# taxupdates

12 posts in `taxupdates` tag

New Income Tax Rules Effective December 2025: Key Updates

The Income Tax Department has introduced key updates effective December 1, 2025, focusing on real-time TDS error alerts, significantly faster ITR refund processing (7 days), strict AIS/26AS income matching rules, and an increased late filing penalty of ₹7,500 for high-income taxpayers.

Tax Refunds Update: High-Value Claims Under Scrutiny, Legitimate Payouts Expected by December 2025

The Income-Tax Department is closely reviewing high-value refund claims flagged for potential discrepancies. While smaller refunds are already being processed, CBDT Chairman Ravi Agrawal has assured taxpayers that legitimate high-value payouts will be cleared by December 2025. Refund claims worth ₹2.42 lakh crore have been filed till November 10, showing an 18% drop from last year. The department has also increased appeal disposals by 40% and remains confident of meeting its ₹25.20 lakh crore direct tax collection target for FY26, supported by 6.99% growth. Leveraging AI-powered tools, the CBDT is enhancing compliance, monitoring taxpayer behavior, and identifying potential evasion

New Income Tax Return Forms and Rules: What You Need to Know

The government is set to introduce simplified income tax return forms under the Income Tax Act, 2025 by January 2026, replacing the long-standing Income Tax Act, 1961. These new forms aim to make tax filing easier, reduce compliance burdens, and improve transparency. Refunds are being processed, with larger claims expected by December 2025. The CBDT is confident of meeting its ambitious ₹25.20 lakh crore direct tax collection target for FY26, supported by strong growth. Taxpayers should prepare for the new system, which takes effect from April 1, 2026.

Major IMS Enhancements on GST Portal: What Businesses Need to Know

Starting October 2025, the GSTN has rolled out major updates to the Invoice Management System (IMS) that simplify compliance, improve transparency, and give taxpayers more control over invoice handling. This blog breaks down the key changes and what they mean for businesses.

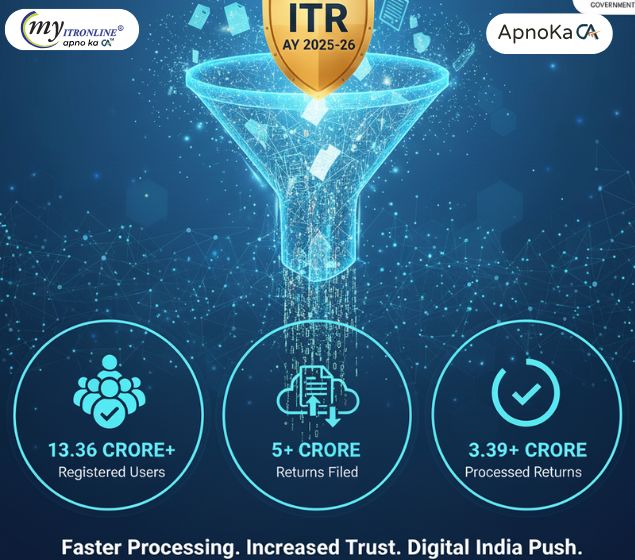

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

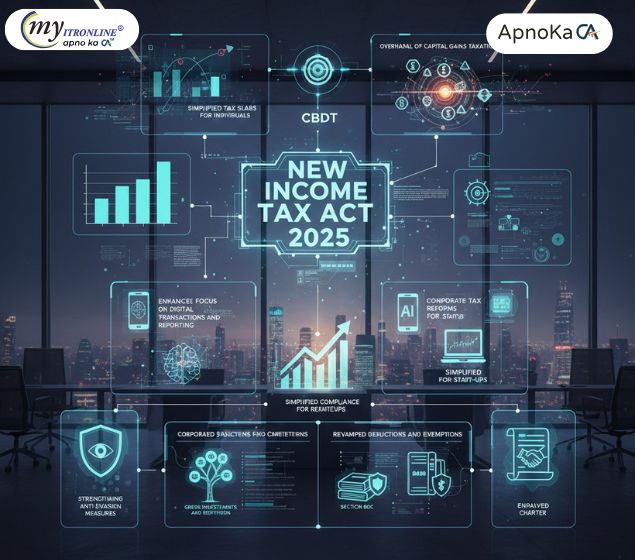

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

Tax Audit under 44AB: Revised 2025 Essentials

This guide explains the updated Guidance Note on Tax Audit under Section 44AB of the Income-tax Act, 1961, for the Assessment Year 2025-26 (Financial Year 2024-25). It clarifies who needs a tax audit, points out key changes in Form 3CD, including new clauses for digital transactions, MSME reporting, and buybacks. It also outlines the audit process, lists important due dates, and details the penalties for non-compliance. The guide offers best practices for taxpayers to help ensure smooth audits and strong tax compliance in India.

.jpg)

Kind Attention Taxpayers! ITR-3 Now Enabled for Online Filing!

The Income Tax Department has enabled online filing for ITR-3 for Assessment Year 2025-26, simplifying tax compliance for individuals and HUFs with business or professional income. This blog post details who needs to file ITR-3, highlights key updates for the current assessment year (including changes in AL reporting and VDA schedules), explains the benefits of online filing, and provides a step-by-step guide to assist taxpayers. It also subtly promotes MyITROnline for expert assistance.

.jpg)

Unlock Past Tax Corrections: Excel Utilities for Updated ITR-1 & ITR-2 (AY 2021-22 & 2022-23) Now Live!

The Income Tax Department has launched Excel utilities for filing Updated Returns (ITR-U) for Assessment Years 2021-22 and 2022-23, extending the filing window to 48 months as per the Finance Act, 2025. This blog details who can file ITR-U using ITR-1 and ITR-2, explains the new deadlines, outlines the penalty structure, and provides a step-by-step guide on using the Excel utilities to declare additional income and ensure tax compliance.

.jpg)

Digital Assets & Tax: What's New for Indian Investors in FY 2025-26?

India's digital asset taxation is maturing. For FY 2025-26, the core 30% tax and 1% TDS on VDAs remain, but expect a wider definition of VDAs and mandatory reporting by exchanges. This blog details current rules and what enhanced compliance means for crypto and other new-age investors.

.jpg)

The Latest on Partner Remuneration: FY 2025-26 Tax Changes Explained

The FY 2025-26 brings crucial changes for partnership firms & LLPs regarding partner remuneration. This blog decodes the new, increased deduction limits under Section 40(b) and the mandatory TDS introduction via Section 194T on payments to partners. It covers who's a working partner, the role of the partnership deed, and essential compliance steps for firms.