# gstr1

12 posts in `gstr1` tag

December 2025 tax due dates: simple tracker for businesses and individuals

December is a crucial month for Indian taxpayers. This tracker lists the key dates for Income Tax (ITR, Advance Tax, TDS), GST (GSTR-1, IFF, GSTR-3B), and MCA filings, plus PF/ESI and TDS statements. Mark these deadlines to avoid late fees, interest, and ITC issues.

Urgent GSTN Alert: Your GST Number Faces Suspension if Bank Details Are Not Submitted

GSTN has issued a strict alert for registered taxpayers: furnish your bank account details on the GST portal within 30 days of registration, or before filing GSTR-1/IFF, whichever is earlier. Non-compliance can lead to suspension via FORM REG-31, blocked GSTR-1 filing, e-way bill generation restrictions, and possible cancellation of registration. To stay compliant, log in to the GST portal, upload your bank details, and ensure verification to keep your GST number active and avoid operational disruptions.

GST Compliance Calendar November 2025

This blog provides a clear and simple calendar of all key GST return filing dates for November 2025. It helps GST-registered taxpayers stay compliant, avoid penalties, and plan their filings in advance.

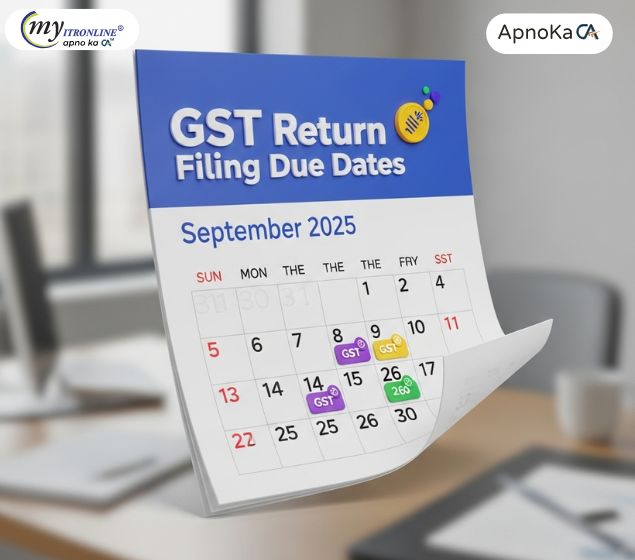

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

.jpg)

Don't Miss These! India's Statutory Compliance Calendar for August 2025

This blog provides a comprehensive guide to the statutory compliance deadlines for August 2025 in India. It covers key due dates for Goods and Services Tax (GST) returns like GSTR-1 and GSTR-3B, Income Tax requirements including TDS/TCS deposits and return filings, and other important statutory payments like PF & ESI. The post is designed to help businesses and individuals track their obligations, avoid penalties, and maintain financial discipline by presenting all critical dates in a clear, easy-to-understand format.

Exciting Update for Your GST Filings: GSTR-3B Will Have a

This blog post explains the upcoming major change in GST filing: the GSTR-3B's auto-populated tax liability will become non-editable from July 2025. It clarifies why this is happening, introduces GSTR-1A as the crucial form for corrections, and outlines the essential steps taxpayers must take to ensure timely and accurate compliance, including a note on the new 3-year return filing deadline.

GSTR-1/1A Table 12: Brace for Impact – Key Updates & Compliance Steps

The GSTN has rolled out crucial Phase-III changes to GSTR-1/1A Table 12, effective from April/May 2025. Key updates include the bifurcation of Table 12 into separate B2B and B2C sections, mandatory HSN/SAC code selection via dropdowns, and the introduction of value validations (initially in warning mode). This summary details these modifications, their impact on taxpayers based on AATO, and essential preparation steps to ensure smooth compliance.

New GSTN Rule: Consolidated B2C HSN Summary Required in GSTR-1

The recent Infosys GSTN update has made it mandatory to include a consolidated HSN (Harmonized System of Nomenclature) summary for all B2C (Business-to-Consumer) transactions in GSTR-1 filing. Earlier applicable mainly to B2B and high-value B2CS invoices, this significant change now requires businesses to classify and report even small B2C sales by HSN code. The update aims to improve transparency, data accuracy, and tax compliance. This blog details the key implications for businesses, steps for reporting the B2C HSN summary in Table 12 of GSTR-1, HSN digit requirements, and best practices to ensure seamless compliance under the new GST regime.

.jpg)

Everything You Need to Know About GSTR-1 & IFF for High-Value B2C Sales

This detailed guide covers the reporting obligations for GSTR-1 and IFF regarding B2C interstate transactions that surpass 1,00,000. Discover the essentials of compliance, necessary documentation, and optimal practices for precise GST filing.

.jpg)

Mark Your Calendars: Important February 2025 GST Filing Deadlines

Make sure that the crucial GST filing dates in February 2025 are met. This guide helps companies avoid fines and handle Input Tax Credit (ITC) claims by highlighting deadlines for a variety of forms, such as GSTR-3B, GSTR-1, CMP-08, GSTR-5, and more.

Never Miss a Deadline: March 2025 GST and Income Tax Compliance Dates

This blog offers a thorough rundown of the TDS, advance tax, and GST reporting dates as well as the March 2025 income tax and GST compliance deadlines. This thorough guide will help you stay in compliance and stay out of trouble.

.jpg)

GSTR-1 Updates: Mandatory HSN Code Reporting Explained for Taxpayers

With effect from February 2025, the GSTN has implemented Phase-3 modifications for HSN code reporting in GSTR-1 and GSTR-1A. These modifications are intended to improve compliance, guarantee standardization, and increase data accuracy. Businesses may face initial difficulties, but there are substantial long-term advantages. To guarantee a seamless transfer, get ready today.