# relief

12 posts in `relief` tag

Supreme Court’s Big GST Decision Huge Relief for Taxpayers

The Supreme Court of India has ruled that once a taxpayer pays the 10% pre-deposit required to file a GST appeal, the government cannot freeze bank accounts or recover additional funds. This landmark decision protects honest taxpayers and ensures fair enforcement under GST law.

GST Appeals Made Easier: Lower Pre Deposit Rules Under Finance Act 2025

The Finance Act 2025 brings relief to businesses by reducing the pre-deposit requirement for penalty only GST appeals from 25% to 10%. Tax appeals remain unchanged at 10%. Businesses can now use Input Tax Credit (ITC) for deposits, improving cash flow and easing compliance. These changes will be effective after CBIC notification.

CBIC Announces 90% Quick Refund for Businesses A Major Relief

The CBIC has rolled out a provisional refund mechanism allowing eligible businesses to receive 90% of their GST refunds upfront from October 1, 2025. This move targets industries facing cash flow issues due to inverted duty structures and aims to accelerate business operations and growth.

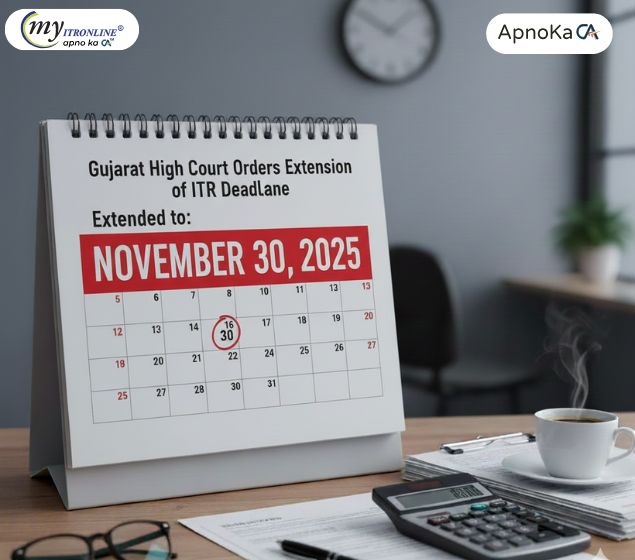

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

Income Tax Department’s Section 87A Relief: What Taxpayers Must Know About STCG Rebate Claims

The Income Tax Department has issued relief for taxpayers who claimed Section 87A rebate on short-term capital gains (STCG). If demands are paid by December 31, 2025, interest will be waived. Learn what went wrong, what’s been clarified, and what you should do next.

ICAI Eases Financial Reporting for Non-Corporate Entities & LLPs in FY 2024-25

The Institute of Chartered Accountants of India (ICAI) has announced a significant, temporary compliance relaxation for non-corporate entities and Limited Liability Partnerships (LLPs) for the Financial Year 2024-25. This allows these entities to optionally adopt updated guidance notes on financial statements, aiming to reduce administrative burden while maintaining transparency and accuracy. This flexibility ensures that core accounting standards remain paramount, offering businesses a choice in their reporting approach for the upcoming fiscal year.

Big News for Small Businesses: Say Goodbye to Annual GST Returns (GSTR-9) From FY 2024-25!

This blog post announces a significant and permanent change in GST compliance for small businesses in India. From Financial Year 2024-25, businesses with an annual aggregate turnover of up to 2 crore are exempt from filing the annual GST return (Form GSTR-9). The article details what changed, who benefits, and the tangible advantages like time and cost savings. It also highlights crucial reminders about continued monthly/quarterly filings, record-keeping, and turnover monitoring. The post emphasizes that this move will greatly enhance the "Ease of Doing Business" for millions of small enterprises.

Historic Diwali Gift for the Nation: Next-Gen GST Reform

This blog details the significant GST cuts introduced as a 'Diwali gift' for the nation. It highlights how these reforms aim to simplify the tax structure and ease financial burdens across various sectors including daily essentials, agriculture, healthcare, education, and certain electronic appliances and vehicles, ultimately fostering a self-reliant India. The article also touches upon process reforms and a positive message from the Prime Minister.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

CBDT Circular 9/2025: No More 20% TDS Trouble in Property Deals

This blog post explains CBDT Circular No. 9/2025, which clarifies that the higher 20% TDS rate under Section 206AB will not apply to property transactions covered by Section 194-IA. This brings significant relief to buyers and sellers by ensuring a consistent 1% TDS deduction on property sales over ₹50 Lakhs, simplifying compliance and streamlining real estate dealings.