’t Be Denied for Form 26AS Mismatch: High Court Ruling

The Allahabad High Court has ruled that tax refunds cannot be denied just because TDS is missing from Form 26AS. If a taxpayer provides valid Form 16A certificates, the Income Tax Department must verify the claim with the deductor instead of rejecting it outright. This protects honest taxpayers from delays caused by clerical errors.

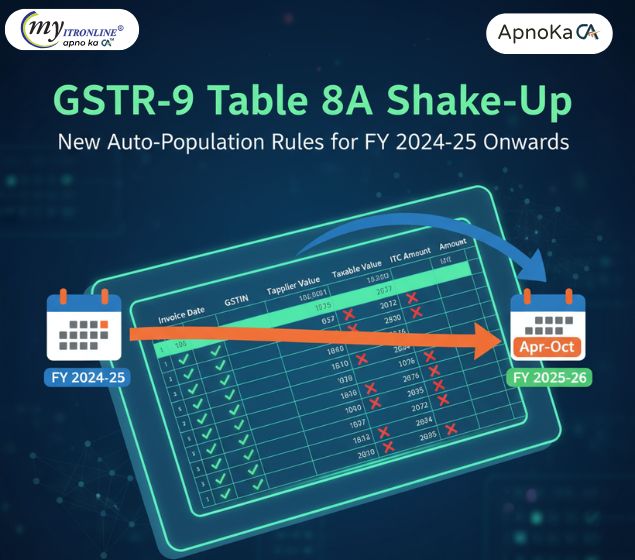

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

GST Compliance Update: CBIC Removes DIN Requirement for Portal-Based Notices

CBIC has released Circular No. 249/06/2025-GST, removing the mandatory use of DIN for communications issued via the GST portal. However, DIN remains compulsory for eOffice-based documents, as clarified in Circulars No. 23/2025 - Customs and 252/09/2025 - GST. This blog explains the changes and what taxpayers need to know.

Income Tax Department’s Section 87A Relief: What Taxpayers Must Know About STCG Rebate Claims

The Income Tax Department has issued relief for taxpayers who claimed Section 87A rebate on short-term capital gains (STCG). If demands are paid by December 31, 2025, interest will be waived. Learn what went wrong, what’s been clarified, and what you should do next.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

Taxpayers Alert: Major Updates in GST Refund Rules

The Goods and Services Tax Network (GSTN) has significantly revamped its refund system, introducing a unified application form (RFD-01), enhanced document uploads, real-time tracking, and integration with PFMS for faster disbursements. This blog details these crucial updates, explaining how they streamline the refund process for taxpayers, promote transparency, and minimize delays, ensuring timely receipt of their legitimate refunds.

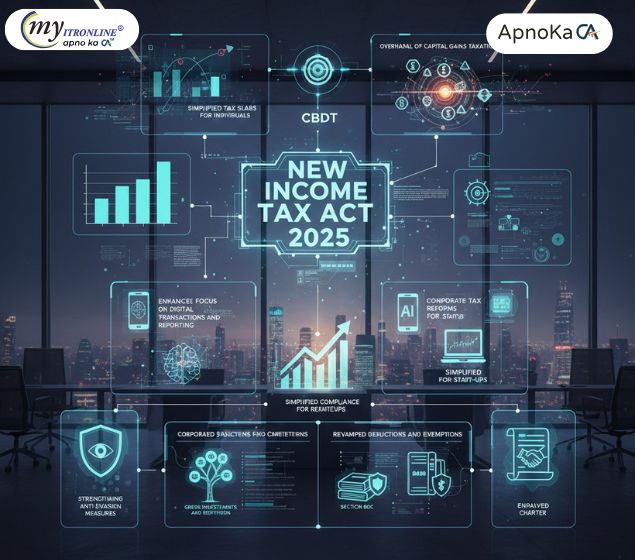

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

ITAT Cancels Tax Addition on Demonetization Cash Deposits

This blog post provides a detailed analysis of a significant Income Tax Appellate Tribunal (ITAT) ruling that cancelled a ₹10.46 lakh tax addition against a senior citizen. The case involves a large cash deposit made during the 2016 demonetization period, which the Assessing Officer had treated as unexplained money under Section 69A. The article explains the taxpayer's defense—that the cash was an accumulation of prior bank withdrawals—and breaks down the ITAT's reasoning, which centered on the "preponderance of probabilities" and the lack of contrary evidence from the revenue. The post highlights key takeaways for taxpayers, emphasizing the importance of plausible explanations and proper documentation.

.jpg)

Goodbye 1961, Hello 2025: India's New Income Tax Act Explained in Simple Terms

This blog post details India's landmark decision to replace the sixty-year-old Income-tax Act, 1961, with the new, simplified Income-tax Act, 2025, which will be effective from April 1, 2026. It breaks down the key changes in simple terms, explaining the reduction in legal complexity, the introduction of a unified "Tax Year," clearer definitions for digital assets, and the move towards faceless, technology-driven tax processes. The post highlights how these changes aim to create a more transparent, efficient, and taxpayer-friendly direct tax system for individuals and businesses across the country.

.jpg)

Good News for Taxpayers: Delayed Income Tax Refunds Are Finally Being Released

The long wait for delayed income tax refunds is finally coming to an end! The Income Tax Department has taken steps to clear pending refunds by resolving portal glitches, verifying returns faster, and processing lakhs of refunds worth crores of ₹ daily. Learn why refunds were delayed, what’s being done now, and follow a simple checklist to make sure your refund reaches your bank account without further delay.

CBDT Raises Tax-Free Benefit Limits: Relief for Salaried Employees with Incomes up to 8 Lakh

The Central Board of Direct Taxes (CBDT) has introduced new rules, 3C and 3D, effective August 18, 2025, which raise the income thresholds to 4 lakh (salary) and ₹8 lakh (gross total income) for taxing specific perquisites. This move provides significant tax relief on non-cash benefits for middle-income salaried employees.