# for

12 posts in `for` tag

Faster Cheque Settlements: RBI’s Big Update from October 2025

The Reserve Bank of India is launching a faster cheque clearing system from October 4, 2025. Cheques will now be processed continuously throughout the day, reducing settlement time from 1–2 days to just a few hours. This change benefits both individuals and businesses by improving cash flow and reducing fraud risks.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

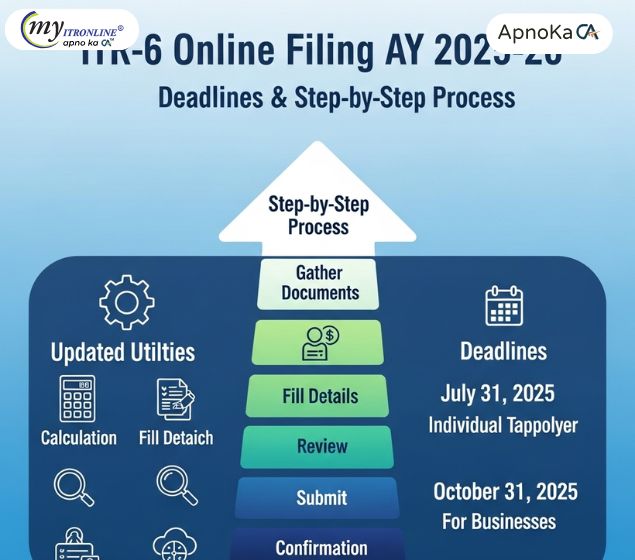

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

Section 154 of Income Tax Act: What You Can and Can’t Correct

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.

GST 2.0: A Game Changer for India? Simplified Taxes & Economic Boost

This blog post provides a comprehensive overview of India's GST 2.0, implemented on September 22, 2025. It details the key features, including the reduction of tax slabs to 5% and 18% (with a new 40% for luxury/sin goods), lower taxes on essential goods, durables, and automobiles, and increased prices for luxury items. The article identifies beneficiaries like everyday households, the middle class, farmers, healthcare consumers, and MSMEs. It also addresses potential challenges such as revenue shortfall, price pass-through issues, and transition headaches for businesses. Finally, it outlines expected economic ripples and crucial factors to monitor for the reform's success, concluding that GST 2.0 is a bold step towards simplifying life for millions. An appendix with sample MRP comparisons is also included.

Good News for Seniors! 7 New Government Perks for a Better Life

This blog outlines seven new government benefits for senior citizens in India, aimed at improving their quality of life. These perks include expanded health insurance (Ayushman Bharat) for those 70+, free assistive devices (Rashtriya Vayoshri Yojana), increased pension amounts, opportunities for active aging through jobs and social groups (SACRED Portal), support for the "Silver Economy" through startup funding (SAGE portal), a dedicated helpline for safety and protection (Elderline 14567), and improved access to facilities via state action plans. The article also provides a brief guide on how seniors can access these benefits, emphasizing a holistic approach to ensuring respect, health, financial security, and happiness for India's elderly population.

Is Your Tax Deadline Extended? Beware of Fake Circulars

A false circular claiming that the Income Tax Return (ITR) deadline has been extended past 15 September 2025 is being circulated. The post explains what the official record shows, how fake notices are spread, why they can be costly, and how to verify whether a circular is genuine.

Income Tax Alert: New Deadline for Correcting Mistakes in TDS/TCS

The Income Tax Department has given a final chance to correct mistakes in TDS/TCS returns for FY 2018–19 to FY 2023–24. The correction deadline is March 31, 2026. After this, only 2 years will be allowed for revisions, and unresolved errors may lead to tax notices.

GST Rate Changes: Your Essential Guide to Stock ITC Recovery & Reversal

This blog post provides a comprehensive guide to the upcoming GST rate changes in India, effective 22 September 2025, focusing specifically on the implications for Input Tax Credit (ITC) on stock. It explains the new simplified tax slab structure (5%, 18%, 40% for luxury goods) and details how businesses should handle ITC for stock purchased before the changes, supplies made after the changes, and unsold old inventory. The post offers practical advice on identifying stock, claiming eligible ITC, reversing ITC where necessary, seeking manufacturer support, and maintaining audit-ready records to navigate this significant tax transition effectively.

Breaking: No Relief in GST, A Big Blow to the Indian Media Industry

This blog post analyzes the impact of the latest GST reforms on the Indian media industry. It highlights how, despite appeals from media and advertising groups, the sector received no significant relief regarding tax parity for digital publications, input tax credit access, or flexible tax payment timing. The article details the approved reforms that benefited other sectors and consumers, contrasting them with the ignored pleas of the media, leading to concerns about worsening the digital divide, liquidity pressure, and hindered cost recovery. It concludes that the lack of targeted reforms poses a major setback for innovation, job creation, and overall growth in the Indian media landscape.

CBDT’s Big Move: Corrective Amendment to the Income-tax Act, 2025

The Central Board of Direct Taxes (CBDT) has issued a significant corrigendum to the recently enacted Income-tax Act, 2025. This blog post delves into the necessity and impact of these corrections, highlighting various typographical, grammatical, and structural fixes. It explains why such legislative "housekeeping" is crucial for legal accuracy and preventing disputes, while also providing context on the broader reforms introduced by the Income-tax Act, 2025, including a simplified structure, unified tax year, and digital-first assessments. The key takeaway emphasizes that while the corrigendum doesn't alter tax policy substance, it ensures the Act is legally sound and ready for smooth implementation, supporting India's goal of a simpler, more transparent tax framework.

Goods & Services Now Under 40% GST Slab, Effective from 22 September 2025

India is set to implement GST 2.0 from September 22, 2025, introducing a new 40% GST rate for "sin" and luxury goods. This reform simplifies the existing tax structure, lowers GST on essentials, and aims to balance public health with revenue generation. The move will benefit households with reduced costs on necessities, while consumers and industries dealing with luxury and harmful products will face higher taxes.GST 2.0: India Introduces New 40% Tax Slab for Luxury & Sin Goods