# taxpayeralert

6 posts in `taxpayeralert` tag

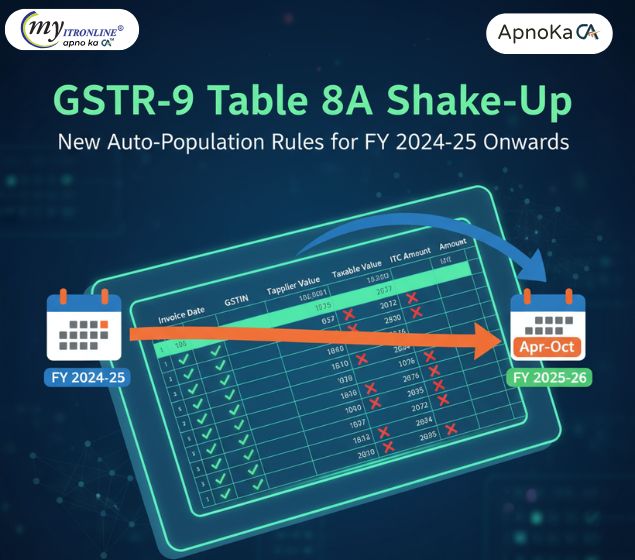

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

.jpg)

ITR-2 & ITR-3 Excel Utilities Are LIVE! Your Essential Guide to Filing for AY 2025-26

This blog post announces the release of ITR-2 and ITR-3 Excel utilities for AY 2025-26. It explains which taxpayers must use these forms and highlights important updates from the Finance Act, 2024. These updates include changes to capital gains segregation, share buyback rules, and higher asset reporting thresholds. The post describes the benefits of using Excel utilities and offers a clear, step-by-step guide for filing. It stresses key points like the e-verification deadline and the need for accuracy and good record-keeping to ensure smooth compliance.

.jpg)

Taxpayer Alert! Decoding Income Tax Department's New Rules for FY 2025-26

The Income Tax Department is making significant updates and tightening compliance for FY 2025-26 (AY 2026-27). This blog post serves as an important "taxpayer alert." It explains key changes, such as the mandatory Aadhaar-based verification for updates to the e-filing portal and PAN applications. There is also a stronger emphasis on computer-assisted scrutiny (CASS) for certain types of returns, including survey/search cases, ITR-7 filers, recurring additions, and intelligence alerts. Additionally, it provides information on expected delays in ITR refunds due to outstanding demands and technical upgrades. The focus on HRA claims will tighten, especially those that involve family members. It highlights the need for proactive compliance, careful record-keeping, and timely responses to avoid penalties and ensure a smooth tax experience.

.jpg)

Taxpayers Alert: Budget 2025 Proposes a 70% Tax Hike on Updated ITRs

A substantial 70% extra tax on files after the two-year mark is the catch of the planned extension of the revised ITR filing term from two to four years in the Union Budget 2025. The goal of this action is to deter tax evasion and promote prompt compliance. This article examines the ramifications, professional viewpoints, and actions that taxpayers must take to avoid fines.

.jpg)

Section 80GGC Deduction Under Scrutiny – ITD’s Compliance Notice Explained

The Income Tax Department (ITD) has started sending SMS alerts to taxpayers who have claimed Section 80GGC deductions for donations made to political parties and electoral trusts. The notice applies to Assessment Years 2022-23, 2023-24, and 2024-25 and urges taxpayers to verify their claims on the Compliance Portal.

If the claim is incorrect, taxpayers must file an Updated Return (ITR-U) under Section 139(8A) before 31st March 2025 to avoid penalties under Section 270A (up to 200% fine) and interest under Section 234F (₹5,000 late fee). This blog explains Section 80GGC deductions, compliance requirements, and the steps to correct errors in tax filings.

Last Chance! Link Your PAN with Aadhaar by May 31st to Avoid Higher Tax Deductions

The deadline to link your PAN with Aadhaar is fast approaching. By May 31st, all taxpayers must ensure this linkage to avoid higher tax deductions and penalties. This blog explains the importance, consequences of missing the deadline, and offers a step-by-step guide for linking PAN with Aadhaar. Stay compliant with the latest tax regulations to ensure smooth financial transactions and avoid complications.