# ret

12 posts in `ret` tag

GST Compliance Calendar November 2025

This blog provides a clear and simple calendar of all key GST return filing dates for November 2025. It helps GST-registered taxpayers stay compliant, avoid penalties, and plan their filings in advance.

ITR E-Verification Made Easy: Your 2025 Guide Using Demat or Bank Account

A complete 2025 guide on how to e-verify your Income Tax Return (ITR) quickly and securely using your pre-validated Bank Account or Demat Account on the e-Filing portal. Learn the prerequisites and the step-by-step Electronic Verification Code (EVC) generation process.

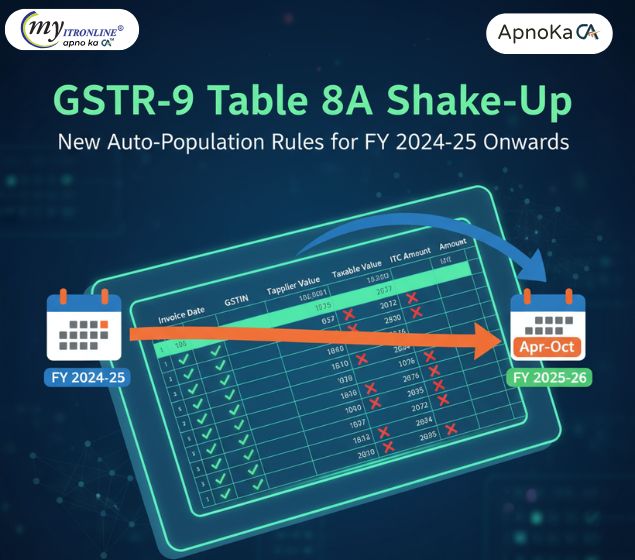

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

GSTR-9 and GSTR-9C Filing for FY 2024-25 is Now Open

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

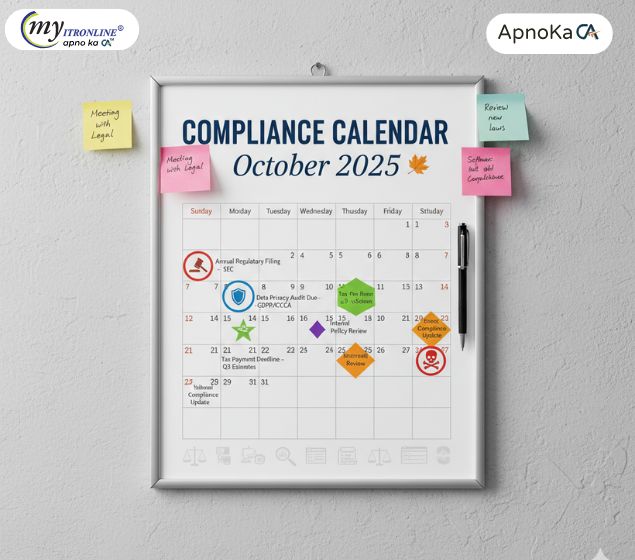

Compliance Calendar October 2025 – Key Tax and Regulatory Deadlines

October 2025 is packed with critical tax and regulatory deadlines. This blog highlights key dates for income tax, GST, MCA filings, EPF/ESI contributions, and audit-related submissions to help you stay compliant and avoid penalties.

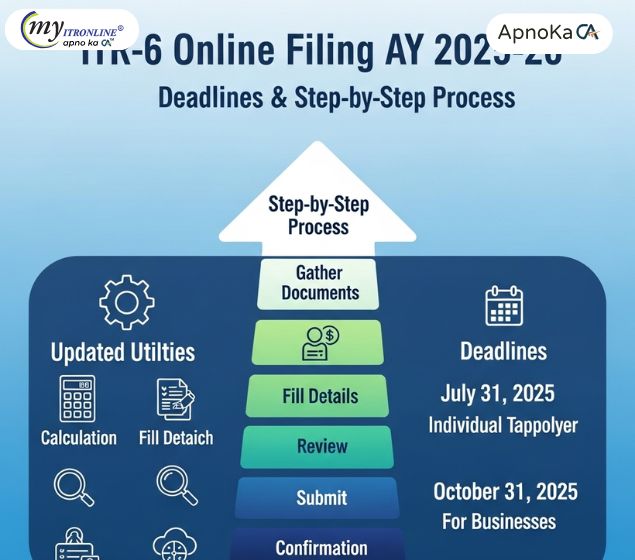

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

Section 154 of Income Tax Act: What You Can and Can’t Correct

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.

