# indiatax

12 posts in `indiatax` tag

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

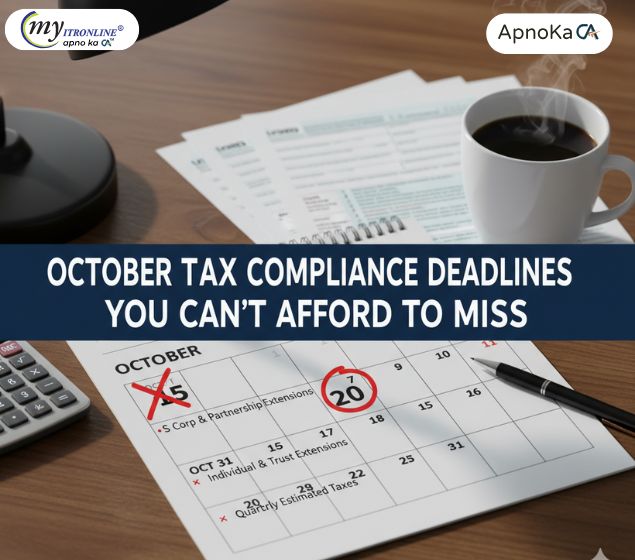

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

GST 2.0: A Game Changer for India? Simplified Taxes & Economic Boost

This blog post provides a comprehensive overview of India's GST 2.0, implemented on September 22, 2025. It details the key features, including the reduction of tax slabs to 5% and 18% (with a new 40% for luxury/sin goods), lower taxes on essential goods, durables, and automobiles, and increased prices for luxury items. The article identifies beneficiaries like everyday households, the middle class, farmers, healthcare consumers, and MSMEs. It also addresses potential challenges such as revenue shortfall, price pass-through issues, and transition headaches for businesses. Finally, it outlines expected economic ripples and crucial factors to monitor for the reform's success, concluding that GST 2.0 is a bold step towards simplifying life for millions. An appendix with sample MRP comparisons is also included.

Due Date for Filing ITRs AY 2025-26 Extended Again

The Income Tax Department has granted a crucial one-day extension for filing Income Tax Returns for Assessment Year 2025-26, pushing the final deadline to September 16, 2025. This extension aims to assist taxpayers who encountered issues with the e-filing portal. This is a final opportunity to avoid penalties, so file your ITR promptly with myITRonline.

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

Historic Diwali Gift for the Nation: Next-Gen GST Reform

This blog details the significant GST cuts introduced as a 'Diwali gift' for the nation. It highlights how these reforms aim to simplify the tax structure and ease financial burdens across various sectors including daily essentials, agriculture, healthcare, education, and certain electronic appliances and vehicles, ultimately fostering a self-reliant India. The article also touches upon process reforms and a positive message from the Prime Minister.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

Taxpayers Alert: Major Updates in GST Refund Rules

The Goods and Services Tax Network (GSTN) has significantly revamped its refund system, introducing a unified application form (RFD-01), enhanced document uploads, real-time tracking, and integration with PFMS for faster disbursements. This blog details these crucial updates, explaining how they streamline the refund process for taxpayers, promote transparency, and minimize delays, ensuring timely receipt of their legitimate refunds.

.jpg)

Goodbye 1961, Hello 2025: India's New Income Tax Act Explained in Simple Terms

This blog post details India's landmark decision to replace the sixty-year-old Income-tax Act, 1961, with the new, simplified Income-tax Act, 2025, which will be effective from April 1, 2026. It breaks down the key changes in simple terms, explaining the reduction in legal complexity, the introduction of a unified "Tax Year," clearer definitions for digital assets, and the move towards faceless, technology-driven tax processes. The post highlights how these changes aim to create a more transparent, efficient, and taxpayer-friendly direct tax system for individuals and businesses across the country.

.jpg)

Income Tax Depreciation Rates for FY 2025-26 (AY 2026-27): The Complete Guide

A comprehensive guide for businesses on the depreciation rates and rules applicable for the Financial Year 2025-26 under the Indian Income Tax Act. The blog details the core principles, including the 'Block of Assets' concept and the WDV method. It provides a clear breakdown of depreciation rates for various asset classes like buildings, machinery, and intangible assets. Furthermore, it covers crucial special provisions such as additional depreciation for manufacturing units, rules for the sale of assets, and recent updates like the non-depreciable status of goodwill, empowering businesses with the knowledge for effective tax planning and compliance.