# taxreform

12 posts in `taxreform` tag

Great News for Entrepreneurs! Get Your GST Number in Just 3 Days

GST 2.0 is a game-changer for small businesses in India. Starting November 1, 2025, new applicants can opt for a simplified GST registration process with automatic approval in just 3 working days. Designed for low-risk businesses, this reform reduces hassle and speeds up business launch.

GST 2.0: Faster, Easier Registration for Startups and MSMEs from November 1

From November 1, 2025, small businesses and startups in India can benefit from a simplified GST registration process. This reform promises approval within 3 working days for low-risk applicants and public sector entities. It’s part of the broader GST 2.0 initiative aimed at making tax compliance faster, easier, and more tech-driven. Learn how this change can help you start your business with less hassle and more confidence.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

GST 2.0: A Game Changer for India? Simplified Taxes & Economic Boost

This blog post provides a comprehensive overview of India's GST 2.0, implemented on September 22, 2025. It details the key features, including the reduction of tax slabs to 5% and 18% (with a new 40% for luxury/sin goods), lower taxes on essential goods, durables, and automobiles, and increased prices for luxury items. The article identifies beneficiaries like everyday households, the middle class, farmers, healthcare consumers, and MSMEs. It also addresses potential challenges such as revenue shortfall, price pass-through issues, and transition headaches for businesses. Finally, it outlines expected economic ripples and crucial factors to monitor for the reform's success, concluding that GST 2.0 is a bold step towards simplifying life for millions. An appendix with sample MRP comparisons is also included.

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

Historic Diwali Gift for the Nation: Next-Gen GST Reform

This blog details the significant GST cuts introduced as a 'Diwali gift' for the nation. It highlights how these reforms aim to simplify the tax structure and ease financial burdens across various sectors including daily essentials, agriculture, healthcare, education, and certain electronic appliances and vehicles, ultimately fostering a self-reliant India. The article also touches upon process reforms and a positive message from the Prime Minister.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

Indian Multiplexes Urge Government for GST Rationalisation on Tickets and F&B

Indian multiplex chains are lobbying the government for a reduction in GST on movie tickets and the allowance of input tax credit (ITC) on food and beverages. They argue these reforms are crucial for making cinema more affordable, boosting industry growth post-pandemic, and competing with OTT platforms. While the Multiplex Association of India proposes a new tiered GST structure, industry opinions vary on whether pricing or content quality is the ultimate driver for audience footfall.

States Push for Tough Steps to Stop Profiteering from GST Cuts

The GST Council is set to meet on September 3-4 to review GST 2.0 reforms. States want strict rules to prevent profiteering so that GST rate cuts actually benefit consumers. Key proposals include a temporary anti-profiteering law, consumer complaint platforms, and tighter monitoring of sensitive sectors. Businesses, however, warn about compliance costs and pricing disruptions.

CBDT Overhauls Income Tax: Simpler Forms & Stronger Data Protection by 2025

The Central Board of Direct Taxes (CBDT) is implementing significant changes to income tax forms and rules, effective April 2025, following the new Income Tax Act of 2025. The initiative focuses on simplifying tax filing through smart, pre-filled forms, drastically reducing the number of forms from 200 to under 100, and ensuring robust protection for digital data collected during tax procedures. While new ITR forms are slated for 2027, immediate efforts are on TDS, TCS, advance tax, and exemption forms. These reforms aim to enhance transparency, ease compliance, and create a smarter, safer tax environment for Indian taxpayers.

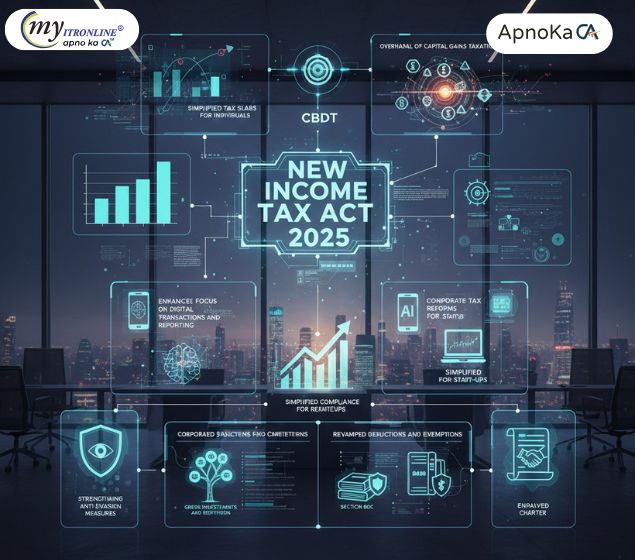

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

Goodbye 1961, Hello 2025: India's New Income Tax Act Explained in Simple Terms

This blog post details India's landmark decision to replace the sixty-year-old Income-tax Act, 1961, with the new, simplified Income-tax Act, 2025, which will be effective from April 1, 2026. It breaks down the key changes in simple terms, explaining the reduction in legal complexity, the introduction of a unified "Tax Year," clearer definitions for digital assets, and the move towards faceless, technology-driven tax processes. The post highlights how these changes aim to create a more transparent, efficient, and taxpayer-friendly direct tax system for individuals and businesses across the country.