# extension

12 posts in `extension` tag

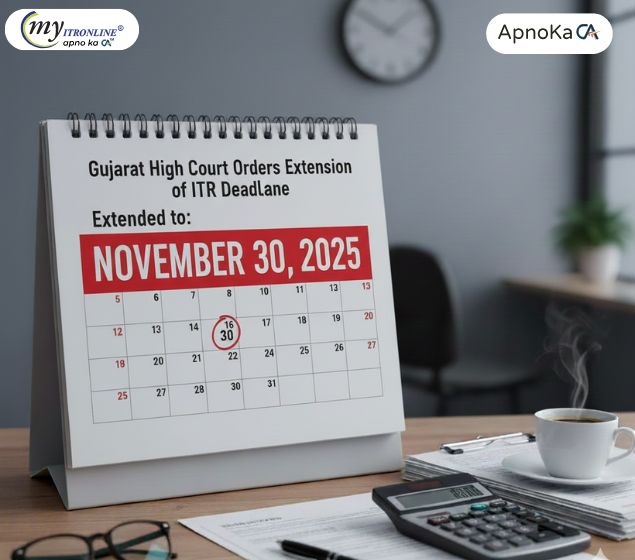

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

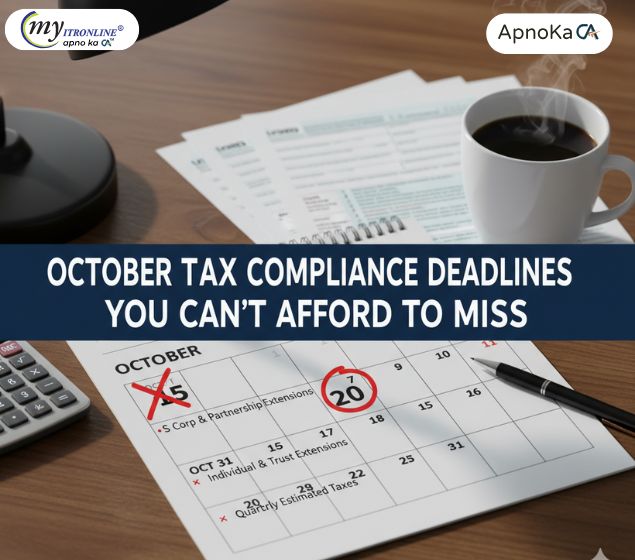

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

Due Date for Filing ITRs AY 2025-26 Extended Again

The Income Tax Department has granted a crucial one-day extension for filing Income Tax Returns for Assessment Year 2025-26, pushing the final deadline to September 16, 2025. This extension aims to assist taxpayers who encountered issues with the e-filing portal. This is a final opportunity to avoid penalties, so file your ITR promptly with myITRonline.

Is Your Tax Deadline Extended? Beware of Fake Circulars

A false circular claiming that the Income Tax Return (ITR) deadline has been extended past 15 September 2025 is being circulated. The post explains what the official record shows, how fake notices are spread, why they can be costly, and how to verify whether a circular is genuine.

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

.jpg)

AY 2025-26 ITR Filings Cross 3.29 Crore; Over 1.13 Crore Already Processed

Despite the ITR filing deadline for AY 2025-26 being extended to September 15, over 3.29 crore returns have already been filed by mid-August, with 1.13 crore processed. This highlights growing tax compliance and the Income Tax Department's processing efficiency.

Breaking News: Income Tax Return (ITR) Filing Deadline for AY 2025-26 Extended to September 15, 2025

The Central Board of Direct Taxes (CBDT) has announced an extension for the filing of Income Tax Returns (ITRs) for Assessment Year (AY) 2025-26. Originally due by July 31, 2025, the deadline has now been extended to September 15, 2025. This decision comes in light of structural and content revisions in the notified ITRs, necessitating additional time for system development and integration, and considering the time required for system readiness. The extension aims to provide taxpayers with a smooth and convenient filing experience, ensuring compliance and accurate reporting

The deadline for linking PAN and Aadhaar is now extended to December 31st, 2025

The deadline for linking PAN and Aadhaar has been extended by the Indian government to December 31, 2025, for applications that are filed prior to October 1, 2024. Not adhering to this requirement could lead to the PAN becoming inactive and affect financial transactions.

.jpg)

FORM CSR-2 Deadline Extended: What Businesses Need to Know

The FORM CSR-2 filing date has been extended by the Ministry of Corporate Affairs (MCA) to March 31, 2025. This extension ensures openness and adherence to the Companies Act of 2013 by giving businesses more time to meet CSR reporting requirements. Read our in-depth blog to find out more about FORM CSR-2, its significance, and the effects of this expansion.

.jpg)

Taxpayer Relief: GSTR-3B Filing Deadline for December 2024 Extended

The deadline for submitting GSTR-3B has been extended to December 2024 by the Central Board of Indirect Taxes and Customs (CBIC). On January 10, 2025, the notification was released with the intention of giving taxpayers compliance relief. Depending on the taxpayer's primary location of business, the updated deadlines are separated into two groups. Businesses gain from this extension, which guarantees easier GST compliance and lessens system load.