# cbdt

12 posts in `cbdt` tag

AY 2025-26 ITR Filing: Understanding New Rules for Tax Reporting & Capital Gains

This blog post details the significant updates in India's Income Tax Return (ITR) forms for Assessment Year 2025-26 (FY 2024-25). It covers the default New Tax Regime and the opt-out process using Form 10-IEA, major changes in capital gains reporting including simplification for small investors (LTCG up to ₹1.25 lakh in ITR-1/4) and bifurcation of Schedule CG (pre/post July 23, 2024). It also explains key tax reporting updates like mandatory TDS section codes, enhanced deduction reporting via dropdowns, new rules for Section 80GG (Form 10BA), increased presumptive tax limits, and the revised threshold for Schedule AL. It concludes with a guide on choosing the correct ITR form and important filing deadlines.

Attention Firms & LLPs: CBDT Releases ITR-5 Form for AY 2025-26 Filing.

The CBDT has released the updated ITR-Form 5 for Assessment Year 2025-26 (applicable to FY 2024-25) via Notification No. 42/2025 dated May 3, 2025. This blog post details who needs to file ITR-5, discusses anticipated key changes aligning with recent amendments and enhanced disclosure norms, outlines implications for taxpayers like Firms and LLPs, and provides actionable steps for compliance.

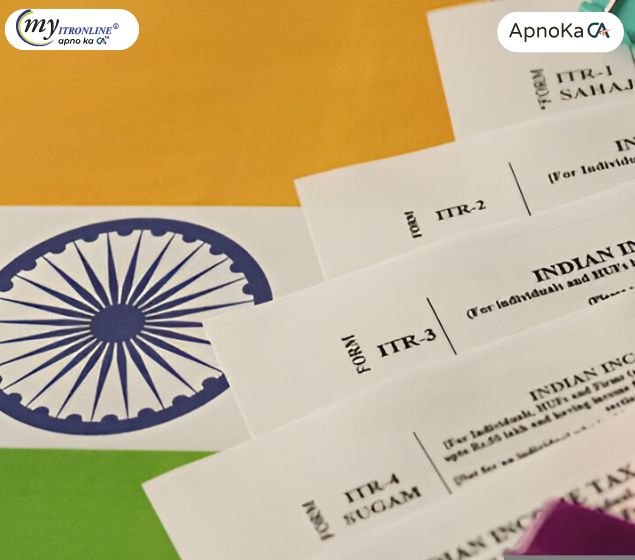

ITR-1 and ITR-4 Forms for AY 2025-26 Released Early: All You Need to Know

The Central Board of Direct Taxes (CBDT) has kickstarted the income tax filing season earlier than usual by releasing the ITR-1 (Sahaj) and ITR-4 (Sugam) forms for Assessment Year 2025-26. This blog explores the eligibility, permissible income sources, and filing restrictions for both forms. It also highlights a major update—taxpayers can now report Long-Term Capital Gains (LTCG) under Section 112A in ITR-1 and ITR-4 under specific conditions. Additionally, it explains the difference between form notification and utility release, emphasizes the importance of early preparation, and provides a comprehensive document checklist for smooth filing. The blog concludes by urging taxpayers to be proactive and file early to avoid last-minute hassles.

ITR-3 AY 2025-26 Key Changes: CBDT Notification & Updates Guide

CBDT has notified ITR-Form 3 for Assessment Year 2025-26 (FY 2024-25) via Notification No. 41/2025. This affects Individuals/HUFs with business/professional income. Key updates include a split Capital Gains schedule (pre/post July 23, 2024), new conditions for claiming share buyback loss (post Oct 1, 2024), an increased asset/liability reporting threshold to ₹1 crore, addition of Sec 44BBC reference, enhanced reporting for deductions like 80C & 10(13A), and mandatory TDS section code reporting. Taxpayers should review these changes for compliant filing.

