# forms

12 posts in `forms` tag

New ITR Forms for AY 2026–27 Announced: Key Updates Taxpayers Should Know

The Government will soon release simplified ITR forms for AY 2026–27, aligned with the new Income-tax Act, 2025. These updated forms aim to make filing easier, reduce compliance burden, and reflect changes expected in Budget 2026. Here’s a quick, clear overview for taxpayers.

Finally! The 2025 Capital Gains Relief Scheme is Making Life Easier

The 2025 Amendment Scheme has modernised the Capital Gains Account Scheme (CGAS) by making it digital-first and easier to use. Taxpayers can now deposit capital gains online through Net Banking, UPI, RTGS, or NEFT, with the deposit date clearly defined. Electronic statements replace passbooks, more banks are authorised to manage CGAS accounts, and simpler ITR forms are on the way. With broader exemptions like Section 54GA included, the scheme reduces stress and makes compliance smoother for property sellers, NRIs, and businesses.

New Income Tax Return Forms and Rules: What You Need to Know

The government is set to introduce simplified income tax return forms under the Income Tax Act, 2025 by January 2026, replacing the long-standing Income Tax Act, 1961. These new forms aim to make tax filing easier, reduce compliance burdens, and improve transparency. Refunds are being processed, with larger claims expected by December 2025. The CBDT is confident of meeting its ambitious ₹25.20 lakh crore direct tax collection target for FY26, supported by strong growth. Taxpayers should prepare for the new system, which takes effect from April 1, 2026.

Great News for Entrepreneurs! Get Your GST Number in Just 3 Days

GST 2.0 is a game-changer for small businesses in India. Starting November 1, 2025, new applicants can opt for a simplified GST registration process with automatic approval in just 3 working days. Designed for low-risk businesses, this reform reduces hassle and speeds up business launch.

GST Rate Changes: Your Essential Guide to Stock ITC Recovery & Reversal

This blog post provides a comprehensive guide to the upcoming GST rate changes in India, effective 22 September 2025, focusing specifically on the implications for Input Tax Credit (ITC) on stock. It explains the new simplified tax slab structure (5%, 18%, 40% for luxury goods) and details how businesses should handle ITC for stock purchased before the changes, supplies made after the changes, and unsold old inventory. The post offers practical advice on identifying stock, claiming eligible ITC, reversing ITC where necessary, seeking manufacturer support, and maintaining audit-ready records to navigate this significant tax transition effectively.

Breaking: No Relief in GST, A Big Blow to the Indian Media Industry

This blog post analyzes the impact of the latest GST reforms on the Indian media industry. It highlights how, despite appeals from media and advertising groups, the sector received no significant relief regarding tax parity for digital publications, input tax credit access, or flexible tax payment timing. The article details the approved reforms that benefited other sectors and consumers, contrasting them with the ignored pleas of the media, leading to concerns about worsening the digital divide, liquidity pressure, and hindered cost recovery. It concludes that the lack of targeted reforms poses a major setback for innovation, job creation, and overall growth in the Indian media landscape.

CBDT's Game-Changer: Relaxing Black Money Rules for Taxpayer Relief

This blog details the recent changes by the CBDT in relaxing certain "black money" rules, aiming to provide significant relief to Indian taxpayers. It explains the rationale behind these changes, focusing on the rationalization of penalties, re-evaluation of "undisclosed" status, new opportunities for compliance, and a reduction in harassment and litigation. The article highlights who benefits from these relaxations, positions them within a broader shift towards trust-based taxation, and advises taxpayers on necessary steps to take.

States Push for Tough Steps to Stop Profiteering from GST Cuts

The GST Council is set to meet on September 3-4 to review GST 2.0 reforms. States want strict rules to prevent profiteering so that GST rate cuts actually benefit consumers. Key proposals include a temporary anti-profiteering law, consumer complaint platforms, and tighter monitoring of sensitive sectors. Businesses, however, warn about compliance costs and pricing disruptions.

CBDT Overhauls Income Tax: Simpler Forms & Stronger Data Protection by 2025

The Central Board of Direct Taxes (CBDT) is implementing significant changes to income tax forms and rules, effective April 2025, following the new Income Tax Act of 2025. The initiative focuses on simplifying tax filing through smart, pre-filled forms, drastically reducing the number of forms from 200 to under 100, and ensuring robust protection for digital data collected during tax procedures. While new ITR forms are slated for 2027, immediate efforts are on TDS, TCS, advance tax, and exemption forms. These reforms aim to enhance transparency, ease compliance, and create a smarter, safer tax environment for Indian taxpayers.

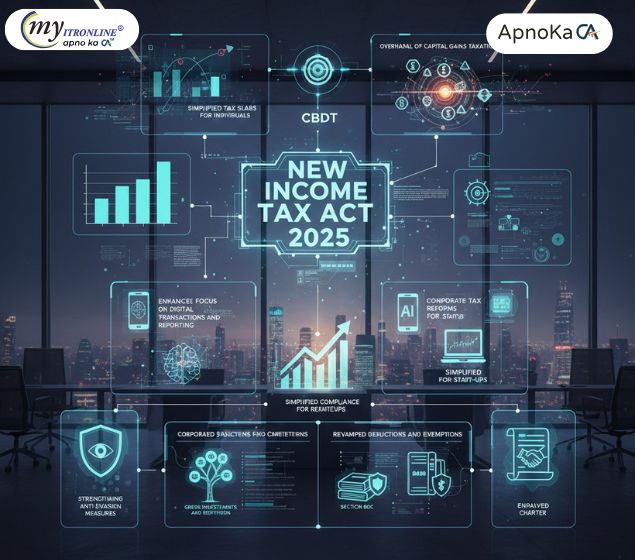

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

Income Tax in India: Are You Prepared for July 2025?

This blog post provides a comprehensive overview of the significant income tax changes coming into effect in India from July 1, 2025. It details the more attractive new tax regime with revised slabs and increased deductions, the extended ITR filing deadline, the mandate for Aadhaar in PAN applications, and the real-time PAN-bank linking system. Furthermore, it touches upon the updated ITR forms and the broader proposals of the Income Tax Bill 2025, offering taxpayers crucial insights for compliance and effective tax planning.

Easier Reporting: GSTR-7 and GSTR-8 Forms Get Updated!

This blog explains the significant updates to GSTR-7 (TDS) and GSTR-8 (TCS) forms, effective February 11, 2025, aimed at enhancing transaction data detail. It covers the 'why' behind these changes, the expected new reporting requirements (with a crucial note on the GSTR-7 invoice-wise reporting deferment), who is affected, and actionable steps for businesses to prepare for smoother GST compliance and reconciliation.