# tds

12 posts in `tds` tag

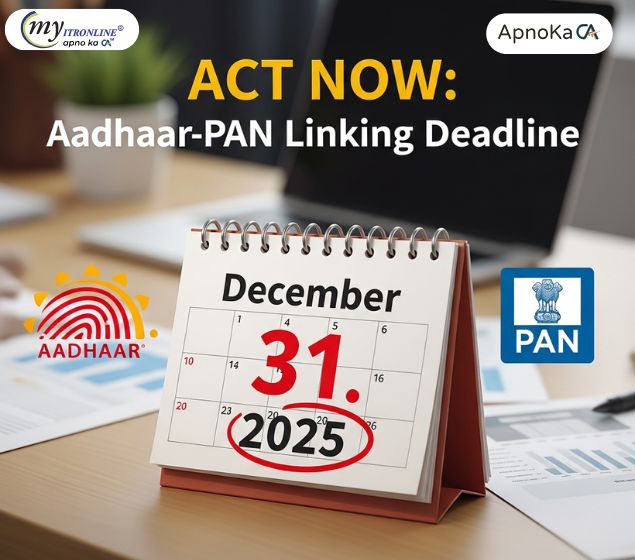

Act Now: Aadhaar-PAN Linking Deadline is December 31, 2025

Link your PAN with Aadhaar by December 31, 2025. If you miss the date, PAN goes inoperative from January 1, 2026, stopping ITR filing and blocking refunds. Pay 1,000 on the e-Filing portal and link now. Some groups are exempt.

Life insurance payouts and TDS: what you should know

A short, clear guide to TDS on life insurance payouts under Section 194DA, covering who it applies to, TDS rates, limits, exemptions, how income is calculated, and compliance steps, with a quick example.

New Income Tax Rules Effective December 2025: Key Updates

The Income Tax Department has introduced key updates effective December 1, 2025, focusing on real-time TDS error alerts, significantly faster ITR refund processing (7 days), strict AIS/26AS income matching rules, and an increased late filing penalty of ₹7,500 for high-income taxpayers.

TDS Rate Chart FY 2025-26 (AY 2026-27)

This blog provides a simplified overview of the latest Tax Deducted at Source (TDS) rates for FY 2025-26 (AY 2026-27). It highlights key changes in thresholds, presents a clear rate chart for residents, and offers practical compliance tips for taxpayers.

GST Compliance Calendar November 2025

This blog provides a clear and simple calendar of all key GST return filing dates for November 2025. It helps GST-registered taxpayers stay compliant, avoid penalties, and plan their filings in advance.

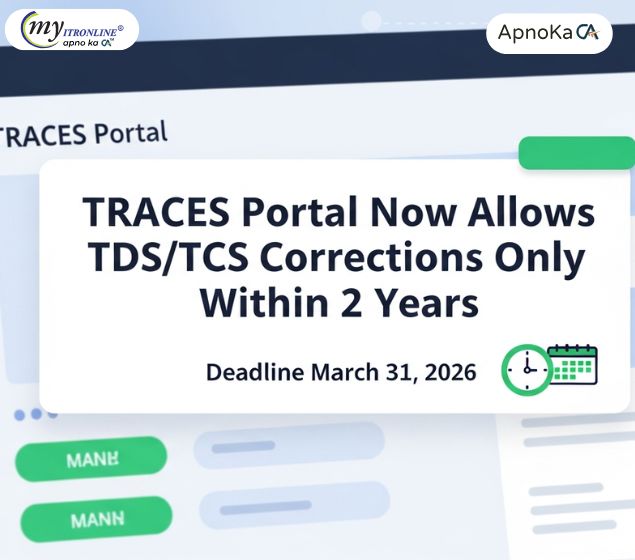

Tax Alert: TRACES Portal Sets 2-Year Limit for TDS/TCS Corrections

The Income Tax Department has shortened the correction window for TDS/TCS statements to just 2 years via the TRACES portal. This change affects deductors, collectors, and taxpayers alike. Corrections for older financial years (FY 2018-19 to FY 2023-24) must be filed by March 31, 2026. After that, no changes will be accepted. Learn what this means for you and how to act now.

