# dsc

12 posts in `dsc` tag

Tax Refunds Can’t Be Denied for Form 26AS Mismatch: High Court Ruling

The Allahabad High Court has ruled that tax refunds cannot be denied just because TDS is missing from Form 26AS. If a taxpayer provides valid Form 16A certificates, the Income Tax Department must verify the claim with the deductor instead of rejecting it outright. This protects honest taxpayers from delays caused by clerical errors.

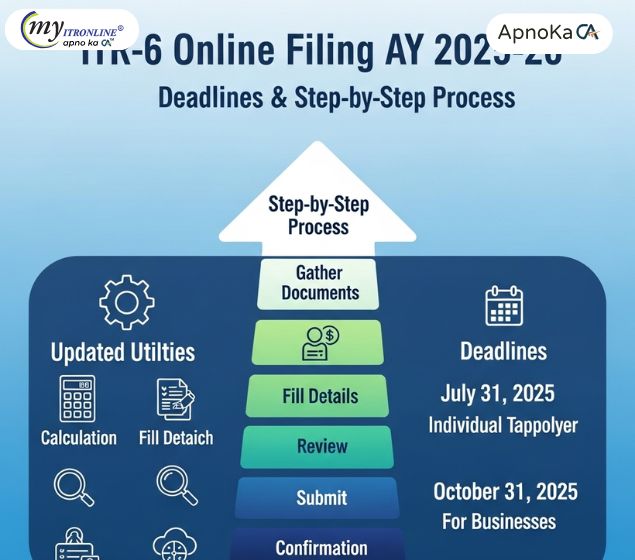

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

.jpg)

Avoid TDS Trouble with Form 26A

This simple guide explains Form 26A and how it helps TDS deductors avoid being "at fault" under Section 201. It covers the benefits, conditions for filing, how interest is calculated, and important court decisions that provide relief. This resource is clear and easy to understand for managing TDS compliance.

Section 194C Explained: TDS on Contractor Payments & How to Report It in Your ITR

This blog post serves as a complete and detailed guide for businesses and individuals to understand Section 194C of the Income Tax Act, 1961. It explains TDS obligations on payments to contractors, outlines applicable rates and thresholds, and most importantly, teaches how to correctly report these deductions in your Income Tax Return (ITR). From verifying Form 26AS and AIS to avoiding mismatch notices, this article helps you ensure compliance, avoid scrutiny, and maintain a clean tax record.

India TDS Rate Chart FY 2025-26 (AY 2026-27): A Preliminary Overview

An initial guide to Tax Deducted at Source (TDS) rates and thresholds for India's Financial Year 2025-26 (Assessment Year 2026-27), based on current provisions as of April 2025. Details include a comprehensive rate chart covering common sections, key considerations like PAN non-furnishing, recent threshold changes (e.g., for interest, rent, commissions), potential policy updates (like the status of Section 206AB), and essential compliance deadlines. The guide strongly emphasizes that final rates are contingent upon the Full Union Budget 2025.

.jpg)

Form 24G Explained: A Step-by-Step Guide for Government Tax Deductors and Collectors

Form 24G is critical for government deductors and collectors to make correct and timely TDS/TCS filings. This blog gives a full guide to Form 24G, including its relevance, due dates, penalties for non-compliance, and a step-by-step filing method. Stay compliant and avoid penalties with our thorough insights.

.jpg)

A Comprehensive Guide to the Updated TDS Rate Chart for FY 2025-26 (AY 2026-27)

This blog includes a thorough TDS rate chart for the fiscal year 2025-26 (assessment year 2026-27). It includes TDS rates for a variety of payments such as wages, interest, rent, professional fees, and more. The site also discusses critical TDS compliance considerations such as PAN requirements, quarterly installments, and penalties for noncompliance. Stay up to speed on the newest TDS rates to guarantee a smooth tax filing experience.

.jpg)

TDS on Rent Limit Increased from 2.4 Lakh to 6 Lakh – Key Changes & Effects

The Indian government has increased the TDS on rent threshold from 2.4 lakh to 6 lakh per annum. This move aims to reduce compliance burdens for tenants, ease cash flow for landlords, and align with rising rental costs. In this blog, we discuss the key changes, benefits, compliance requirements, and the impact on individuals and businesses.

.jpg)

India Company Registration Costs: A Detailed Analysis

The costs of creating a company in India are covered in full in this blog, including state taxes, professional fees, DIN fees, MCA fees, and DSC fees. It also offers a table that summarizes the associated expenditures and describes the variables that influence business registration fees in India. For entrepreneurs and business owners wishing to form a company in India, the blog is an invaluable resource.

TDS on GST Invoices

This blog provides a comprehensive guide to understanding the Tax Deducted at Source (TDS) mechanism on GST bills. It covers who is liable to deduct TDS, how to calculate TDS, and the benefits and challenges of implementing TDS on GST bills. The blog also provides best practices for implementing TDS on GST bills and answers frequently asked questions.

e-Verification of Income Tax Returns: A Comprehensive Step-by-Step Guide

This comprehensive guide provides step-by-step instructions on how to e-Verify your Income Tax Return (ITR) using various methods such as Aadhaar OTP, Net Banking, Bank Account EVC, Demat Account EVC, Digital Signature Certificate (DSC), or Bank ATM. By following these detailed instructions, you can ensure the accuracy and authenticity of your tax return filing process, helping you stay compliant with tax regulations and avoid penalties.