# taxation

12 posts in `taxation` tag

Your Money, Simpler Taxes: Big Changes Coming to the Income Tax Law

The Indian Income Tax Act is evolving rapidly. From the push for the New Tax Regime to AI-driven scrutiny and rationalized capital gains, discover the key trends and anticipated changes that could reshape your financial planning and compliance strategy in the coming years.

Income Tax Benefits for Individuals and HUFs A.Y. 2026–27

A simplified guide to income tax benefits available to Individuals and Hindu Undivided Families (HUFs) for A.Y. 2026–27. Covers exemption limits, rebates, popular deductions, and simplified tax schemes to help taxpayers plan better and save legally.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

GST on Bricks: Understanding the Latest Rules

This blog post clarifies the latest GST rules for bricks in India, effective September 22, 2025. It details the two tax options for most brick types (6% without ITC under composition scheme or 12% with ITC under regular scheme) and introduces a special 5% GST rate with ITC for sand-lime bricks, which cannot opt for the composition scheme. The article also highlights the crucial annual turnover threshold of ₹20 lakh for GST registration. It explains the importance of these changes, who is affected, the pros and cons, and provides actionable advice for businesses, including checking turnover, correct brick classification, scheme selection, pricing adjustments, and record-keeping. Finally, it discusses the implications for buyers and builders and outlines potential issues such as classification disputes and transitional challenges.

194J vs. 44AD: Tax Scrutiny on India's Content Creators & Consultants

This blog post addresses the increasing tax notices faced by Indian content creators, influencers, and consultants due to a common mismatch: clients deducting TDS under Section 194J while they file income tax returns under Section 44AD. It breaks down the key tax provisions (194J, 44AD, 44ADA), explaining what each means for freelancers and businesses. The article clarifies that a 194J deduction doesn't automatically mandate filing under 44ADA; the crucial factor is whether the profession is listed under Section 44AA. It details potential impacts on tax burden, cash flow, and the need for increased documentation, while also offering actionable steps for creators and consultants to ensure compliance, including clarifying work nature, maintaining records, client communication, cash flow monitoring, and seeking professional tax advice.

Breaking: No Relief in GST, A Big Blow to the Indian Media Industry

This blog post analyzes the impact of the latest GST reforms on the Indian media industry. It highlights how, despite appeals from media and advertising groups, the sector received no significant relief regarding tax parity for digital publications, input tax credit access, or flexible tax payment timing. The article details the approved reforms that benefited other sectors and consumers, contrasting them with the ignored pleas of the media, leading to concerns about worsening the digital divide, liquidity pressure, and hindered cost recovery. It concludes that the lack of targeted reforms poses a major setback for innovation, job creation, and overall growth in the Indian media landscape.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

States Push for Tough Steps to Stop Profiteering from GST Cuts

The GST Council is set to meet on September 3-4 to review GST 2.0 reforms. States want strict rules to prevent profiteering so that GST rate cuts actually benefit consumers. Key proposals include a temporary anti-profiteering law, consumer complaint platforms, and tighter monitoring of sensitive sectors. Businesses, however, warn about compliance costs and pricing disruptions.

CBDT Overhauls Income Tax: Simpler Forms & Stronger Data Protection by 2025

The Central Board of Direct Taxes (CBDT) is implementing significant changes to income tax forms and rules, effective April 2025, following the new Income Tax Act of 2025. The initiative focuses on simplifying tax filing through smart, pre-filled forms, drastically reducing the number of forms from 200 to under 100, and ensuring robust protection for digital data collected during tax procedures. While new ITR forms are slated for 2027, immediate efforts are on TDS, TCS, advance tax, and exemption forms. These reforms aim to enhance transparency, ease compliance, and create a smarter, safer tax environment for Indian taxpayers.

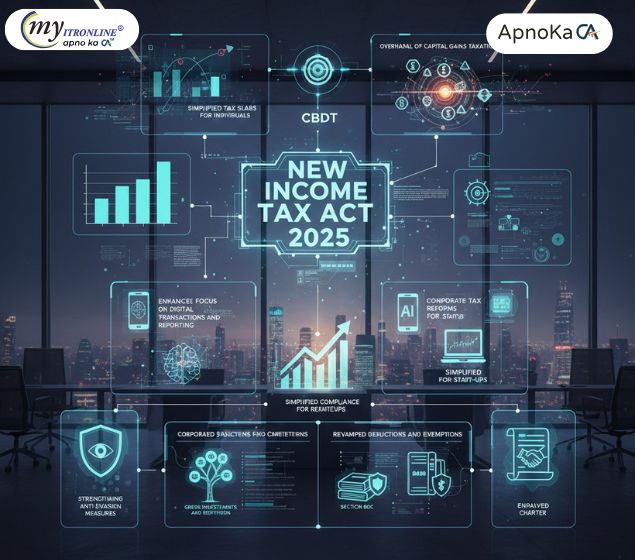

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

ITAT Cancels Tax Addition on Demonetization Cash Deposits

This blog post provides a detailed analysis of a significant Income Tax Appellate Tribunal (ITAT) ruling that cancelled a ₹10.46 lakh tax addition against a senior citizen. The case involves a large cash deposit made during the 2016 demonetization period, which the Assessing Officer had treated as unexplained money under Section 69A. The article explains the taxpayer's defense—that the cash was an accumulation of prior bank withdrawals—and breaks down the ITAT's reasoning, which centered on the "preponderance of probabilities" and the lack of contrary evidence from the revenue. The post highlights key takeaways for taxpayers, emphasizing the importance of plausible explanations and proper documentation.