# itr6

4 posts in `itr6` tag

ITR-6 Excel Utility for AY 2025-26 is Live: What Corporate Filers Need to Know

This blog announces the release of the ITR-6 Excel Utility for the Assessment Year 2025-26 by the Income Tax Department. It details which companies are required to file this form, highlights key updates and changes for this year (such as LEI and capital gains reporting), provides a step-by-step guide on how to use the offline utility, and clarifies the important filing deadlines to help corporate filers ensure timely and accurate compliance.

.jpg)

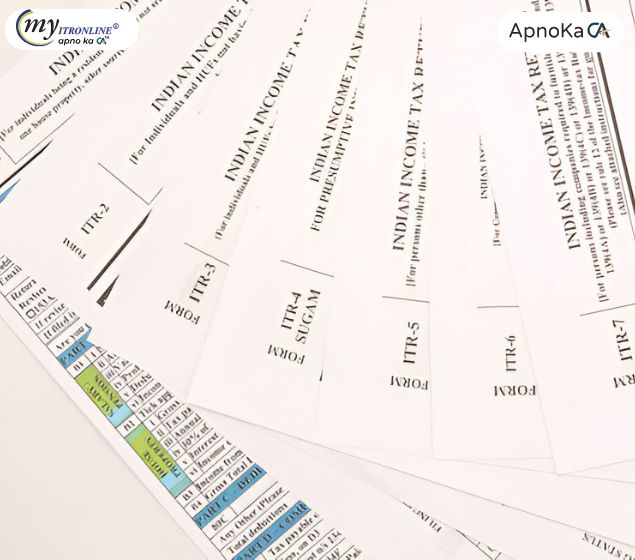

ITR Forms AY 2025-26: Your Easy Guide to Choosing the Right One

This guide makes it easier to choose the right Income Tax Return (ITR) form for Assessment Year (AY) 2025-26 (Financial Year 2024-25). It explains each ITR form (ITR-1 Sahaj, ITR-2, ITR-3, ITR-4 Sugam, ITR-5, ITR-6, ITR-7) by outlining who can use each one, who cannot, and the specific income sources or taxpayer categories they cover. The guide also notes important updates for AY 2025-26, including the inclusion of certain LTCG in ITR-1 and ITR-4, changes in VDA reporting, updated capital gains segregation, higher thresholds for asset and liability reporting, and required deduction disclosures. The purpose is to help individuals and entities choose the right form for accurate and compliant tax filing.

Understanding ITR Forms (ITR-1 to ITR-7) for AY 2025-26: Selecting the Appropriate Form for Your Earnings

This blog post serves as a comprehensive guide to selecting the correct Income Tax Return (ITR) form (ITR-1 to ITR-7) for Assessment Year 2025-26 (Financial Year 2024-25). It begins by emphasizing the importance of choosing the right form to avoid penalties and highlights the extended filing deadline for individuals and HUFs. The post then details important updates for AY 2025-26, including changes to LTCG reporting in ITR-1/4, compulsory detailed disclosures for old regime deductions, new TDS section requirements, revised asset reporting thresholds, and the default new tax regime. A simplified overview of applicability and exclusions for each ITR form (ITR-1 to ITR-7) is provided. Finally, it uses seven practical case studies to illustrate how different taxpayer profiles (salaried, freelancers, businesses, firms, companies, trusts) can correctly identify their applicable ITR form. The synopsis concludes by advising readers to consult official guidelines and tax professionals for accurate filing.

CBDT Notifies ITR Forms 1-7 for AY 2025-26 (FY 2024-25): What Taxpayers Need to Know

The CBDT has notified the ITR forms (1-7) for AY 2025-26, incorporating changes from the Finance Act, 2024. This blog provides a comprehensive overview of the key modifications in each form, focusing on changes in capital gains reporting, eligibility criteria, deduction disclosures, and other compliance requirements to help taxpayers prepare for the upcoming filing season.