# capitalgainstax

12 posts in `capitalgainstax` tag

Understanding Section 112A: Tax Rules for Equity Investors

Section 112A of the Income Tax Act governs taxation of long-term capital gains on listed equity shares, equity-oriented mutual funds, and business trust units. It provides exemption up to 1,00,000 and levies 10% tax beyond that, without indexation benefit.

Smart Property Moves: How Sections 54 and 54F Can Slash Your Tax Bill on Residential Property Sales (Latest Rules 2025)

Discover how Sections 54 and 54F of the Indian Income Tax Act provide crucial tax exemptions on Long-Term Capital Gains from property sales. This comprehensive guide covers the latest rules for 2025, including the new ₹10 Crore cap and the two-house option under Section 54, offering practical examples and a step-by-step plan for effective tax planning.

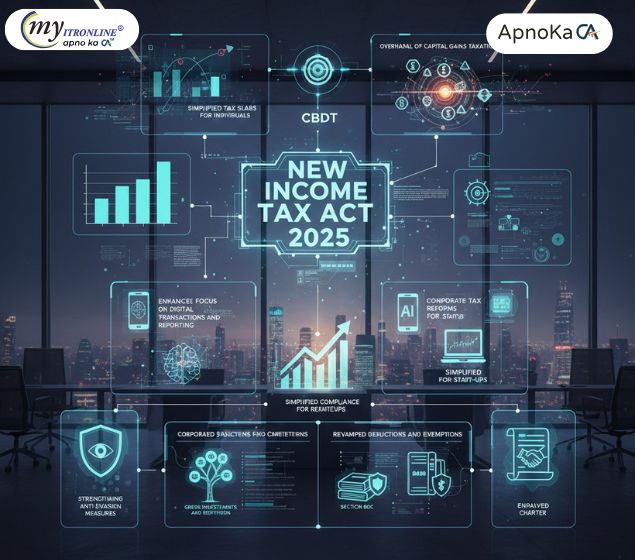

New Income Tax Act 2025: Key Updates from the CBDT

The Central Board of Direct Taxes (CBDT) has announced a significant overhaul of the Income Tax Act, effective from assessment year 2025-26. This blog details the crucial changes, including simplified individual tax slabs, revised capital gains taxation, a stronger focus on digital transactions, corporate tax reforms, revamped deductions and exemptions, enhanced anti-evasion measures, and the introduction of a Taxpayer Charter. Understanding these updates is vital for both individuals and corporations to ensure compliance and optimize financial planning under the new regime.

.jpg)

LTCG Tax: Recent Updates & 2025 Bill Clarifications

Recent changes to Long Term Capital Gains (LTCG) tax rates and rules, which take effect on July 23, 2024, have greatly affected how investors figure their tax liability for the Assessment Year 2025-26. This blog post outlines these important updates across different asset classes, including equity, debt, and real estate. It explains the details of indexation and clears up common misunderstandings, especially related to the Income Tax Bill, 2025. It highlights the need for careful tax planning and urges taxpayers to get expert help.

.jpg)

Big News for Property Sellers: IREDA Bonds Now Offer Up to 50 Lakh Tax Exemption on Capital Gains!

This blog post details how the Central Board of Direct Taxes (CBDT) has granted "54EC status" to IREDA bonds, offering property sellers a significant tax exemption of up to 50 lakh on long-term capital gains. It explains what 54EC bonds are, why IREDA's inclusion is beneficial for both investors and India's green energy goals, how the tax exemption works, key investment considerations like limits and lock-in periods, and who can invest. The post highlights the advantages of investing in these safe, fixed-return bonds while contributing to a sustainable future.

.jpg)

Tax Smart: Your Easy Guide to Capital Gains in India

This blog provides a simple and easy-to-understand guide to Capital Gains Tax rates in India for various assets like shares, mutual funds (debt & equity), gold, and property, differentiating between short-term and long-term gains.

.jpg)

Capital Gains Tax Changes: New Rules and Rates Start July 23, 2024!

This blog post deciphers the significant changes to Capital Gains Tax in India, effective from July 23, 2024, as introduced in the Union Budget 2024. It simplifies the concepts of Short-Term and Long-Term Capital Gains, detailing the new holding periods and updated tax rates for various assets like listed shares, equity and debt mutual funds, property, and gold. The article highlights key implications for taxpayers and emphasizes the importance of professional advice from Myitronline for navigating these complex rules and optimizing investment strategies.

.jpg)

CII for FY 2025-26 Notified: What India's New Cost Inflation Index Means for Your Capital Gains

The Central Board of Direct Taxes (CBDT) has announced the Cost Inflation Index (CII) for FY 2025-26 as 376. This blog post explains what CII is, how the new index will be applied from AY 2026-27, who it impacts, and provides an example of how it reduces taxable long-term capital gains, particularly for real estate acquired before July 23, 2024. It highlights the importance of understanding this update for accurate tax filing.

India Capital Gains Tax FY 2024-25: Shares & Mutual Fund STCG/LTCG Rates

This post details the taxation rules for capital gains from shares and equity mutual funds in India for FY 2024-25 (AY 2025-26). It explains the crucial changes effective July 23, 2024, including updated STCG and LTCG tax rates, revised exemption limits, holding period classifications, dividend taxation, and reporting requirements in ITR forms.

Updated Capital Gains Tax 2024: Significant Modifications, Rates & Proper Filing of ITR

The Indian government has updated the capital gains tax rates for equity shares and mutual funds, effective from July 23, 2024. Short-term capital gains (STCG) are now taxed at 20% (an increase from the previous 15%), while long-term capital gains (LTCG) are now taxed at 12.5% (up from 10%). Discover how to file your Income Tax Return (ITR) with a date-wise breakdown, the responsibilities of brokers, and tips for saving on taxes.

.jpg)

How to Avoid Paying Capital Gains Tax on Stock Market Profits | An explanation of LTCG and STCG

Investors in the stock market must comprehend capital gains tax. This blog offers practical tips to reduce or prevent taxes on your stock market profits in addition to explaining Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG). Find out how to be tax-efficient while increasing your profits.

.jpg)

Taxpayers Are Notified of Capital Gains Income Tax: Section 87A Rebate

This blog explains why taxpayers with capital gains are receiving Section 87A rebate notices. Learn about eligibility, common mistakes, and how to respond to income tax notices effectively.