# taxseason

12 posts in `taxseason` tag

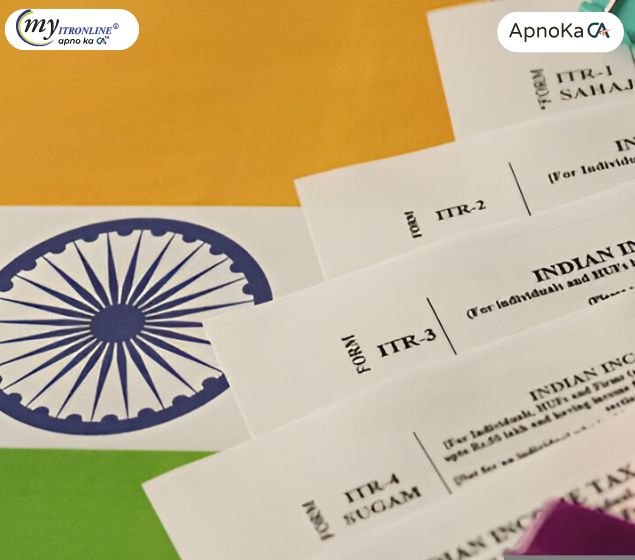

ITR-1 and ITR-4 Forms for AY 2025-26 Released Early: All You Need to Know

The Central Board of Direct Taxes (CBDT) has kickstarted the income tax filing season earlier than usual by releasing the ITR-1 (Sahaj) and ITR-4 (Sugam) forms for Assessment Year 2025-26. This blog explores the eligibility, permissible income sources, and filing restrictions for both forms. It also highlights a major update—taxpayers can now report Long-Term Capital Gains (LTCG) under Section 112A in ITR-1 and ITR-4 under specific conditions. Additionally, it explains the difference between form notification and utility release, emphasizes the importance of early preparation, and provides a comprehensive document checklist for smooth filing. The blog concludes by urging taxpayers to be proactive and file early to avoid last-minute hassles.

Tax Season Starts Early: ITR-1 (Sahaj) & ITR-4 (Sugam) Notified for AY 2025-26!

The blog post announces the early notification of ITR-1 (Sahaj) and ITR-4 (Sugam) forms by the CBDT for the Assessment Year 2025-26 (corresponding to Financial Year 2024-25). It details the eligibility criteria for using these forms, explains the significance of the early notification for taxpayers (more preparation time, potentially earlier filing utility release), clarifies the difference between form notification and utility release, reminds readers about the AY/FY distinction, and advises taxpayers to start gathering necessary documents while waiting for the official filing utilities to be launched on the Income Tax portal.

.jpg)

Common Income Tax Blunders and How to Avoid Them

This blog serves as your guide to avoiding common income tax mistakes. Learn how to claim all your deductions, avoid math errors, leverage e-filing, respond to IRS notices, and keep proper records.

Don't Get Audited! A Guide to Avoiding False Claims in Your ITR Filing

Filing your Income Tax Return (ITR) can be stressful, but making false claims can be even worse. This blog explores the importance of accurate ITR filing, the risks of misinformation, and offers valuable tips to ensure a smooth and compliant tax filing experience.

Important Tax Deadlines for July 2024

As the first quarter of the 2024-25 financial year ends, it's essential for taxpayers and businesses in India to be aware of important tax deadlines in July 2024. This blog provides a comprehensive guide on critical due dates set by the Income Tax Department and GST authorities. It covers deadlines for TDS deposits, TDS certificates, income tax returns, and GST filings, helping you stay compliant and avoid penalties.

Unlocking the Secrets of AIS & TIS: Your Key to Smoother Income Tax Filing in India

This blog explores the concept of AIS (Annual Information Statement) and TIS (Taxpayer Information Summary) in the context of income tax filing in India. It explains what each document is, how they differ, and the benefits they offer (reconciliation of income, pre-filling ITR forms, identifying omissions, etc.). The blog also provides a clear distinction between AIS and TIS, highlighting their purpose and information source. Finally, it offers tips for utilizing these resources effectively and ensuring a smooth tax filing experience.

10 Common Income Tax Mistakes to Avoid This Filing Season

Filing your income tax return can be a daunting task, but by avoiding these 10 critical mistakes, you can ensure a smooth and stress-free filing experience. From missing the tax filing deadline to claiming ineligible deductions, these common errors can lead to delays, penalties, and even audits. Take the time to review your return carefully and avoid these costly mistakes.

How to Claim Tax Refund and What to Do If Your Refund is Delayed

This blog post provides a comprehensive guide on how to claim a tax refund, including the necessary steps, required documents, and tips to avoid delays. It also covers what to do if your refund is delayed, including how to track its status and resolve common issues.

.jpg)

Excel Utility for ITR-5 AY 2024-25 Released: Streamline Your Tax Filing Process

The Income Tax Department has introduced the Excel Utility for ITR-5 for the Assessment Year 2024-25, simplifying the tax filing process for various entities. This user-friendly tool is now accessible on the official income tax e-filing portal and is designed for firms, Limited Liability Partnerships (LLPs), Association of Persons (AOPs), Body of Individuals (BOIs), artificial juridical persons, cooperative societies, and local authorities. The utility offers features like automated calculations, validation checks, and detailed instructions, ensuring accurate and efficient tax return preparation. Download the utility today to streamline your tax filing experience.

Returns and Forms Applicable for Hindu Undivided Family (HUF) for AY 2024-2025

As the Assessment Year (AY) 2024-2025 approaches, Hindu Undivided Families (HUFs) must be well-prepared for their tax filings. This guide provides a detailed overview of the returns and forms applicable to HUFs, helping ensure compliance and optimize tax liabilities. From understanding the nature of HUFs and their income sources to selecting the correct ITR forms and following the filing process, this comprehensive guide covers everything you need to know for a smooth tax season.

Have you received your Form-16? ITR Filing for FY 2023-24 (AY 2024-25) has started.

As the financial year 2023-24 concludes, it's time to file your Income Tax Return (ITR) for Assessment Year (AY) 2024-25. This blog post provides a comprehensive guide on using Form-16, a crucial TDS certificate issued by employers, to accurately and efficiently file your ITR. We cover everything from gathering necessary documents to verifying your return, along with common mistakes to avoid. Stay compliant and ensure a smooth tax filing process with our detailed instructions and tips. Start your ITR filing today

Crucial Update: Deadline for Submission of Statement of Financial Transactions (SFT)

This update highlights the critical deadline for submitting the Statement of Financial Transactions (SFT). It emphasizes the importance of adhering to this deadline to comply with regulatory requirements.