# itrfiling

12 posts in `itrfiling` tag

Why Your Income Tax Refund Is Delayed and How to Check Status

Many taxpayers are still waiting for their refund. This guide explains how to check your income tax refund status, why refunds get delayed, and simple steps you can take to fix the issue and receive your money soon.

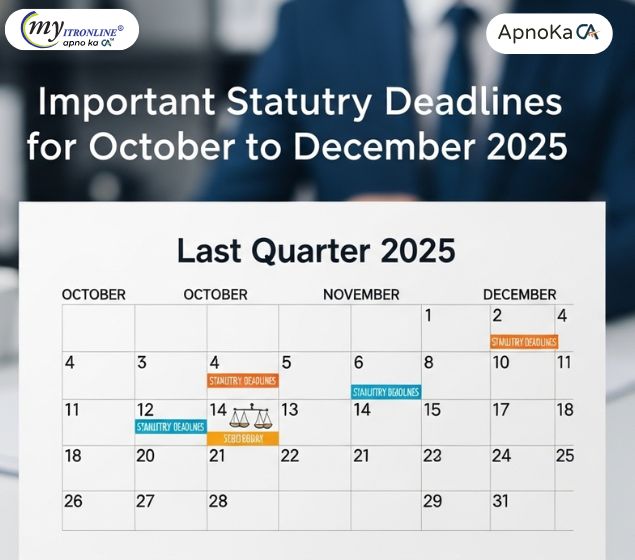

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

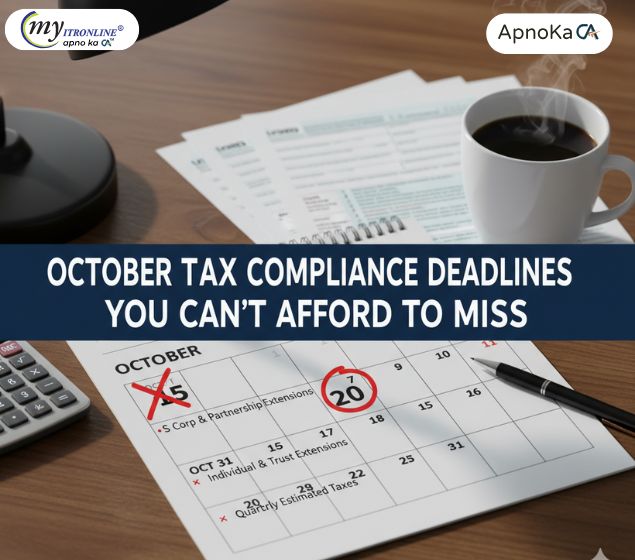

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

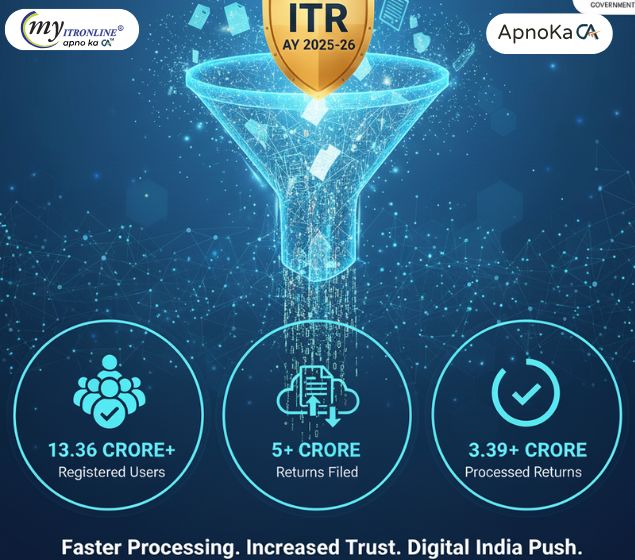

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

.jpg)

The 1,50,000 Mistake: Why Filing Under 44AD Instead of 44ADA Could Wreck Your Finances

This blog post addresses a common but serious error made by professionals and freelancers who incorrectly file their income tax returns under Section 44AD (for businesses) instead of the appropriate Section 44ADA (for professionals). It explains the fundamental differences between the two sections, how the Income Tax Department's AI systems detect this discrepancy through TDS mismatches and unusually low-profit declarations, and the severe consequences that follow, including mandatory audits and multiple financial penalties. The article concludes by offering a clear, step-by-step guide on what to do if you receive a notice for this mistake, emphasizing the importance of consulting a professional and taking prompt corrective action.

