# gstportal

12 posts in `gstportal` tag

Quick GST Registration in 3 Days for Small Businesses

The GST portal has launched a faster registration process for low-risk taxpayers. With Aadhaar authentication and proper document upload, eligible applicants can now get GST registration within 3 working days.

GSTR-9 and GSTR-9C Filing for FY 2024-25 is Now Open

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

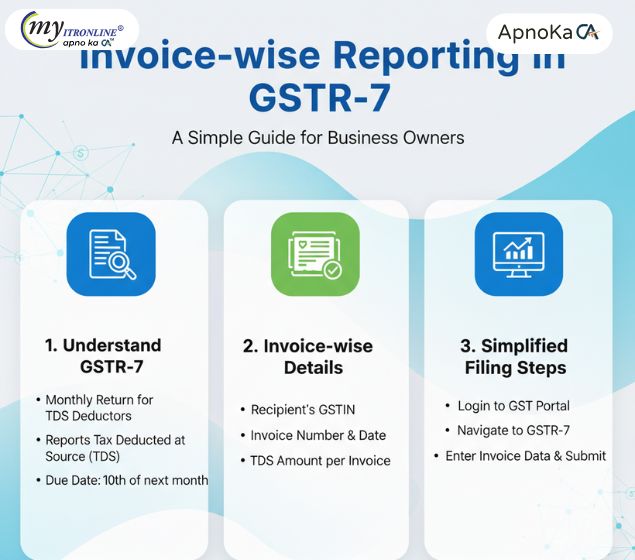

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Major IMS Enhancements on GST Portal: What Businesses Need to Know

Starting October 2025, the GSTN has rolled out major updates to the Invoice Management System (IMS) that simplify compliance, improve transparency, and give taxpayers more control over invoice handling. This blog breaks down the key changes and what they mean for businesses.

GST Compliance Update: CBIC Removes DIN Requirement for Portal-Based Notices

CBIC has released Circular No. 249/06/2025-GST, removing the mandatory use of DIN for communications issued via the GST portal. However, DIN remains compulsory for eOffice-based documents, as clarified in Circulars No. 23/2025 - Customs and 252/09/2025 - GST. This blog explains the changes and what taxpayers need to know.

.jpg)

GST Portal Update: Appeal Against Waiver Order (SPL-07) Rejection Now Live!

The GST Portal has introduced a crucial update enabling taxpayers to file appeals (Form APL-01) against rejection orders (SPL-07) issued under the GST Amnesty Scheme. This provides a vital recourse for businesses whose applications for penalty and interest waivers were denied. This detailed guide covers the context of the amnesty scheme, the significance of this new online appeal functionality, critical points to consider before filing (like the 'no withdrawal' policy and pre-deposit requirements), and a comprehensive step-by-step process for filing the appeal on the GST Portal.

Invoice-wise Reporting Feature in Form GSTR-7: An In-Depth Analysis

This blog post provides a detailed analysis of the newly introduced invoice-wise reporting feature in Form GSTR-7 under GST. It explains the changes, benefits for both deductors and deductees, the current implementation status, and how businesses can prepare for this significant update in TDS reporting.

.jpg)

Navigating the GST Waiver Program: An All-Inclusive Guide to SPL 01, SPL 02, DRC-03, and Frequently Encountered Problems

This blog offers a comprehensive overview of the GST Waiver Scheme, highlighting key forms such as SPL 01 and SPL 02, along with alternative payment options like DRC-03 and DRC-03A. It also discusses frequent technical challenges encountered on the GST portal and outlines significant deadlines for tax payments and waiver applications.

.jpg)

A Complete Guide to GST Registration in India for 2024–2025

With an emphasis on Rule 8 of the CGST Rules, 2017 and the significance of Aadhaar identification, this blog offers a comprehensive reference to GST registration in India for 2024–2025. It goes over important commercial factors, the registration procedure, and the most recent upgrades.

.png)

2024: Managing GST Refund Requests: A Comprehensive Guide for Companies

This article offers a thorough overview of managing GST refund requests in 2024, including information on the revised procedures, qualifying standards, required paperwork, and filing guidelines. It also discusses typical errors and difficulties that companies go into while submitting GST refund claims. Keep yourself updated on significant developments to guarantee effective cash flow and tax law compliance.

GSTR-1A: New GST Form Details

The Goods and Services Tax Network (GSTN) has introduced a new form, GSTR-1A, to simplify the GST filing process. This comprehensive guide provides expert advice on how to navigate the new form, make corrections, and ensure seamless reconciliation. Learn how to file GSTR-1A accurately, avoid common mistakes, and stay compliant with GST regulations.

New GST Forms for Pan Masala and Tobacco: SRM-I and SRM-II Explained

This blog post provides an in-depth analysis of the new GST forms, SRM-I and SRM-II, introduced for pan masala and tobacco manufacturers. The article covers the registration and return filing procedures, implications for the industry, and the significance of these forms in enhancing regulatory oversight and compliance. By understanding these new forms, manufacturers can ensure tax compliance and avoid potential penalties for non-compliance, ultimately contributing to a more transparent and responsible sector.