# efiling

12 posts in `efiling` tag

Late Filing of Form 10IC Will Not Deny Lower Tax Rate: ITAT Ruling

Mumbai ITAT has ruled that late filing of Form 10IC should not prevent eligible taxpayers from availing the concessional corporate tax rate under Section 115BAA. The order states that filing Form 10IC is a procedural requirement and the intent to opt for the new tax regime is more important.

Why Your Tax Refund Is Delayed and What CBDT Wants You to Know

Many taxpayers are waiting for refunds, especially where the refund is large. The Central Board of Direct Taxes (CBDT) is closely checking high-value and flagged returns to stop fake claims and tax cheating. This guide explains the main reasons for delays, which cases get compulsory scrutiny, and simple steps you can take now to clear your refund faster.

Refund Credited but Not Reflected in Bank What to Do?

Many taxpayers face the issue where their Income Tax refund status shows "Refund Credited" but the money doesn’t appear in their bank account. This guide explains why it happens, how to check your bank and portal details, and what steps to take to resolve it quickly.

PAN Cards to Be Deactivated from January 1, 2026 If Not Linked with Aadhaar

The Indian government has set December 31, 2025, as the final deadline to link PAN cards with Aadhaar. Starting January 1, 2026, non-linked PANs will be deactivated, affecting tax filing, refunds, and financial services. Learn who needs to link, what happens if you don’t, and how to complete the process online or via SMS.

Refund Adjusted Against Outstanding Demand: What You Need to Know

If your income tax refund is adjusted against an old tax demand, it’s likely due to Section 245 of the Income Tax Act. This blog explains what the notice means, how to respond within 30 days, and what options you have. Learn how to protect your refund and keep your tax records clean.

ITR E-Verification Made Easy: Your 2025 Guide Using Demat or Bank Account

A complete 2025 guide on how to e-verify your Income Tax Return (ITR) quickly and securely using your pre-validated Bank Account or Demat Account on the e-Filing portal. Learn the prerequisites and the step-by-step Electronic Verification Code (EVC) generation process.

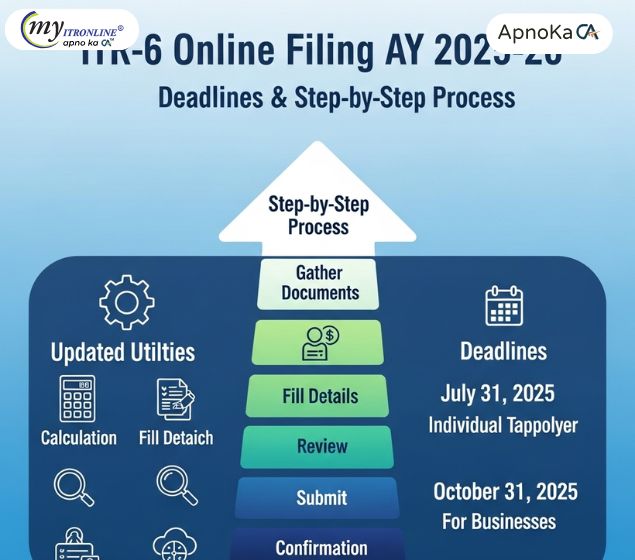

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

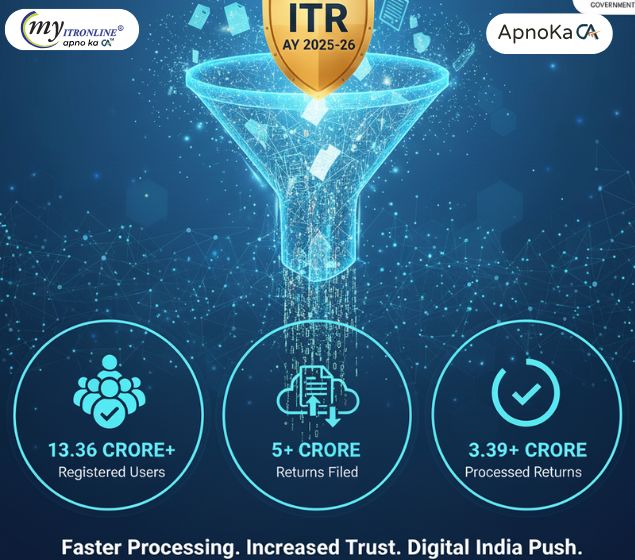

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

.jpg)

Good News for Taxpayers: Delayed Income Tax Refunds Are Finally Being Released

The long wait for delayed income tax refunds is finally coming to an end! The Income Tax Department has taken steps to clear pending refunds by resolving portal glitches, verifying returns faster, and processing lakhs of refunds worth crores of ₹ daily. Learn why refunds were delayed, what’s being done now, and follow a simple checklist to make sure your refund reaches your bank account without further delay.

.jpg)

Kind Attention Taxpayers! ITR-3 Now Enabled for Online Filing!

The Income Tax Department has enabled online filing for ITR-3 for Assessment Year 2025-26, simplifying tax compliance for individuals and HUFs with business or professional income. This blog post details who needs to file ITR-3, highlights key updates for the current assessment year (including changes in AL reporting and VDA schedules), explains the benefits of online filing, and provides a step-by-step guide to assist taxpayers. It also subtly promotes MyITROnline for expert assistance.

.jpg)

Your ITR: File It or Face These Costly Consequences

This blog post details the various consequences of not filing Income Tax Returns in India, including immediate financial penalties, loss of benefits like carrying forward losses or claiming refunds, and harsher repercussions such as best judgment assessment, heavy fines, and even prosecution.

.jpg)

Important Update: Tax Audit Forms 3CA-3CD & 3CB-3CD Now Live with Latest Changes

This blog post announces the release of updated Tax Audit Forms 3CA-3CD and 3CB-3CD on the e-Filing portal. These updates are based on Notification No. 23/2025. It explains the purpose of these forms, identifies who must file them, and highlights the importance of knowing the new changes and meeting deadlines. The post stresses the need for proactive compliance to avoid penalties and positions myITROnline as a helpful partner for smooth tax audit and ITR filing.