# taxaudit

12 posts in `taxaudit` tag

GST Annual Return Simplified: Key ITC Changes in GSTR-9 & GSTR-9C for FY 2024-25

A simplified guide to ITC changes in GSTR-9 and GSTR-9C for FY 2024-25, covering late claims, reversals, reclaims, and reconciliation requirements.

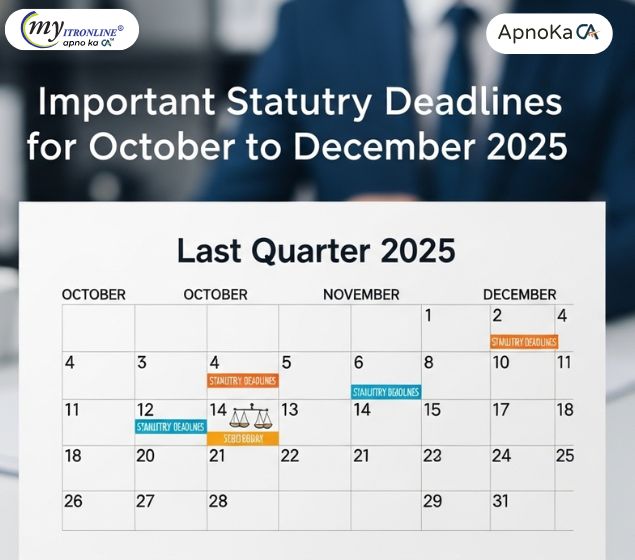

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

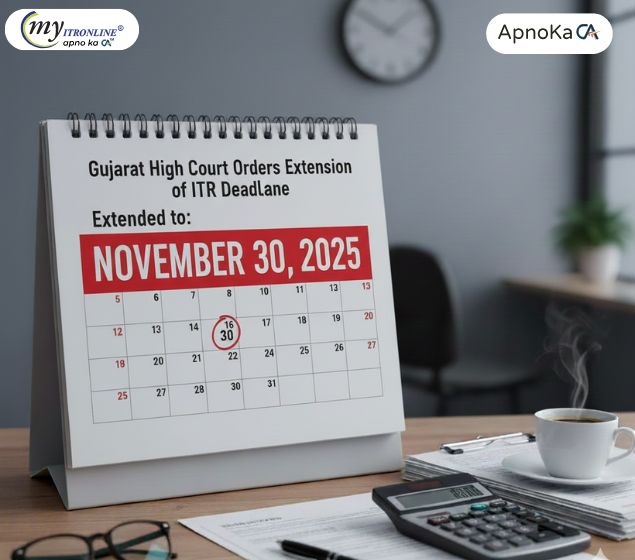

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.

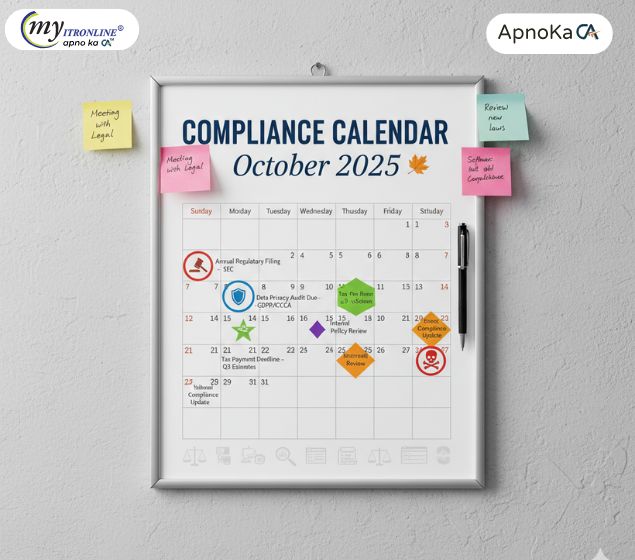

Compliance Calendar October 2025 – Key Tax and Regulatory Deadlines

October 2025 is packed with critical tax and regulatory deadlines. This blog highlights key dates for income tax, GST, MCA filings, EPF/ESI contributions, and audit-related submissions to help you stay compliant and avoid penalties.

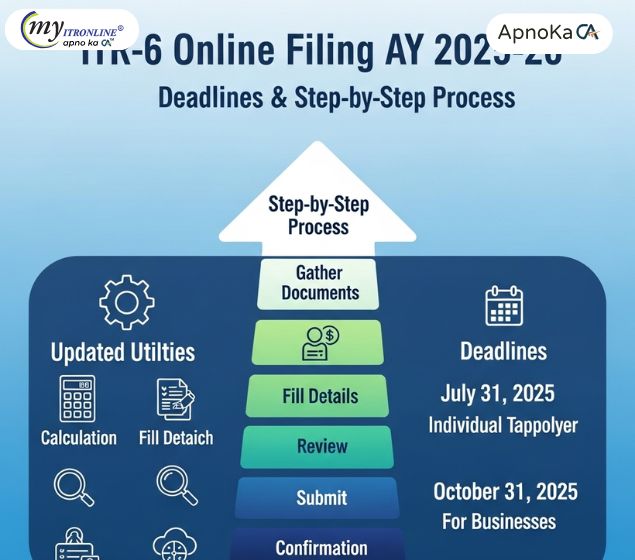

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

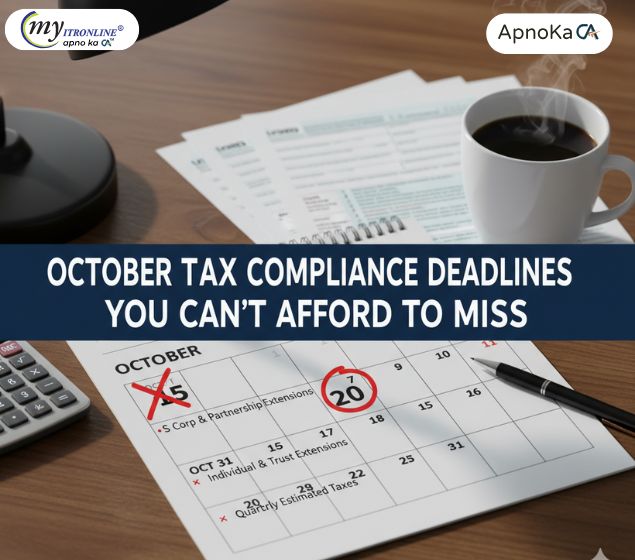

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

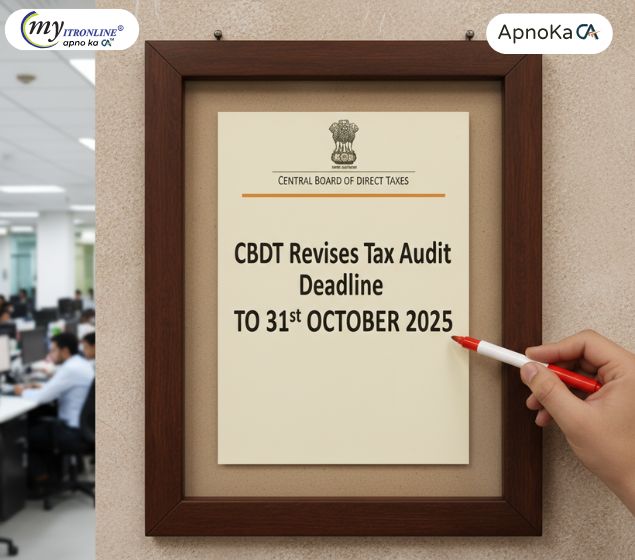

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.