# taxsaving

12 posts in `taxsaving` tag

Old Tax Regime Benefits: Essential Deductions (80E, 80G, 80TTA, 80TTB) Beyond 80C

This blog post delves into crucial tax-saving sections beyond the popular 80C, specifically detailing Sections 80E (education loan interest), 80G (donations), 80TTA (savings interest for non-seniors), and 80TTB (interest on deposits for senior citizens). It explains who can claim these, their limits, and, most importantly, their non-applicability under the New Tax Regime for FY 2024-25. The post encourages taxpayers to compare regimes carefully and highlights myitronline's services for expert assistance.

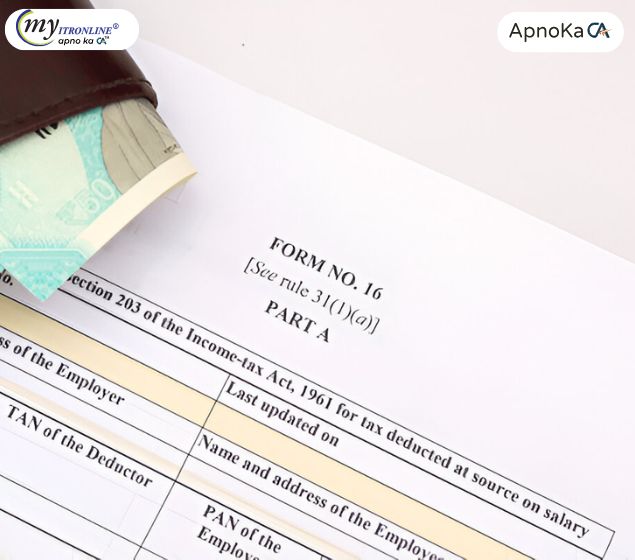

Significant Form 16 Updates for FY 2024-25: A Brief Overview!

This blog provides a concise overview of the significant updates to Form 16 for salaried employees in the Financial Year 2024-25. It highlights the increased standard deduction and improved NPS benefits under the new tax regime, along with the inclusion of other TDS/TCS information, guiding taxpayers on what to expect for their upcoming ITR filing.

Start Your Tax Filing Now: ITR-1 & ITR-4 Excel Utilities for AY 2025-26 Released!

Big news for individual taxpayers and small businesses! The Income Tax Department has released the Excel Utilities for ITR-1 (Sahaj) and ITR-4 (Sugam) for Assessment Year 2025-26. This means you can now begin filing your income tax returns offline. This blog covers who can use these forms, the benefits of early filing, and how MYITRONLINE can provide seamless assistance.

Rectify Your ITR: Claim Forgotten Section 80C Deductions and Avoid Penalties

This blog post provides a comprehensive guide for taxpayers who have missed claiming eligible deductions under Section 80C of the Income Tax Act, 1961, in their original Income Tax Return (ITR). It explains the importance of Section 80C, the concept of a Revised ITR, and offers a detailed step-by-step process for filing a revised return online. The article also emphasizes the significance of adhering to deadlines to avoid penalties and provides essential tips for a smooth filing experience, ensuring taxpayers can reclaim their rightful tax benefits

19 Lakh Salary? Here's How to Pay ZERO Income Tax in the New Regime

This blog delves into the strategic methods allowing salaried professionals to pay nil income tax on a ₹19 lakh annual salary under India's New Tax Regime (effective FY 2024-25). It outlines how leveraging increased basic exemption limits, the enhanced Section 87A rebate, standard deductions, employer's NPS contributions, and smart flexi-pay salary structuring can lead to a tax-free income, complete with illustrative calculations and actionable steps.

Double Your Benefits: Utilize Sections 80C & 80D Simultaneously to Enhance Your Tax Savings

This blog explores how Indian taxpayers can maximise their income tax savings by leveraging both Section 80C and Section 80D of the Income Tax Act. While Section 80C focuses on investments and expenses like PPF, ELSS, and home loan principal repayment, Section 80D offers deductions on health insurance premiums and preventive health check-ups. By using these sections together, taxpayers can claim deductions up to ₹2,00,000 annually. The blog explains eligibility, deduction limits, strategic planning tips, and helps readers choose between the old and new tax regimes for optimal tax benefits.

Section 44ADA Explained: Presumptive Taxation Benefits for Self-Employed

This comprehensive guide delves into Section 44ADA of the Income Tax Act, 1961, offering a simplified "presumptive taxation" scheme for eligible self-employed professionals. Discover who qualifies, how to calculate your taxable income at a minimum of 50% of gross receipts, and the significant benefits like exemption from detailed bookkeeping and tax audits. Learn about crucial compliance aspects, including advance tax and the increased ₹75 Lakhs gross receipts limit, to make informed decisions for smarter tax planning and effortless compliance.

.jpg)

Don't Miss Out! Maximize Section 87A & Claim Every Deduction in Your FY 2024-25 ITR

Maximize your savings and simplify your ITR filing for FY 2024-25! Discover how to effectively utilize the Section 87A rebate and navigate the complexities of deductions under both the old and new tax regimes. This essential guide empowers you to make informed choices, accurately claim every eligible deduction, and confidently file your ITR to prevent any unwelcome tax notices.

CBDT Notifies IRFC Zero Coupon Bonds: Tax Impact for Investors

The CBDT has notified IRFC's Ten-Year Zero Coupon Bonds under the Income Tax Act, potentially making the maturity proceeds tax-exempt under Section 10(15)(iv)(h). This offers a significant tax advantage for long-term investors compared to non-notified bonds.

Maximize Tax Savings: How to Claim Both 80C & 80CCD Deductions (AY 2025-26)

This guide explains how taxpayers can claim deductions under both Section 80C and Section 80CCD (NPS) of the Income Tax Act for AY 2025-26. It details the limits and interaction of 80C, 80CCD(1), 80CCD(1B - additional ₹50k), and 80CCD(2 - employer contribution). The post clarifies that combining these benefits (up to ₹2 Lakh + employer contribution) is possible under the Old Tax Regime, while only 80CCD(2) is available under the New Tax Regime. An example illustrates maximizing deductions under the Old Regime.

Exciting Update for NSS Investors! The Section 194EE Exemption Renders 80CCA Withdrawals Free from Tax.

Recent updates clarify that NSS withdrawals associated with Section 80CCA deductions are exempt from TDS under Section 194EE. Investors can receive the complete principal amount without tax, with only the interest being subject to taxation.

.jpg)

HRA Notice Alert! How to Respond and Prevent Future Issues

This detailed guide outlines the reasons taxpayers are issued HRA scrutiny notices, particularly for claims exceeding 5L. It also covers how to react by verifying claims, settling any unpaid TDS under Section 194IB, modifying ITR, and providing CA certificates to prevent penalties and future audits.