Tax Refunds Can’t Be Denied for Form 26AS Mismatch: High Court Ruling

The Allahabad High Court has ruled that tax refunds cannot be denied just because TDS is missing from Form 26AS. If a taxpayer provides valid Form 16A certificates, the Income Tax Department must verify the claim with the deductor instead of rejecting it outright. This protects honest taxpayers from delays caused by clerical errors.

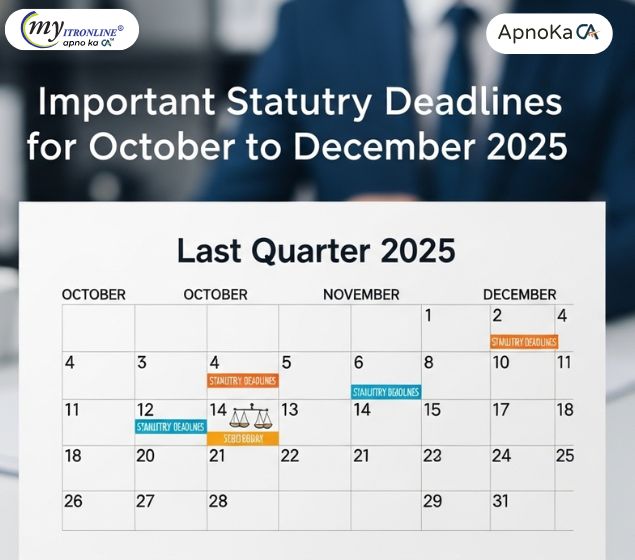

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

ITAT Ahmedabad: No Penalty for Late TDS Remittance under Section 271C

In a landmark ruling, ITAT Ahmedabad has held that penalty under Section 271C of the Income Tax Act is not applicable for delayed remittance of TDS, provided the tax was deducted and paid with interest. This decision, based on Supreme Court precedent, offers relief to taxpayers facing procedural delays.

March 31, 2026: The TDS/TCS Correction Deadline You Cannot Miss

The Income Tax Act, 2025 has introduced a crucial change in TDS/TCS compliance: the timeline for filing correction statements has been reduced from 6 years to 2 years. Businesses must file all pending TDS/TCS corrections for FY 2018-19 Q4 through FY 2023-24 Q3 by March 31, 2026. Failure to meet this deadline will lead to automatic recovery proceedings, penalties, and compliance complications. Learn about the key changes, understand the implications for your organization, and discover the immediate steps you need to take to ensure full compliance before the deadline expires.

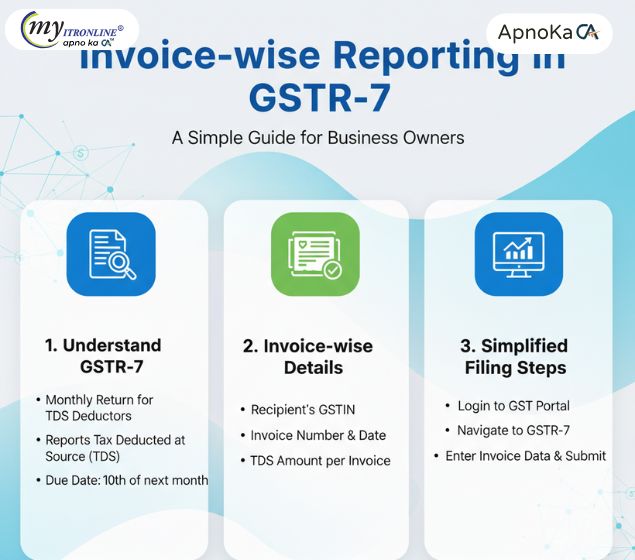

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.