# incometax

12 posts in `incometax` tag

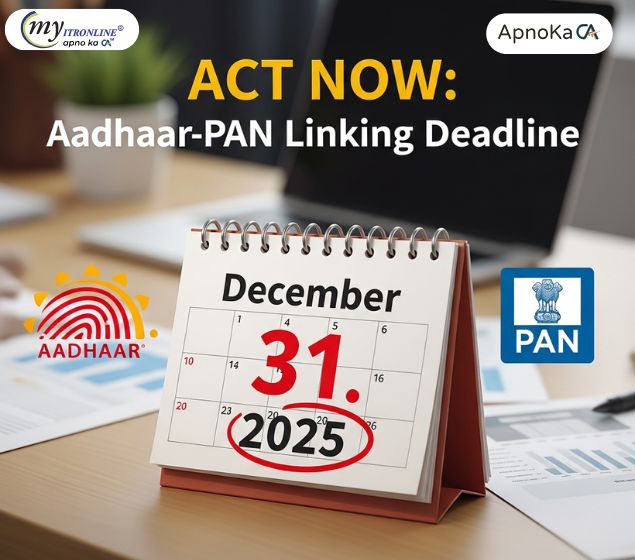

Act Now: Aadhaar-PAN Linking Deadline is December 31, 2025

Link your PAN with Aadhaar by December 31, 2025. If you miss the date, PAN goes inoperative from January 1, 2026, stopping ITR filing and blocking refunds. Pay 1,000 on the e-Filing portal and link now. Some groups are exempt.

Foreign Assets Alert: Avoid Heavy Penalties by Updating Returns

The Income Tax Department has warned about 25,000 taxpayers to review and revise AY 2025-26 returns for foreign assets and income by December 31, 2025. Non-reporting can lead to a 10 lakh fine and up to 300% penalty. Last year’s drive led to major disclosures. Act now to stay compliant.

Unexplained partner capital firm not liable, partner responsible

A clear summary of the ITAT Hyderabad ruling that unexplained partner capital cannot be treated as firm income, with simple points on responsibility, legal support, and what firms and partners should do.

Life insurance payouts and TDS: what you should know

A short, clear guide to TDS on life insurance payouts under Section 194DA, covering who it applies to, TDS rates, limits, exemptions, how income is calculated, and compliance steps, with a quick example.

New Income Tax Rules Effective December 2025: Key Updates

The Income Tax Department has introduced key updates effective December 1, 2025, focusing on real-time TDS error alerts, significantly faster ITR refund processing (7 days), strict AIS/26AS income matching rules, and an increased late filing penalty of ₹7,500 for high-income taxpayers.

December 2025 tax due dates: simple tracker for businesses and individuals

December is a crucial month for Indian taxpayers. This tracker lists the key dates for Income Tax (ITR, Advance Tax, TDS), GST (GSTR-1, IFF, GSTR-3B), and MCA filings, plus PF/ESI and TDS statements. Mark these deadlines to avoid late fees, interest, and ITC issues.

Tax Alert: Foreign Assets Under Scanner Fix Your ITR Before 31 December

The Income Tax Department is sending alerts to people who may have foreign bank accounts, investments or property that are not shown in their Income Tax Return. If you get this message, you must check and revise your ITR before 31 December 2025 to avoid big tax and penalties under the Black Money Act.

Why Your Income Tax Refund Is Delayed and How to Check Status

Many taxpayers are still waiting for their refund. This guide explains how to check your income tax refund status, why refunds get delayed, and simple steps you can take to fix the issue and receive your money soon.

Income Tax Refund Hold: New Rules for Big Refunds

Many taxpayers in India are seeing a delay in income tax refunds, especially when the refund amount is high. The Income Tax Department is checking big refunds more carefully to stop wrong or fake claims. In this blog, you will understand in simple words why your refund is delayed and what you should do next.

Your Money, Simpler Taxes: Big Changes Coming to the Income Tax Law

The Indian Income Tax Act is evolving rapidly. From the push for the New Tax Regime to AI-driven scrutiny and rationalized capital gains, discover the key trends and anticipated changes that could reshape your financial planning and compliance strategy in the coming years.

Capital Gains Accounts Scheme (CGAS) 2025: Major Digital Updates for Taxpayers

The Capital Gains Accounts Scheme (CGAS) has been overhauled for FY 2025-26. Key changes include authorization of 19 private banks (HDFC, ICICI, Axis), acceptance of all major digital payment modes (UPI, NEFT, Cards), online account closure, and the inclusion of Section 54GA (SEZ relocation) exemption.

Seven Years in Jail for Two PAN Cards: A Tax Evasion Warning

A recent court judgment has made it clear that holding more than one PAN card is no longer just a minor issue with a 10,000 fine. In a high-profile case, two individuals were sentenced to seven years in jail for possessing duplicate PANs, one of which was forged. The ruling shows that when a second PAN is linked to fraud or forgery, it becomes a criminal offense under the IPC. Taxpayers with duplicate PANs must act quickly and surrender the extra card to avoid severe legal consequences.