# gstr7

8 posts in `gstr7` tag

GST Changes from October 2025: What You Need to Know

Starting October 2025, the GST system will undergo major changes affecting how businesses file returns and claim input tax credit. Key updates include manual ITC acceptance, locked GSTR-3B liabilities, new credit note rules, and invoice-level TDS reporting. Businesses must adapt to stay compliant and avoid filing issues.

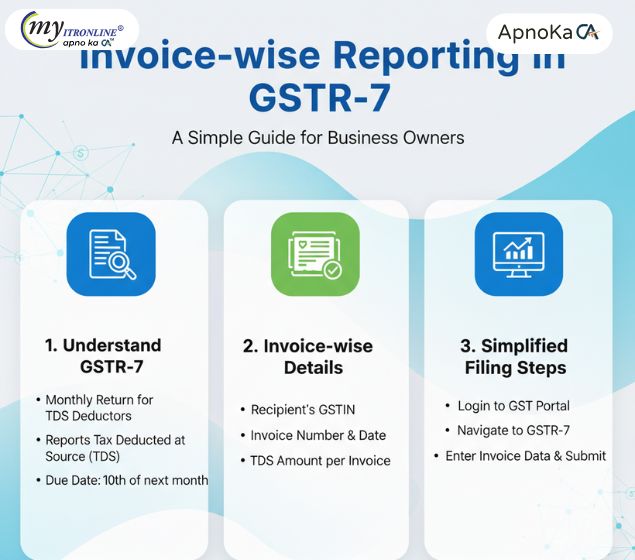

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

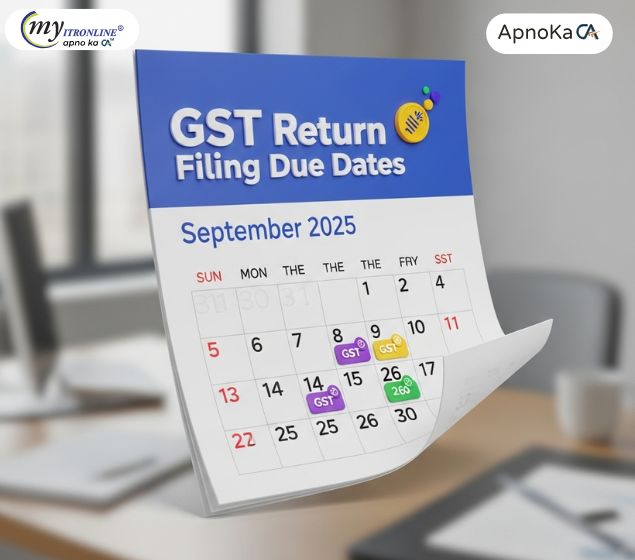

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

Easier Reporting: GSTR-7 and GSTR-8 Forms Get Updated!

This blog explains the significant updates to GSTR-7 (TDS) and GSTR-8 (TCS) forms, effective February 11, 2025, aimed at enhancing transaction data detail. It covers the 'why' behind these changes, the expected new reporting requirements (with a crucial note on the GSTR-7 invoice-wise reporting deferment), who is affected, and actionable steps for businesses to prepare for smoother GST compliance and reconciliation.

Invoice-wise Reporting Feature in Form GSTR-7: An In-Depth Analysis

This blog post provides a detailed analysis of the newly introduced invoice-wise reporting feature in Form GSTR-7 under GST. It explains the changes, benefits for both deductors and deductees, the current implementation status, and how businesses can prepare for this significant update in TDS reporting.

.jpg)

TDS Compliance Under GST: Insights into Section 51

Under Section 51 of the GST Act, specified entities must deduct TDS at 2% for payments exceeding ₹2.5 lakh. Exemptions include unregistered suppliers, exempt goods, and small contracts. Deductors must adhere to filing deadlines and compliance norms, while suppliers can claim TDS as ITC, fostering transparency and tax compliance.

.jpg)

The relief for taxpayers is the elimination of late fees for 'Nil' GSTR-7 filings

For 'Nil' GSTR-7 filings, the Goods and Services Tax Network (GSTN) has eliminated late costs, which is a comfort to taxpayers. Businesses and individuals that do not have TDS deductions during a tax period will find compliance easier as a result of this change. Find out about 'Nil' files, GSTR-7 filings, and the advantages of this waiver for taxpayers.

.png)

Mandatory Sequential GSTR-7 Filing: Implications of Notification No. 17/2024

The sequential submission of GSTR-7 returns is required by Notification No. 17/2024 in order to guarantee precise tax reconciliation and enhanced compliance. The significance of the sequential filing regulation, significant modifications made, sanctions for non-compliance, and advice for companies on how to adjust smoothly are all covered in this blog.