.jpg)

AY 2025-26 ITR Filings Cross 3.29 Crore; Over 1.13 Crore Already Processed

Despite the ITR filing deadline for AY 2025-26 being extended to September 15, over 3.29 crore returns have already been filed by mid-August, with 1.13 crore processed. This highlights growing tax compliance and the Income Tax Department's processing efficiency.

.jpg)

Lost Your Form 16? Don't Panic! Here's How to File Your ITR Successfully Without It.

This comprehensive guide addresses the common concern of a missing Form 16. It empowers salaried individuals to confidently file their Income Tax Return by detailing essential alternative documents (pay slips, Form 26AS, AIS) and providing a clear, step-by-step process for successful and compliant ITR filing, ensuring no one misses the deadline due to a lost document.

.jpg)

Understanding Agricultural Income Tax in India (FY 2024-25)

This blog post demystifies the tax treatment of agricultural income in India for the Financial Year 2024-25 onwards. It clearly defines what constitutes agricultural income and what does not. The post explains the crucial concept of "partial integration," a unique tax calculation method for individuals with both agricultural and non-agricultural income, illustrating it with a simple example. It also highlights essential compliance requirements like reporting agricultural income in ITR and maintaining records, alongside reasons for the historical tax exemption.

.jpg)

Important Update: Tax Audit Forms 3CA-3CD & 3CB-3CD Now Live with Latest Changes

This blog post announces the release of updated Tax Audit Forms 3CA-3CD and 3CB-3CD on the e-Filing portal. These updates are based on Notification No. 23/2025. It explains the purpose of these forms, identifies who must file them, and highlights the importance of knowing the new changes and meeting deadlines. The post stresses the need for proactive compliance to avoid penalties and positions myITROnline as a helpful partner for smooth tax audit and ITR filing.

.jpg)

URGENT: Don't Hide Foreign ESOPs! Face 10,00,000 Penalty if Undisclosed!

This blog post alerts Indian taxpayers about the important need to report foreign Employee Stock Option Plans (ESOPs) in their Income Tax Returns. It describes what foreign ESOPs are and explains why disclosing them is required under laws like the "Black Money Act." Failing to comply can lead to a large penalty of 10,00,000 and possible jail time. The post also offers straightforward instructions on how and where to report these assets in ITR-2 or ITR-3, urging taxpayers to act quickly and recommending myITROnline for expert help.

.jpg)

New Tax Regime for ITR-1 Filers: Everything You Need to Know for AY 2025-26

The New Tax Regime is now default for FY 2024-25. Our comprehensive guide helps salaried individuals and pensioners file ITR-1 (Sahaj) easily, covering eligibility, new deductions like the ₹75,000 standard deduction, and a step-by-step online process. File by September 15, 2025!

.jpg)

India's New Income Tax Regime (Section 115BAC): Your Comprehensive Guide for FY 2024-25 & 2025-26

This comprehensive guide breaks down India's New Income Tax Regime under Section 115BAC, now the default for individuals and HUFs. It details the revised income tax slab rates for Financial Years 2024-25 and 2025-26, highlighting the increased basic exemption limits and the enhanced rebate under Section 87A. The article clearly outlines the limited deductions and exemptions still allowed (e.g., standard deduction, employer's NPS contribution) versus the numerous ones no longer applicable. It concludes by helping taxpayers determine whether the new regime or the old regime is more beneficial for their specific financial situation and explains the process for switching between the two.