# deduction

12 posts in `deduction` tag

Drive Electric, Save on Tax: A Simple Guide to Section 80EEB

A simple guide to Section 80EEB, explaining how individuals can save up to ₹1,50,000 annually on EV loan interest, eligibility rules, and how to claim the deduction under the old tax regime.

Fueling Indian R&D: CBDT’s Approval under Section 35(1)(iia) | 100% Tax Deduction for Innovation

The CBDT has issued Notification No. 4/2025 under Section 35(1)(iia) of the Income Tax Act, granting approval to a company for scientific research and development. Contributions made to the approved entity qualify for a 100% tax deduction, encouraging businesses to support innovation while reducing their tax burden. This move strengthens India’s R&D ecosystem and promotes industry-science collaboration.

TDS Rate Chart FY 2025-26 (AY 2026-27)

This blog provides a simplified overview of the latest Tax Deducted at Source (TDS) rates for FY 2025-26 (AY 2026-27). It highlights key changes in thresholds, presents a clear rate chart for residents, and offers practical compliance tips for taxpayers.

Can You Claim Business Expenses During a No-Income Period?

This blog explains whether a business can claim deductions for expenses like rent, salaries, and utilities during a period of zero income. It focuses on Section 37(1) of the Income Tax Act and clarifies the difference between an idle business and one that never started. Includes a checklist to help taxpayers understand eligibility.

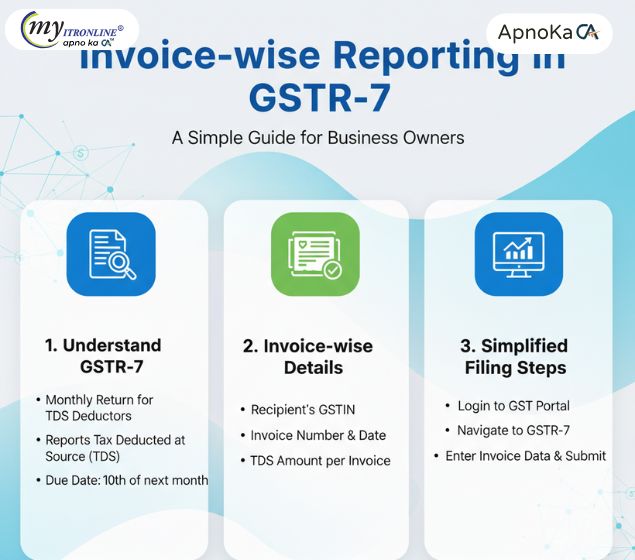

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Income Tax AY 2024–25: Understanding Section 115BAC Rules

Section 115BAC introduces a simplified tax structure with reduced slab rates, but at the cost of foregoing key exemptions and deductions. Effective from AY 2024–25 as the default regime, this blog explains the revised tax slabs, outlines the benefits that are no longer available, and guides taxpayers on choosing between the new and old regimes based on their financial profile and investment habits.

.jpg)

The Latest on Partner Remuneration: FY 2025-26 Tax Changes Explained

The FY 2025-26 brings crucial changes for partnership firms & LLPs regarding partner remuneration. This blog decodes the new, increased deduction limits under Section 40(b) and the mandatory TDS introduction via Section 194T on payments to partners. It covers who's a working partner, the role of the partnership deed, and essential compliance steps for firms.

.jpg)

Your Wallet's Choice: 8 Reasons to Stick with the Old Tax Regime for FY 2024-25

This detailed blog post explores 8 compelling reasons why India's Old Tax Regime remains a more financially attractive option for many taxpayers in FY 2024-25. It breaks down crucial benefits like Section 80C investments, home loan interest, health insurance premiums, and other key deductions/exemptions, illustrating how these can lead to significant tax savings despite the New Tax Regime's lower rates

.jpg)

New Tax Regime for ITR-1 Filers: Everything You Need to Know for AY 2025-26

The New Tax Regime is now default for FY 2024-25. Our comprehensive guide helps salaried individuals and pensioners file ITR-1 (Sahaj) easily, covering eligibility, new deductions like the ₹75,000 standard deduction, and a step-by-step online process. File by September 15, 2025!

.jpg)

India's New Income Tax Regime (Section 115BAC): Your Comprehensive Guide for FY 2024-25 & 2025-26

This comprehensive guide breaks down India's New Income Tax Regime under Section 115BAC, now the default for individuals and HUFs. It details the revised income tax slab rates for Financial Years 2024-25 and 2025-26, highlighting the increased basic exemption limits and the enhanced rebate under Section 87A. The article clearly outlines the limited deductions and exemptions still allowed (e.g., standard deduction, employer's NPS contribution) versus the numerous ones no longer applicable. It concludes by helping taxpayers determine whether the new regime or the old regime is more beneficial for their specific financial situation and explains the process for switching between the two.

Claiming 80E: Education Loan Interest Tax Deduction Guide

This comprehensive blog post demystifies Section 80E of the Indian Income Tax Act, which allows individuals to claim deductions on the interest paid on education loans. It details who can claim, eligible loans, the eight-year deduction window, and the crucial distinction between principal and interest. The post emphasizes the importance of accurate documentation, such as annual interest certificates, and provides actionable strategies to match figures with lender data and navigate ITR forms correctly, thereby avoiding common pitfalls that lead to tax scrutiny. Ultimately, it equips taxpayers with the knowledge to maximize their Section 80E benefits confidently.

Income Tax Notice: Decoding Section 142(1) for Missing Deductions in Your ITR

This comprehensive blog post demystifies Section 142(1) notices from the Income Tax Department, specifically when issued for missing or incorrect deductions in your ITR. It explains the purpose of such notices, common reasons for their issuance (like Form 26AS/AIS/TIS mismatches or lack of supporting documents), and provides a step-by-step guide on how to prepare an accurate and timely response. The post also highlights the severe consequences of non-compliance and offers valuable tips for prevention through meticulous record-keeping and thorough ITR review.