# gstr3b

12 posts in `gstr3b` tag

New GST Rule December 2025: No Bank Details = No GSTR-3B Filing

Starting December 2025, GST registrations will face automatic suspension if bank account details are not updated within 30 days or before filing GSTR-1/IFF. This new compliance rule directly impacts filing, billing, and business continuity, making timely updates essential for businesses.

GST Annual Return Simplified: Key ITC Changes in GSTR-9 & GSTR-9C for FY 2024-25

A simplified guide to ITC changes in GSTR-9 and GSTR-9C for FY 2024-25, covering late claims, reversals, reclaims, and reconciliation requirements.

December 2025 tax due dates: simple tracker for businesses and individuals

December is a crucial month for Indian taxpayers. This tracker lists the key dates for Income Tax (ITR, Advance Tax, TDS), GST (GSTR-1, IFF, GSTR-3B), and MCA filings, plus PF/ESI and TDS statements. Mark these deadlines to avoid late fees, interest, and ITC issues.

10 GST Moves That Can Trigger an Audit, Scrutiny, or Notice

The GST system uses AI and data analytics to flag discrepancies. This guide details the 10 most common GST mistakes such as excess ITC and GSTR mismatches that instantly catch the department’s eye and lead to notices or audits.

Suo Moto Cancellation of GST Registration: Reasons, Process & How to Revoke It

This blog explains what Suo Moto cancellation of GST registration means, why it happens, and how businesses can respond and apply for revocation. It includes the reasons, forms, timelines, and tips to stay compliant.

GST Compliance Calendar November 2025

This blog provides a clear and simple calendar of all key GST return filing dates for November 2025. It helps GST-registered taxpayers stay compliant, avoid penalties, and plan their filings in advance.

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

GSTN Clarifies: No Change in ITC Auto-Population from GSTR-2B to GSTR-3B

GSTN has issued a clarification confirming that the auto-population of Input Tax Credit (ITC) from GSTR-2B to GSTR-3B remains unchanged, even after the implementation of the Invoice Management System (IMS). GSTR-2B will continue to be generated automatically on the 14th of every month. This update helps clear confusion and reassures taxpayers that their filing process remains stable.

GST Changes from October 2025: What You Need to Know

Starting October 2025, the GST system will undergo major changes affecting how businesses file returns and claim input tax credit. Key updates include manual ITC acceptance, locked GSTR-3B liabilities, new credit note rules, and invoice-level TDS reporting. Businesses must adapt to stay compliant and avoid filing issues.

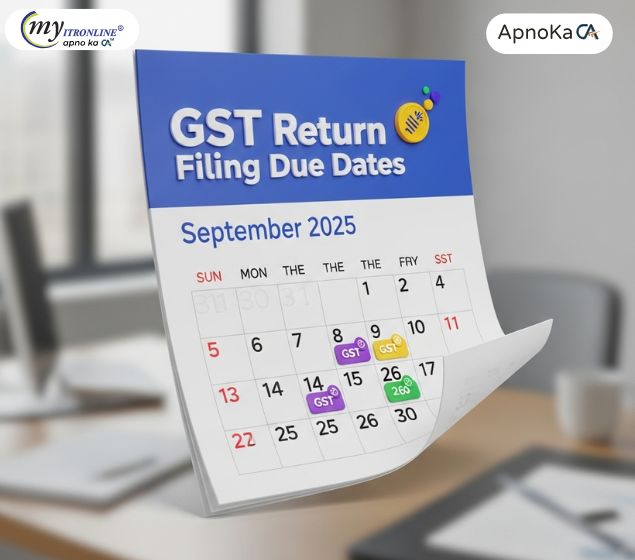

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

.jpg)

Don't Miss These! India's Statutory Compliance Calendar for August 2025

This blog provides a comprehensive guide to the statutory compliance deadlines for August 2025 in India. It covers key due dates for Goods and Services Tax (GST) returns like GSTR-1 and GSTR-3B, Income Tax requirements including TDS/TCS deposits and return filings, and other important statutory payments like PF & ESI. The post is designed to help businesses and individuals track their obligations, avoid penalties, and maintain financial discipline by presenting all critical dates in a clear, easy-to-understand format.

.jpg)

GSTR-3B Table 3.2: Your Essential Guide to the New Auto-Fill Rules

This blog post breaks down the recent GST Portal advisory about Table 3.2 of GSTR-3B. It explains that starting July 2025, details of inter-state supplies to unregistered persons, composition taxpayers, and UIN holders will be auto-filled and non-editable in GSTR-3B. This information will come directly from GSTR-1 or IFF. The advisory aims to cut down on mistakes and keep data consistent. The post also covers why this change is occurring, how to fix errors by amending GSTR-1/IFF or using GSTR-1A, and offers an action plan for taxpayers to ensure they report accurately and smoothly file their GST.