# incometax

12 posts in `incometax` tag

Tax Alert: Foreign Assets Under Scanner Fix Your ITR Before 31 December

The Income Tax Department is sending alerts to people who may have foreign bank accounts, investments or property that are not shown in their Income Tax Return. If you get this message, you must check and revise your ITR before 31 December 2025 to avoid big tax and penalties under the Black Money Act.

Why Your Income Tax Refund Is Delayed and How to Check Status

Many taxpayers are still waiting for their refund. This guide explains how to check your income tax refund status, why refunds get delayed, and simple steps you can take to fix the issue and receive your money soon.

Income Tax Refund Hold: New Rules for Big Refunds

Many taxpayers in India are seeing a delay in income tax refunds, especially when the refund amount is high. The Income Tax Department is checking big refunds more carefully to stop wrong or fake claims. In this blog, you will understand in simple words why your refund is delayed and what you should do next.

Your Money, Simpler Taxes: Big Changes Coming to the Income Tax Law

The Indian Income Tax Act is evolving rapidly. From the push for the New Tax Regime to AI-driven scrutiny and rationalized capital gains, discover the key trends and anticipated changes that could reshape your financial planning and compliance strategy in the coming years.

Capital Gains Accounts Scheme (CGAS) 2025: Major Digital Updates for Taxpayers

The Capital Gains Accounts Scheme (CGAS) has been overhauled for FY 2025-26. Key changes include authorization of 19 private banks (HDFC, ICICI, Axis), acceptance of all major digital payment modes (UPI, NEFT, Cards), online account closure, and the inclusion of Section 54GA (SEZ relocation) exemption.

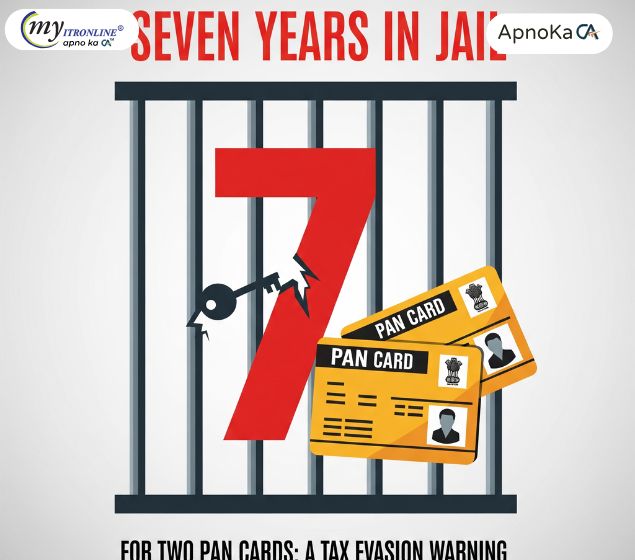

Seven Years in Jail for Two PAN Cards: A Tax Evasion Warning

A recent court judgment has made it clear that holding more than one PAN card is no longer just a minor issue with a 10,000 fine. In a high-profile case, two individuals were sentenced to seven years in jail for possessing duplicate PANs, one of which was forged. The ruling shows that when a second PAN is linked to fraud or forgery, it becomes a criminal offense under the IPC. Taxpayers with duplicate PANs must act quickly and surrender the extra card to avoid severe legal consequences.

Finally! The 2025 Capital Gains Relief Scheme is Making Life Easier

The 2025 Amendment Scheme has modernised the Capital Gains Account Scheme (CGAS) by making it digital-first and easier to use. Taxpayers can now deposit capital gains online through Net Banking, UPI, RTGS, or NEFT, with the deposit date clearly defined. Electronic statements replace passbooks, more banks are authorised to manage CGAS accounts, and simpler ITR forms are on the way. With broader exemptions like Section 54GA included, the scheme reduces stress and makes compliance smoother for property sellers, NRIs, and businesses.

Why Your Tax Refund Is Delayed and What CBDT Wants You to Know

Many taxpayers are waiting for refunds, especially where the refund is large. The Central Board of Direct Taxes (CBDT) is closely checking high-value and flagged returns to stop fake claims and tax cheating. This guide explains the main reasons for delays, which cases get compulsory scrutiny, and simple steps you can take now to clear your refund faster.

Tax Refunds Update: High-Value Claims Under Scrutiny, Legitimate Payouts Expected by December 2025

The Income-Tax Department is closely reviewing high-value refund claims flagged for potential discrepancies. While smaller refunds are already being processed, CBDT Chairman Ravi Agrawal has assured taxpayers that legitimate high-value payouts will be cleared by December 2025. Refund claims worth ₹2.42 lakh crore have been filed till November 10, showing an 18% drop from last year. The department has also increased appeal disposals by 40% and remains confident of meeting its ₹25.20 lakh crore direct tax collection target for FY26, supported by 6.99% growth. Leveraging AI-powered tools, the CBDT is enhancing compliance, monitoring taxpayer behavior, and identifying potential evasion

New Income Tax Return Forms and Rules: What You Need to Know

The government is set to introduce simplified income tax return forms under the Income Tax Act, 2025 by January 2026, replacing the long-standing Income Tax Act, 1961. These new forms aim to make tax filing easier, reduce compliance burdens, and improve transparency. Refunds are being processed, with larger claims expected by December 2025. The CBDT is confident of meeting its ambitious ₹25.20 lakh crore direct tax collection target for FY26, supported by strong growth. Taxpayers should prepare for the new system, which takes effect from April 1, 2026.

Fueling Indian R&D: CBDT’s Approval under Section 35(1)(iia) | 100% Tax Deduction for Innovation

The CBDT has issued Notification No. 4/2025 under Section 35(1)(iia) of the Income Tax Act, granting approval to a company for scientific research and development. Contributions made to the approved entity qualify for a 100% tax deduction, encouraging businesses to support innovation while reducing their tax burden. This move strengthens India’s R&D ecosystem and promotes industry-science collaboration.

CBDT’s New Rules: Faster Tax Refunds and Easier ITR Corrections

The CBDT has empowered the CPC Bengaluru with concurrent jurisdiction under Section 154 to rectify obvious errors in ITRs like missed TDS/TCS credits, relief miscalculations, and interest under Section 244A—leading to faster refunds, reduced compliance burden, and greater transparency. Effective from October 27, 2025 (Notification No. 155/2025), this centralized approach streamlines rectifications and allows demand notices under Section 156 where needed.