# dir3kyc

3 posts in `dir3kyc` tag

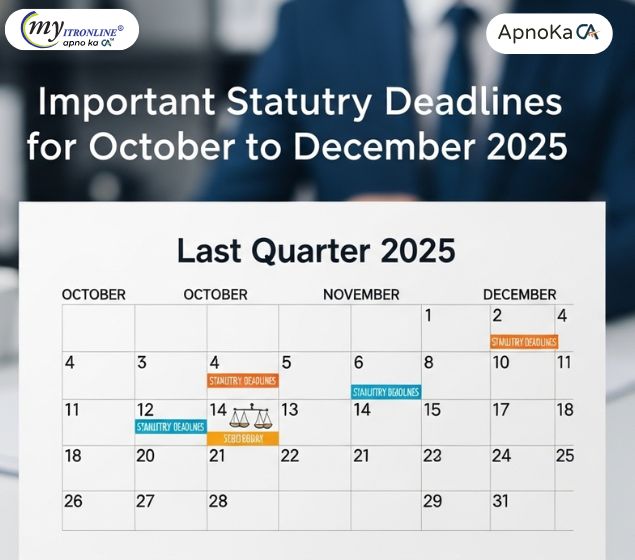

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

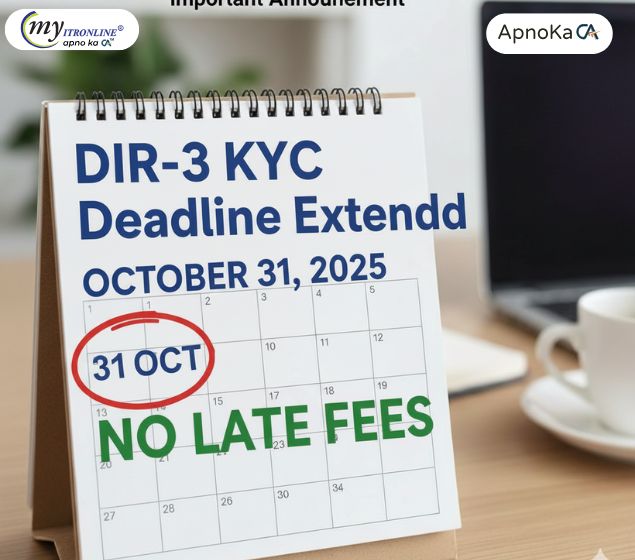

DIR-3 KYC Deadline Extended to October 31, 2025 – No Late Fees

The Ministry of Corporate Affairs (MCA) has extended the DIR-3 KYC deadline to October 31, 2025. This allows directors to file without incurring the ₹5,000 late fee and avoid DIN deactivation. Learn who needs to file, which form to use, and why early action is crucial.

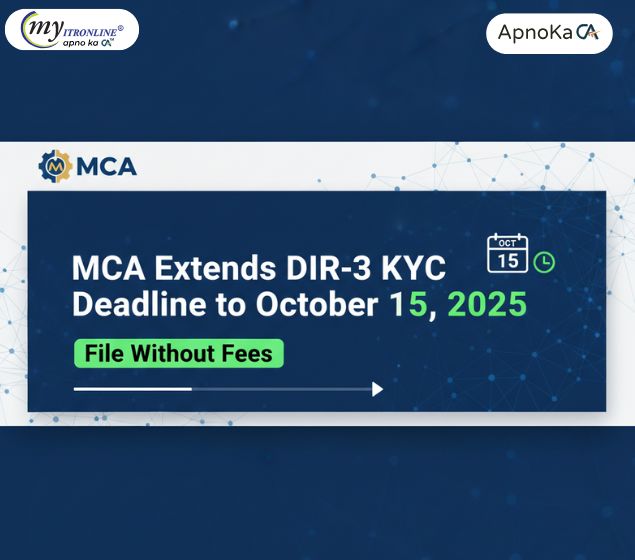

MCA Extends DIR-3 KYC Deadline to October 15, 2025 - File Without Fees

The Ministry of Corporate Affairs has extended the DIR-3 KYC filing deadline from September 30, 2025 to October 15, 2025, without any filing fees. This compliance requirement applies to all directors holding a DIN. Directors can file either DIR-3 KYC (with DSC) or DIR-3 KYC-WEB (OTP-based) forms. Non-compliance will result in DIN deactivation, penalties up to ₹5,000, and disqualification from director appointments. The extension follows stakeholder representations requesting additional time for compliance.