AY 2025-26 Tax Alert: Key Modifications in ITR-1 (Sahaj) & ITR-4 (Sugam)

This blog provides a detailed breakdown of modifications in ITR-1 and ITR-4 forms for Assessment Year 2025-26 based on a recent analysis. It explains the new allowance for minor LTCG under Sec 112A (up to ₹1.25 lakh) in both forms, the enhanced conditional presumptive tax limits under Sec 44AD/44ADA linked to digital receipts, and common changes. These common changes include expanded disclosures for Form 10-IEA (new tax regime opt-out), mandatory specific clause selection for Chapter VI-A deductions, enhanced reporting for Sec 89A (foreign retirement income), compulsory disclosure of all active Indian bank accounts, and mandatory selection of a refund account. The post advises taxpayers on how to prepare based on these specific updates.

Tax Season Starts Early: ITR-1 (Sahaj) & ITR-4 (Sugam) Notified for AY 2025-26!

The blog post announces the early notification of ITR-1 (Sahaj) and ITR-4 (Sugam) forms by the CBDT for the Assessment Year 2025-26 (corresponding to Financial Year 2024-25). It details the eligibility criteria for using these forms, explains the significance of the early notification for taxpayers (more preparation time, potentially earlier filing utility release), clarifies the difference between form notification and utility release, reminds readers about the AY/FY distinction, and advises taxpayers to start gathering necessary documents while waiting for the official filing utilities to be launched on the Income Tax portal.

Don't Miss the Deadline: Vivad se Vishwas 2024 Ends April 30, 2025!

This blog post details the recently announced final deadline of April 30, 2025, for filing declarations under the Direct Tax Vivad se Vishwas Scheme, 2024 (VSV 2.0). It explains the scheme's purpose, eligibility criteria (including the expansion for certain cases), key benefits like waiver of interest/penalty, the procedural steps involving Forms 1-4, and urges eligible taxpayers to act before the deadline to resolve pending direct tax disputes.

CBDT Guidelines on Section 37(1): What Business Expenses Are Now Disallowed?

This blog post examines the clarified disallowances under Section 37(1) of the Income Tax Act following the Finance Act 2022 amendment to Explanation 1. It details how expenses related to illegal activities, penalties, compounding fees, prohibited benefits/perks (like certain freebies), and violations of foreign laws are now more explicitly non-deductible, emphasizing the need for businesses to ensure compliance and maintain thorough documentation.

India's New 1% TCS Rule: What Buyers & Sellers of Luxury Goods Over 10 Lakh Must Know

This post details India's new 1% Tax Collected at Source (TCS) regulation, effective April 22, 2025, under Section 206C(1F). It applies to specific luxury goods (watches, art, yachts, etc.) when the sale value exceeds ₹10 lakh. The article explains the TCS mechanism, lists affected items, clarifies calculation, outlines buyer and seller responsibilities, differentiates it from Section 206C(1H), and highlights that the TCS paid is adjustable against the buyer's income tax liability.

CBDT Notification 23/2025: Impact on Your Form 3CD Tax Audit

This blog outlines the key changes to Form 3CD (Tax Audit Report) implemented by CBDT Notification 23/2025, which takes effect from Assessment Year 2025-26. It discusses possible updates in reporting related to MSME payments, Virtual Digital Assets (VDAs), concessional tax regimes, and depreciation, as well as the necessary steps for both taxpayers and auditors.

CBDT Notifies New ITR-B Form for Tax Search Cases: 2025 Guidelines

This guide explains the newly introduced ITR-B form for taxpayers involved in search/requisition operations under sections 132/132A/153A/153C. It covers filing requirements, deadlines, consequences of non-compliance, and essential details to include.

.jpg)

Interpreting the CBDT’s Seventh Amendment Rules, 2025: Section 194T and Its TDS Effects.

The 7th Amendment Rules 2025 established by the CBDT introduces Section 194T, which requires a 10% TDS on salaries, bonuses, commissions, and other earnings. Understand its implications, necessary compliance measures, and how both businesses and individuals should adjust.