Check If Your Account Is at Risk and What You Can Do

This blog explains RBI’s new directive effective November 11, 2025, targeting dormant, inactive, and zero-balance accounts. It highlights which accounts are at risk and provides easy steps to keep your account safe and active.

Check If Your Account Is at Risk and What You Can Do

Starting November 11, 2025, the Reserve Bank of India (RBI) has asked banks to take action against certain types of accounts that are inactive or not updated. If you have an old account you haven’t used in a while, it could be at risk of being frozen or closed.

This move is meant to make banking safer and reduce the chances of fraud. But it also means you need to check your account status and take action if needed.

Which Accounts Are at Risk?

RBI has told banks to focus on three types of accounts that are often ignored or misused:

1. Dormant Accounts (No Activity for Over 2 Years)

- If you haven’t made any transaction like deposit, withdrawal, transfer, or even updated your KYC for 2 years, your account is marked as dormant.

- These accounts are easy targets for fraud because they’re not monitored by the user.

- Banks will now send notices and may freeze or close these accounts if no action is taken.

2. Inactive Accounts (No Activity for Over 1 Year)

- Many banks treat accounts with no customer activity for 1 year as inactive.

- If you don’t respond to alerts or update your KYC, your account may soon be marked dormant and face closure.

3. Zero Balance Accounts (Unused and Not Verified)

- Accounts with zero balance that were opened but never used especially under schemes like Jan Dhan are also being reviewed.

- If these accounts haven’t been verified or updated with KYC, banks may close them to prevent misuse.

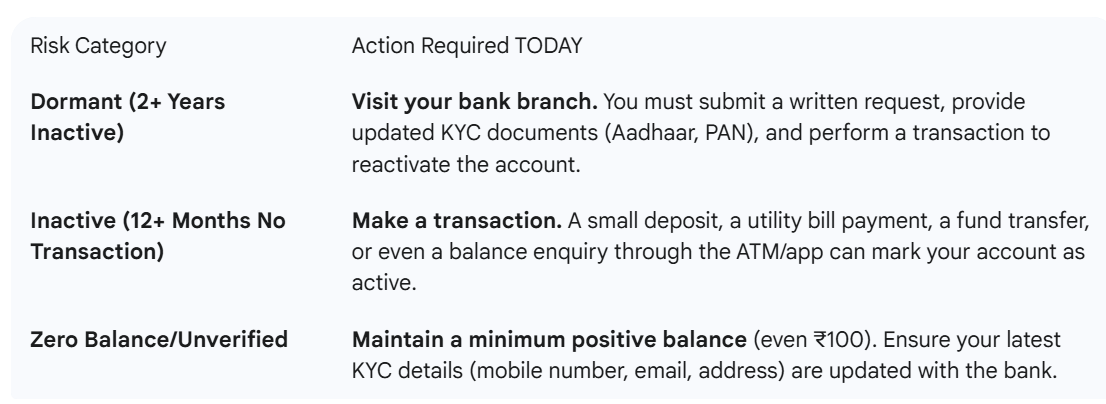

What You Should Do Today

Note: Only transactions made by you count. Interest added by the bank or charges deducted do not count as activity.

Why This Matters

RBI wants banks to maintain clean records and protect customers from fraud. By keeping your account active and updated, you:

- Keep your money safe

- Avoid account closure

- Stay in line with banking rules

Final Tip

Don’t wait for your bank to send a warning. If you have an account you haven’t used in a while, take action today. A small step like updating your KYC or making a quick transaction can save your account from being closed.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)

.jpg

)