# income

12 posts in `income` tag

Didn’t File ITR by September 16? Here’s What You Can Still Do

This blog post provides a comprehensive guide for individuals who have missed the September 16, 2025, deadline for filing their Income Tax Return (ITR) for FY 2024-25. It reassures readers that filing is still possible through a "belated return" by December 31, 2025, but outlines the associated penalties, including late filing fees (₹1,000 or ₹5,000) and interest on unpaid tax. The article also details other consequences of late filing, such as the inability to carry forward certain losses, delayed refunds, and potential loss of specific deductions. It touches on rare exceptions and what happens if even the belated deadline is missed. Finally, it offers practical advice to act promptly, gather documents, compute accurately, and seek professional help, promoting MyITROnline as a solution for simplified tax filing.

Smart Property Moves: How Sections 54 and 54F Can Slash Your Tax Bill on Residential Property Sales (Latest Rules 2025)

Discover how Sections 54 and 54F of the Indian Income Tax Act provide crucial tax exemptions on Long-Term Capital Gains from property sales. This comprehensive guide covers the latest rules for 2025, including the new ₹10 Crore cap and the two-house option under Section 54, offering practical examples and a step-by-step plan for effective tax planning.

194J vs. 44AD: Tax Scrutiny on India's Content Creators & Consultants

This blog post addresses the increasing tax notices faced by Indian content creators, influencers, and consultants due to a common mismatch: clients deducting TDS under Section 194J while they file income tax returns under Section 44AD. It breaks down the key tax provisions (194J, 44AD, 44ADA), explaining what each means for freelancers and businesses. The article clarifies that a 194J deduction doesn't automatically mandate filing under 44ADA; the crucial factor is whether the profession is listed under Section 44AA. It details potential impacts on tax burden, cash flow, and the need for increased documentation, while also offering actionable steps for creators and consultants to ensure compliance, including clarifying work nature, maintaining records, client communication, cash flow monitoring, and seeking professional tax advice.

Due Date for Filing ITRs AY 2025-26 Extended Again

The Income Tax Department has granted a crucial one-day extension for filing Income Tax Returns for Assessment Year 2025-26, pushing the final deadline to September 16, 2025. This extension aims to assist taxpayers who encountered issues with the e-filing portal. This is a final opportunity to avoid penalties, so file your ITR promptly with myITRonline.

Is Your Tax Deadline Extended? Beware of Fake Circulars

A false circular claiming that the Income Tax Return (ITR) deadline has been extended past 15 September 2025 is being circulated. The post explains what the official record shows, how fake notices are spread, why they can be costly, and how to verify whether a circular is genuine.

Income Tax Alert: New Deadline for Correcting Mistakes in TDS/TCS

The Income Tax Department has given a final chance to correct mistakes in TDS/TCS returns for FY 2018–19 to FY 2023–24. The correction deadline is March 31, 2026. After this, only 2 years will be allowed for revisions, and unresolved errors may lead to tax notices.

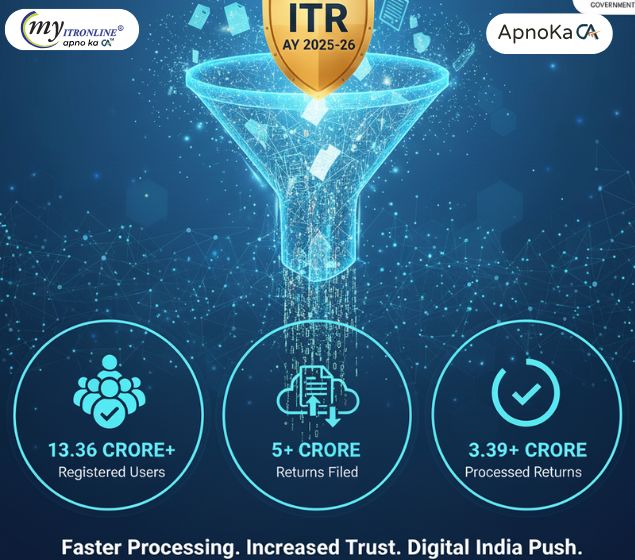

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

Don't Pay 20% LTCG Tax! How to Use Sections 54, 54EC, 54F

This blog post provides a comprehensive yet easy-to-understand guide to saving Long-Term Capital Gains (LTCG) tax arising from property sales in India. It delves into three crucial sections of the Income Tax Act – Section 54, Section 54EC, and Section 54F – detailing their eligibility criteria, investment options, time limits for reinvestment, and lock-in periods. The post also includes a comparative table and a practical example to illustrate how these exemptions work, empowering taxpayers to make informed decisions and potentially reduce their tax liabilities.

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.