# gstr9

12 posts in `gstr9` tag

GST Annual Return Simplified: Key ITC Changes in GSTR-9 & GSTR-9C for FY 2024-25

A simplified guide to ITC changes in GSTR-9 and GSTR-9C for FY 2024-25, covering late claims, reversals, reclaims, and reconciliation requirements.

Key GSTR-9 Changes for FY 2024-25: Your Essential Compliance Guide

The GST landscape for FY 2024-25 sees major updates to GSTR-9 and GSTR-9C. This guide breaks down the structural changes, like the new Table 6A1 for prior-year ITC, revised deadlines, and enhanced reconciliation requirements, ensuring taxpayers stay compliant and avoid late fees.

Key Changes in GSTR-9 and GSTR-9C for FY 2024-25: Everything You Should Know

The GST portal has opened GSTR-9 and GSTR-9C for FY 2024-25 with a filing deadline of December 31, 2025. This guide explains the key changes in both forms, filing thresholds, auto-population details, and practical tips to file on time and avoid penalties—written in clear, simple language.

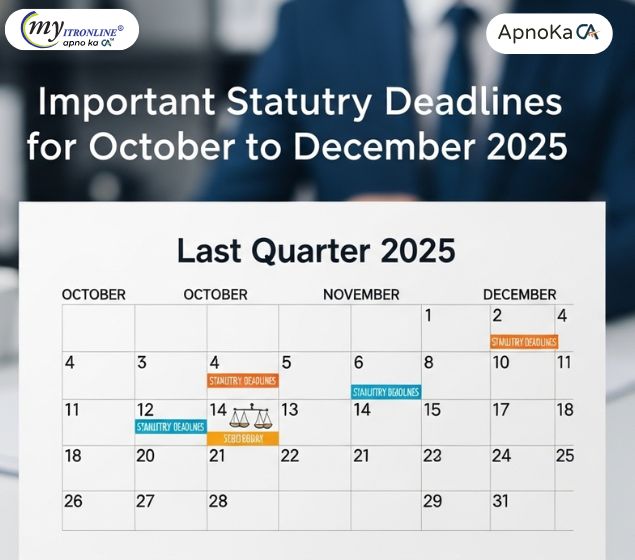

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

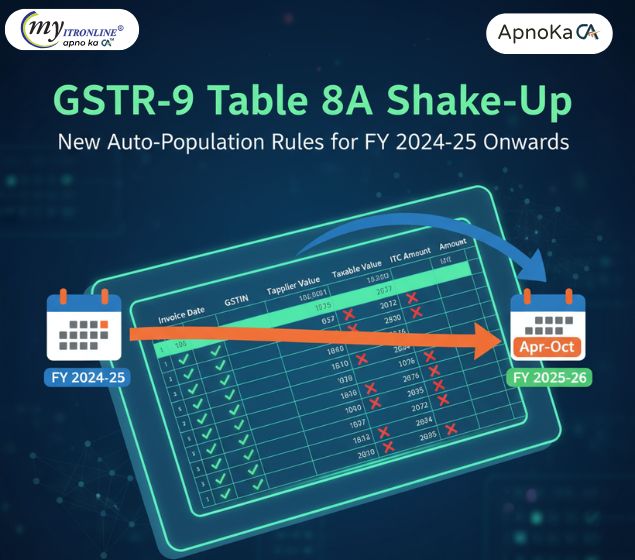

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

GSTR-9 and GSTR-9C Filing for FY 2024-25 is Now Open

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

Big News for Small Businesses: Say Goodbye to Annual GST Returns (GSTR-9) From FY 2024-25!

This blog post announces a significant and permanent change in GST compliance for small businesses in India. From Financial Year 2024-25, businesses with an annual aggregate turnover of up to 2 crore are exempt from filing the annual GST return (Form GSTR-9). The article details what changed, who benefits, and the tangible advantages like time and cost savings. It also highlights crucial reminders about continued monthly/quarterly filings, record-keeping, and turnover monitoring. The post emphasizes that this move will greatly enhance the "Ease of Doing Business" for millions of small enterprises.

.jpg)

Scheme for Waiving Late Fees on GSTR-9 and GSTR-9C: File by March 31, 2025

For GSTR-9 and GSTR-9C filings, the GST administration has implemented a late fee relief program. To avoid penalties, submit your unfiled taxes by March 31, 2025. The waiver terms, the revised late charge schedule, and how to file your returns are all explained in this blog.

.jpg)

GST Compliance Checklist: 9 Key Tasks to Finish Before March 31, 2025

This blog lists the nine essential GST compliances that companies need to finish by March 31, 2025, in order to stay out of trouble and maintain seamless operations. Learn how to stay in compliance and keep correct financial records, from LUT reporting and GSTR-9 filing to e-invoicing and ITC reversal.

.jpg)

Big Relief for Taxpayers: CBIC Waives Late Fees for GSTR-9C Filing

Late costs for GSTR-9C files that were postponed from FY 2017–18 to FY 2022–23 have been forgiven by the Central Board of Indirect Taxes and Customs (CBIC). The 55th meeting of the GST Council accepted this plan, which permits taxpayers to file outstanding taxes by March 31, 2025, without incurring penalties. Businesses gain from the waiver because it promotes compliance, lessens financial strains, and streamlines the GST system. Discover its significance, qualifying requirements, and detailed application procedure in this extensive blog.

.jpg)

How to Resolve Table 8A and 8C Discrepancies in GSTR-9: GSTN’s Guidelines

A critical advisory resolving inconsistencies in Tables 8A and 8C of GSTR-9 for FY 2023–2024 was released by the Goods and Services Tax Network (GSTN). By requiring manual reporting for Table 8C and auto-populating Table 8A with GSTR-2B, this modification guarantees increased accuracy in Input Tax Credit (ITC) reporting. Learn how to efficiently comply, minimize errors, and reconcile data.

CBIC Announces GSTR-9 Relief for FY 2023-24

The Central Board of Indirect Taxes and Customs (CBIC) has announced a major benefit for small businesses in India. They are exempt from filing the annual GST return (GSTR-9) for the financial year 2023-24, if their turnover is up to Rs. 2 crore. This blog explores the implications of this exemption, its advantages for small businesses, and who still needs to file GSTR-9.