# form26as

12 posts in `form26as` tag

Why Your Tax Refund Is Delayed and What CBDT Wants You to Know

Many taxpayers are waiting for refunds, especially where the refund is large. The Central Board of Direct Taxes (CBDT) is closely checking high-value and flagged returns to stop fake claims and tax cheating. This guide explains the main reasons for delays, which cases get compulsory scrutiny, and simple steps you can take now to clear your refund faster.

Did Your Large Cash Deposit Trigger an Income Tax Notice? Don't Panic!

Large cash deposits in bank accounts often trigger Income Tax notices in India. Banks are required to report high‑value transactions, and the ITD may ask for clarification if deposits exceed thresholds. With proper documentation like invoices, sale deeds, or gift deeds you can explain the source of funds and avoid heavy taxes or penalties. Notices are not accusations but part of routine scrutiny.

Intimation U/S 143(1): Your ITR is Processed Here's How to Respond

The Intimation under Section 143(1) is a routine message from the Income Tax Department after processing your ITR. It may confirm your return, show a refund, or raise a tax demand. This blog explains how to read the notice, respond correctly, and avoid penalties.

Tax Alert: TRACES Portal Sets 2-Year Limit for TDS/TCS Corrections

The Income Tax Department has shortened the correction window for TDS/TCS statements to just 2 years via the TRACES portal. This change affects deductors, collectors, and taxpayers alike. Corrections for older financial years (FY 2018-19 to FY 2023-24) must be filed by March 31, 2026. After that, no changes will be accepted. Learn what this means for you and how to act now.

Tax Refunds Can’t Be Denied for Form 26AS Mismatch: High Court Ruling

The Allahabad High Court has ruled that tax refunds cannot be denied just because TDS is missing from Form 26AS. If a taxpayer provides valid Form 16A certificates, the Income Tax Department must verify the claim with the deductor instead of rejecting it outright. This protects honest taxpayers from delays caused by clerical errors.

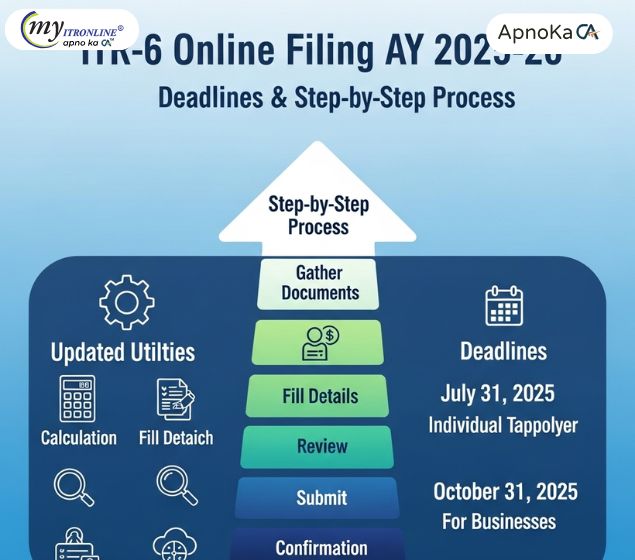

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

Section 154 of Income Tax Act: What You Can and Can’t Correct

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.

Income Tax Alert: New Deadline for Correcting Mistakes in TDS/TCS

The Income Tax Department has given a final chance to correct mistakes in TDS/TCS returns for FY 2018–19 to FY 2023–24. The correction deadline is March 31, 2026. After this, only 2 years will be allowed for revisions, and unresolved errors may lead to tax notices.

.jpg)

Lost Your Form 16? Don't Panic! Here's How to File Your ITR Successfully Without It.

This comprehensive guide addresses the common concern of a missing Form 16. It empowers salaried individuals to confidently file their Income Tax Return by detailing essential alternative documents (pay slips, Form 26AS, AIS) and providing a clear, step-by-step process for successful and compliant ITR filing, ensuring no one misses the deadline due to a lost document.

Income Tax Notice: Decoding Section 142(1) for Missing Deductions in Your ITR

This comprehensive blog post demystifies Section 142(1) notices from the Income Tax Department, specifically when issued for missing or incorrect deductions in your ITR. It explains the purpose of such notices, common reasons for their issuance (like Form 26AS/AIS/TIS mismatches or lack of supporting documents), and provides a step-by-step guide on how to prepare an accurate and timely response. The post also highlights the severe consequences of non-compliance and offers valuable tips for prevention through meticulous record-keeping and thorough ITR review.

Your ITR Filing Checklist for AY 2025-26: Essential Documents You Can't Miss!

This blog post provides a crucial checklist of essential documents required for filing Income Tax Returns for Assessment Year 2025-26 (Financial Year 2024-25). It details the importance and usage of key documents such as Form 16, Form 16A/B/C, Form 26AS, AIS/TIS, Capital Gains statements, and proofs for tax-saving investments/expenses (for the Old Tax Regime). The post emphasizes the benefit of early preparation for a smooth and error-free filing experience and includes a pro-tip for cross-verification. It concludes by offering MyITRonline's expert assistance for accurate and hassle-free tax filingYour ITR Filing Checklist for AY 2025-26: Essential Documents You Can't Miss!

What is TDS and How Does it Affect Your Income Tax? Your Complete Guide

TDS: Explained! From your salary slip to bank statements, understand what Tax Deducted at Source really means for your income tax in India. Learn its purpose, common types, and how to track your credits via Form 26AS. Ready to decode TDS and ensure accurate ITR filing? Myitronline is here to help you every step of the way.