# cbdt

12 posts in `cbdt` tag

Income Tax Department’s Section 87A Relief: What Taxpayers Must Know About STCG Rebate Claims

The Income Tax Department has issued relief for taxpayers who claimed Section 87A rebate on short-term capital gains (STCG). If demands are paid by December 31, 2025, interest will be waived. Learn what went wrong, what’s been clarified, and what you should do next.

Is Your Tax Deadline Extended? Beware of Fake Circulars

A false circular claiming that the Income Tax Return (ITR) deadline has been extended past 15 September 2025 is being circulated. The post explains what the official record shows, how fake notices are spread, why they can be costly, and how to verify whether a circular is genuine.

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

CBDT Circular 9/2025: No More 20% TDS Trouble in Property Deals

This blog post explains CBDT Circular No. 9/2025, which clarifies that the higher 20% TDS rate under Section 206AB will not apply to property transactions covered by Section 194-IA. This brings significant relief to buyers and sellers by ensuring a consistent 1% TDS deduction on property sales over ₹50 Lakhs, simplifying compliance and streamlining real estate dealings.

CBDT Overhauls Income Tax: Simpler Forms & Stronger Data Protection by 2025

The Central Board of Direct Taxes (CBDT) is implementing significant changes to income tax forms and rules, effective April 2025, following the new Income Tax Act of 2025. The initiative focuses on simplifying tax filing through smart, pre-filled forms, drastically reducing the number of forms from 200 to under 100, and ensuring robust protection for digital data collected during tax procedures. While new ITR forms are slated for 2027, immediate efforts are on TDS, TCS, advance tax, and exemption forms. These reforms aim to enhance transparency, ease compliance, and create a smarter, safer tax environment for Indian taxpayers.

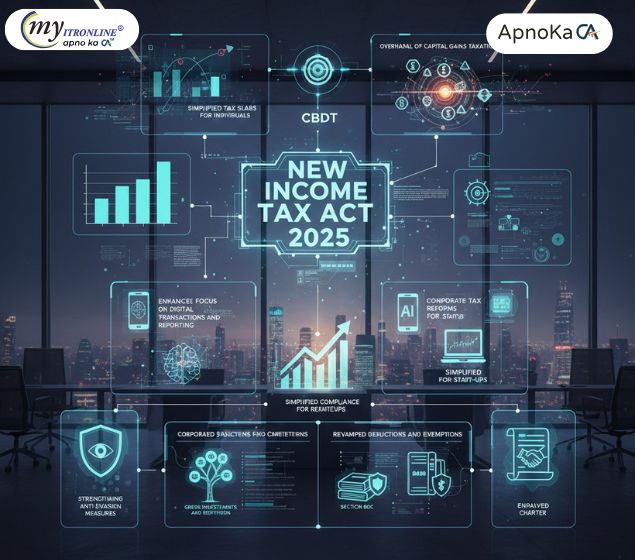

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

CBDT Instruction No. 01/2025 – Black Money Act Update for Minor Foreign Assets

The CBDT has issued Instruction No. 01/2025 on 18 August 2025, aligning its policy with the Finance (No. 2) Act, 2024. This update ensures that prosecution under Sections 49 and 50 of the Black Money Act will not be initiated for undisclosed non-immovable foreign assets valued up to ₹20 lakh. The move offers relief to genuine taxpayers, prevents harsh action for minor errors, and focuses enforcement on serious non-compliance cases.

CBDT Simplifies Tax Rules for IFSC Funds: A Major Win for Investors

This blog post breaks down the recent significant amendment made by the CBDT to Rule 21AIA of the Income Tax Rules. It details the removal of sub-rule (4), which previously imposed additional compliance burdens on "specified funds" like retail schemes and ETFs in the IFSC. The post explains how this change aligns tax laws with IFSCA regulations, effectively eliminating dual regulation. The primary impact is simplified compliance, reduced regulatory overlap, and a more attractive investment environment in India's IFSC, ultimately fostering growth in financial hubs like GIFT City.

.jpg)

AY 2025-26 ITR Filings Cross 3.29 Crore; Over 1.13 Crore Already Processed

Despite the ITR filing deadline for AY 2025-26 being extended to September 15, over 3.29 crore returns have already been filed by mid-August, with 1.13 crore processed. This highlights growing tax compliance and the Income Tax Department's processing efficiency.

CBDT Raises Tax-Free Benefit Limits: Relief for Salaried Employees with Incomes up to 8 Lakh

The Central Board of Direct Taxes (CBDT) has introduced new rules, 3C and 3D, effective August 18, 2025, which raise the income thresholds to 4 lakh (salary) and ₹8 lakh (gross total income) for taxing specific perquisites. This move provides significant tax relief on non-cash benefits for middle-income salaried employees.