# taxpayer

12 posts in `taxpayer` tag

Tax Alert: Foreign Assets Under Scanner Fix Your ITR Before 31 December

The Income Tax Department is sending alerts to people who may have foreign bank accounts, investments or property that are not shown in their Income Tax Return. If you get this message, you must check and revise your ITR before 31 December 2025 to avoid big tax and penalties under the Black Money Act.

Income Tax Refund Hold: New Rules for Big Refunds

Many taxpayers in India are seeing a delay in income tax refunds, especially when the refund amount is high. The Income Tax Department is checking big refunds more carefully to stop wrong or fake claims. In this blog, you will understand in simple words why your refund is delayed and what you should do next.

MVAT & PT Returns Deadline Extended for October 2025 Updated Filing Schedule

The Maharashtra government has extended the deadlines for filing MVAT and Professional Tax returns for October 2025. Payment due dates remain unchanged, and interest applies if taxes are paid late. Taxpayers now have additional time to file returns correctly and avoid late fees. This update helps businesses manage compliance efficiently and avoid penalties by following the revised dates.

Supreme Court Relief: Buyer Not Liable for Seller’s Default on ITC

The Supreme Court has clarified that a genuine buyer cannot be denied Input Tax Credit (ITC) merely because the seller failed to deposit tax. In the case of Commissioner Trade & Tax Delhi vs. Shanti Kiran India Pvt. Ltd., the Court emphasized that if purchases are genuine, invoices valid, and payments made through banks, ITC should not be denied. This ruling strengthens taxpayer rights and prevents innocent buyers from being penalized for the seller’s default.

Suo Moto Cancellation of GST Registration: Reasons, Process & How to Revoke It

This blog explains what Suo Moto cancellation of GST registration means, why it happens, and how businesses can respond and apply for revocation. It includes the reasons, forms, timelines, and tips to stay compliant.

Supreme Court Backs Genuine Buyers: No ITC Denial for Seller’s Default

The Supreme Court has ruled that genuine buyers cannot be denied Input Tax Credit just because the seller failed to deposit tax or lost registration. This landmark decision under DVAT sets a strong precedent for GST cases too, ensuring fairness and protecting honest taxpayers.

Intimation U/S 143(1): Your ITR is Processed Here's How to Respond

The Intimation under Section 143(1) is a routine message from the Income Tax Department after processing your ITR. It may confirm your return, show a refund, or raise a tax demand. This blog explains how to read the notice, respond correctly, and avoid penalties.

Refund Credited but Not Reflected in Bank What to Do?

Many taxpayers face the issue where their Income Tax refund status shows "Refund Credited" but the money doesn’t appear in their bank account. This guide explains why it happens, how to check your bank and portal details, and what steps to take to resolve it quickly.

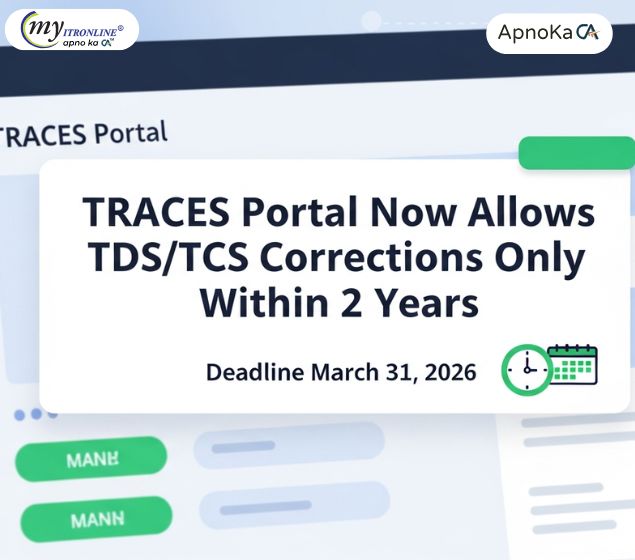

Tax Alert: TRACES Portal Sets 2-Year Limit for TDS/TCS Corrections

The Income Tax Department has shortened the correction window for TDS/TCS statements to just 2 years via the TRACES portal. This change affects deductors, collectors, and taxpayers alike. Corrections for older financial years (FY 2018-19 to FY 2023-24) must be filed by March 31, 2026. After that, no changes will be accepted. Learn what this means for you and how to act now.

Quick GST Registration in 3 Days for Small Businesses

The GST portal has launched a faster registration process for low-risk taxpayers. With Aadhaar authentication and proper document upload, eligible applicants can now get GST registration within 3 working days.

Big relief for taxpayers: Supreme Court protects buyers from seller’s default

The Supreme Court of India has held that a genuine buyer cannot be denied ITC merely because the seller failed to deposit tax. In M/s Shanti Kiran India Pvt Ltd vs Commissioner, Trade & Tax, Delhi (October 9, 2025), the Court emphasized fairness: action should target the defaulting seller, not the compliant purchaser. While the case arose under the Delhi VAT Act, its reasoning strongly influences GST disputes under Section 16(2)(c). Businesses gain a constitutional shield against automatic ITC denials but must continue robust documentation, vendor checks, and genuine transactions. Example: if you paid ₹100 in tax against a valid invoice and acted in good faith, your ITC right stands.

Refund Adjusted Against Outstanding Demand: What You Need to Know

If your income tax refund is adjusted against an old tax demand, it’s likely due to Section 245 of the Income Tax Act. This blog explains what the notice means, how to respond within 30 days, and what options you have. Learn how to protect your refund and keep your tax records clean.