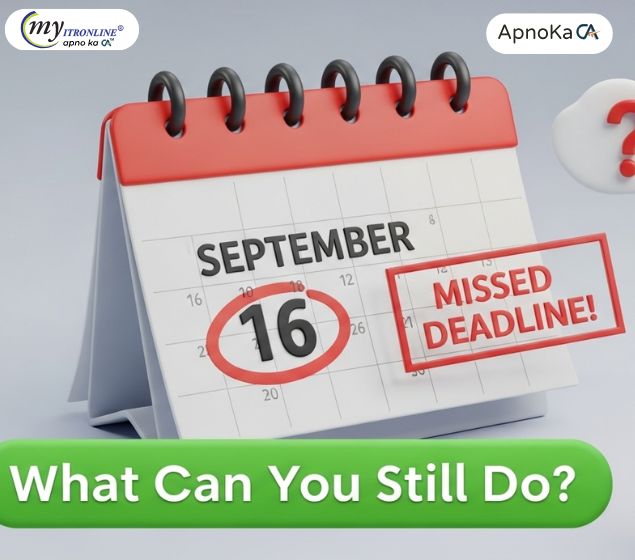

Didn’t File ITR by September 16? Here’s What You Can Still Do

This blog post provides a comprehensive guide for individuals who have missed the September 16, 2025, deadline for filing their Income Tax Return (ITR) for FY 2024-25. It reassures readers that filing is still possible through a "belated return" by December 31, 2025, but outlines the associated penalties, including late filing fees (₹1,000 or ₹5,000) and interest on unpaid tax. The article also details other consequences of late filing, such as the inability to carry forward certain losses, delayed refunds, and potential loss of specific deductions. It touches on rare exceptions and what happens if even the belated deadline is missed. Finally, it offers practical advice to act promptly, gather documents, compute accurately, and seek professional help, promoting MyITROnline as a solution for simplified tax filing.

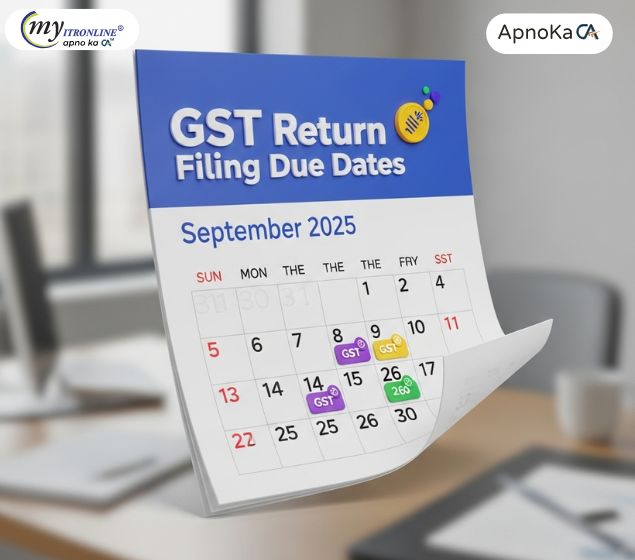

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

Complete Guide to ITR-7 Form (AY 2025-26): Utility, Schema & Validation

The Income Tax Department has released the ITR-7 Form for AY 2025-26, applicable to persons and institutions required to file returns under sections 139(4A), 139(4B), 139(4C), and 139(4D). This blog covers the newly released Excel-based utility, JSON schema, and validation guidelines to simplify your tax filing process.

.jpg)

Unlock Past Tax Corrections: Excel Utilities for Updated ITR-1 & ITR-2 (AY 2021-22 & 2022-23) Now Live!

The Income Tax Department has launched Excel utilities for filing Updated Returns (ITR-U) for Assessment Years 2021-22 and 2022-23, extending the filing window to 48 months as per the Finance Act, 2025. This blog details who can file ITR-U using ITR-1 and ITR-2, explains the new deadlines, outlines the penalty structure, and provides a step-by-step guide on using the Excel utilities to declare additional income and ensure tax compliance.