# taxexemption

12 posts in `taxexemption` tag

Pay Zero Tax on 10 Crore Capital Gains: Your Guide to Strategic Reinvestment

Selling a big asset like property, stocks, or gold can lead to huge capital gains and a big tax bill. But if you reinvest smartly, you can claim full exemption under Section 54 or 54F, up to ₹10 Crore. This blog explains how to do it, the deadlines, and the rules to follow.

Income Tax AY 2024–25: Understanding Section 115BAC Rules

Section 115BAC introduces a simplified tax structure with reduced slab rates, but at the cost of foregoing key exemptions and deductions. Effective from AY 2024–25 as the default regime, this blog explains the revised tax slabs, outlines the benefits that are no longer available, and guides taxpayers on choosing between the new and old regimes based on their financial profile and investment habits.

Smart Property Moves: How Sections 54 and 54F Can Slash Your Tax Bill on Residential Property Sales (Latest Rules 2025)

Discover how Sections 54 and 54F of the Indian Income Tax Act provide crucial tax exemptions on Long-Term Capital Gains from property sales. This comprehensive guide covers the latest rules for 2025, including the new ₹10 Crore cap and the two-house option under Section 54, offering practical examples and a step-by-step plan for effective tax planning.

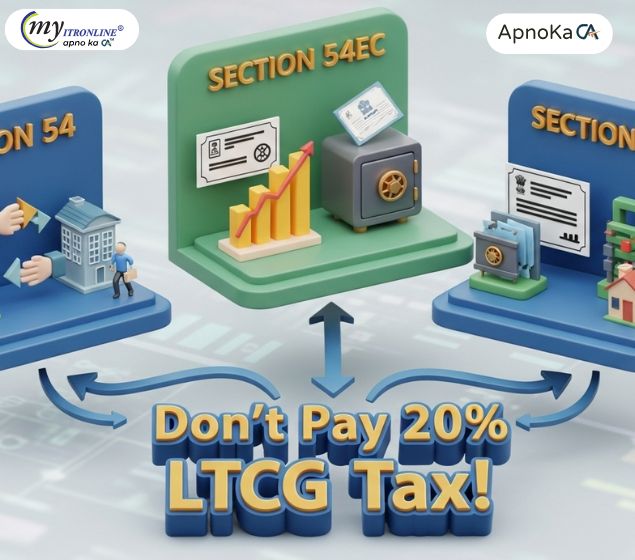

Don't Pay 20% LTCG Tax! How to Use Sections 54, 54EC, 54F

This blog post provides a comprehensive yet easy-to-understand guide to saving Long-Term Capital Gains (LTCG) tax arising from property sales in India. It delves into three crucial sections of the Income Tax Act – Section 54, Section 54EC, and Section 54F – detailing their eligibility criteria, investment options, time limits for reinvestment, and lock-in periods. The post also includes a comparative table and a practical example to illustrate how these exemptions work, empowering taxpayers to make informed decisions and potentially reduce their tax liabilities.

CBDT Simplifies Tax Rules for IFSC Funds: A Major Win for Investors

This blog post breaks down the recent significant amendment made by the CBDT to Rule 21AIA of the Income Tax Rules. It details the removal of sub-rule (4), which previously imposed additional compliance burdens on "specified funds" like retail schemes and ETFs in the IFSC. The post explains how this change aligns tax laws with IFSCA regulations, effectively eliminating dual regulation. The primary impact is simplified compliance, reduced regulatory overlap, and a more attractive investment environment in India's IFSC, ultimately fostering growth in financial hubs like GIFT City.

.jpg)

Big News for Property Sellers: IREDA Bonds Now Offer Up to 50 Lakh Tax Exemption on Capital Gains!

This blog post details how the Central Board of Direct Taxes (CBDT) has granted "54EC status" to IREDA bonds, offering property sellers a significant tax exemption of up to 50 lakh on long-term capital gains. It explains what 54EC bonds are, why IREDA's inclusion is beneficial for both investors and India's green energy goals, how the tax exemption works, key investment considerations like limits and lock-in periods, and who can invest. The post highlights the advantages of investing in these safe, fixed-return bonds while contributing to a sustainable future.

.jpg)

Understanding Agricultural Income Tax in India (FY 2024-25)

This blog post demystifies the tax treatment of agricultural income in India for the Financial Year 2024-25 onwards. It clearly defines what constitutes agricultural income and what does not. The post explains the crucial concept of "partial integration," a unique tax calculation method for individuals with both agricultural and non-agricultural income, illustrating it with a simple example. It also highlights essential compliance requirements like reporting agricultural income in ITR and maintaining records, alongside reasons for the historical tax exemption.

.jpg)

Big news for legal aid! CBDT Notification S.O. 3204(E) grants vital income tax exemptions to District Legal Service Authorities in Haryana (Gurgaon, Mewat & more) from AY 2025-26. Find out which income is exempt and what conditions apply!

Big news for legal aid. The CBDT Notification S.O. 3204(E) gives important income tax exemptions to District Legal Service Authorities in Haryana, including Gurgaon, Mewat, and others, starting from AY 2025-26. Discover which income is exempt and the conditions that apply.

.jpg)

India's New Income Tax Regime (Section 115BAC): Your Comprehensive Guide for FY 2024-25 & 2025-26

This comprehensive guide breaks down India's New Income Tax Regime under Section 115BAC, now the default for individuals and HUFs. It details the revised income tax slab rates for Financial Years 2024-25 and 2025-26, highlighting the increased basic exemption limits and the enhanced rebate under Section 87A. The article clearly outlines the limited deductions and exemptions still allowed (e.g., standard deduction, employer's NPS contribution) versus the numerous ones no longer applicable. It concludes by helping taxpayers determine whether the new regime or the old regime is more beneficial for their specific financial situation and explains the process for switching between the two.

.jpg)

New Gratuity Norms 2025: What Indian Employees Must Know

This blog post offers a detailed look at gratuity in India for 2025. It defines gratuity and outlines the different situations in which it is payable, including superannuation, resignation, death, or disablement. The post explains the eligibility criteria, highlighting the five-year continuous service rule and its main exceptions. It also provides clear formulas and examples for calculating gratuity for both employers covered and not covered by the Payment of Gratuity Act, 1972. A significant portion covers the tax implications for 2025 under Section 10(10) of the Income Tax Act. This section differentiates between government and non-government employees, explains the 20 Lakh exemption limit, and addresses the effect of the new tax regime (Section 115BAC) on gratuity exemptions. The article concludes with key takeaways for better financial planning.

Form 10B Guide for Trusts (AY 2025-26)

This comprehensive guide explains Form 10B, an essential audit report for charitable/religious trusts, educational institutions, and hospitals under the Income Tax Act (2025). It details who needs to file it (especially those with over ₹5 crore income, foreign contributions, or income applied outside India), its key contents, the step-by-step online filing process, and the crucial September 30, 2025 due date for AY 2025-26. The synopsis also highlights the severe consequences of non-compliance, emphasizing the report's vital role in maintaining tax-exempt status and ensuring financial transparency.

Easy Guide: Selling Your House? How to Save Tax with Section 54!

This blog provides a simple guide to Income Tax Section 54, explaining how individuals and HUFs can save tax on long-term capital gains from selling a residential house by reinvesting in a new one. It covers the core conditions, timelines, and the use of the Capital Gains Account Scheme. The main focus is on the crucial update allowing exemption for investing in two houses (if capital gain is up to ₹2 Crore), emphasizing that this benefit can be used only once in a lifetime. The post highlights common pitfalls and advises on documentation and expert consultation.