# compliance

12 posts in `compliance` tag

No DIN, No Problem! Your GST Notices Remain Valid.

The CBIC has clarified that GST notices from the official portal are now valid with a Reference Number (RFN), even without a separate Document Identification Number (DIN). The RFN serves as a unique identifier, making the DIN redundant for these digital communications. This move aims to reduce confusion, simplify verification, and emphasize digital communication. Taxpayers can use the RFN on the GST website to authenticate notices. Caution is advised for notices received without a DIN via other channels.

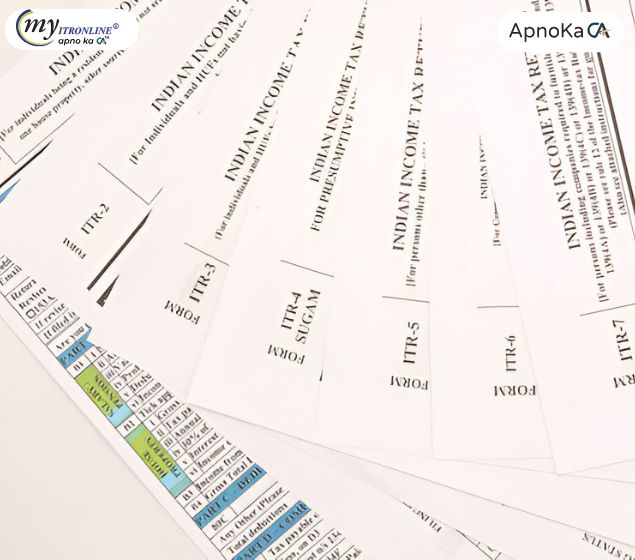

Understanding ITR Forms (ITR-1 to ITR-7) for AY 2025-26: Selecting the Appropriate Form for Your Earnings

This blog post serves as a comprehensive guide to selecting the correct Income Tax Return (ITR) form (ITR-1 to ITR-7) for Assessment Year 2025-26 (Financial Year 2024-25). It begins by emphasizing the importance of choosing the right form to avoid penalties and highlights the extended filing deadline for individuals and HUFs. The post then details important updates for AY 2025-26, including changes to LTCG reporting in ITR-1/4, compulsory detailed disclosures for old regime deductions, new TDS section requirements, revised asset reporting thresholds, and the default new tax regime. A simplified overview of applicability and exclusions for each ITR form (ITR-1 to ITR-7) is provided. Finally, it uses seven practical case studies to illustrate how different taxpayer profiles (salaried, freelancers, businesses, firms, companies, trusts) can correctly identify their applicable ITR form. The synopsis concludes by advising readers to consult official guidelines and tax professionals for accurate filing.

Exciting Update for Your GST Filings: GSTR-3B Will Have a

This blog post explains the upcoming major change in GST filing: the GSTR-3B's auto-populated tax liability will become non-editable from July 2025. It clarifies why this is happening, introduces GSTR-1A as the crucial form for corrections, and outlines the essential steps taxpayers must take to ensure timely and accurate compliance, including a note on the new 3-year return filing deadline.

Disability Deductions (80DD & 80U) AY 2025-26: Your Certificate Acknowledgement Number is Now a Must-Have!

This blog post details a critical update for Indian taxpayers claiming deductions under Sections 80DD and 80U for disability for Assessment Year (AY) 2025-26. It highlights the new mandatory requirement to furnish the disability certificate's acknowledgement number in the Income Tax Return (ITR). The post explains the significance of this change for verification and compliance, provides a clear checklist for taxpayers, and outlines essential documentation beyond the acknowledgement number, ensuring a smoother tax filing process under the Old Tax Regime.

June 2025 Tax Deadlines: Don't Miss These!

June is a critical month for tax and compliance in India. This blog post provides a comprehensive, guide to the over 20 crucial deadlines for June 2025 across Income Tax, GST, Company Law (ROC), and Labour Laws. Learn how to stay compliant, avoid penalties, and ensure the financial well-being and smooth operation of your business. From TDS/TCS and advance tax payments to GST returns and ROC filings, we cover everything you need to know.

Major Updates to AOC-4, MGT-7, and Other ROC Annual Filing Forms

This blog post details the significant updates to ROC Annual Filing forms, especially AOC-4 and MGT-7/7A, as part of the MCA V3 portal rollout effective July 14, 2025. It covers changes like integrated web forms, Excel-based data, pre-filled data, and revised submission processes, alongside crucial information on deadlines and penalties to help companies ensure timely and compliant submissions

200% Fine & Prosecution: What New ITR Rules Mean for You

This blog post warns taxpayers about the updated ITR regulations, highlighting the drastic consequences of under-reporting or misreporting income, including a 200% penalty and potential criminal prosecution. It explains why the Income Tax Department is increasing scrutiny through data analytics and detailed ITR forms, and provides essential steps for taxpayers to ensure compliance and avoid severe financial and legal repercussions.

Big Relief for NGOs: 10-Year Validity Period for Trust Registrations

This blog post details the Indian government's pivotal move to introduce a 10-year validity period for trust registrations, replacing the previous perpetual system. It highlights how this "revolutionary change" significantly reduces administrative burden, enhances planning stability, and improves transparency for charitable organizations and NGOs. The article also outlines key implications for existing and new trusts, emphasizing the shift towards digitalization and a more efficient non-profit sector.

New Rules for ITR-1 & ITR-4: Your AY 2025-26 Guide (Old Tax System)

This comprehensive blog post outlines the significant changes introduced by the Income Tax Department for Assessment Year 2025-26 (FY 2024-25) concerning ITR-1 (Sahaj) and ITR-4 (Sugam) under the Old Tax Regime. It details the newly mandated annexures for claiming various deductions, including HRA, Section 80C, 80D, 80DD, 80DDB, 80E, 80EE, and 80EEB. Readers will find crucial information on the new required fields for each section, key points to remember for seamless e-filing, common validation errors to avoid, and important deadlines. The post emphasizes the importance of accurate data submission and retaining supporting documents to ensure tax compliance.

Decoding ITR Complexity: Major Changes to Sahaj & Sugam for AY 2025-26

For Assessment Year 2025-26, the familiar ITR-1 (Sahaj) and ITR-4 (Sugam) forms, traditionally seen as straightforward, are undergoing significant changes that add layers of complexity. This blog explores the impact of the new tax regime as default, increased disclosure requirements, and the need for meticulous data reconciliation, explaining why even simple returns now demand careful attention. Discover how MYITRONLINE can help you navigate these evolving tax landscapes.

Start Your Tax Filing Now: ITR-1 & ITR-4 Excel Utilities for AY 2025-26 Released!

Big news for individual taxpayers and small businesses! The Income Tax Department has released the Excel Utilities for ITR-1 (Sahaj) and ITR-4 (Sugam) for Assessment Year 2025-26. This means you can now begin filing your income tax returns offline. This blog covers who can use these forms, the benefits of early filing, and how MYITRONLINE can provide seamless assistance.

Don’t Put 10,000 on the Line! Learn the 5 Essential Rules for E-Way Bill Compliance in 2025

This blog post outlines the critical E-Way Bill compliance rules for 2025, detailing mandatory thresholds, validity periods, and filing procedures (Form GST EWB-01). Learn how to avoid hefty penalties of ₹10,000 or more by adhering to these updated regulations, including insights on interstate vs. intrastate applicability, and new rules regarding generation and extension limits. Discover how MYITRONLINE can help your business navigate these complexities.